German automobiles and motorcycles manufacturer BMW is working with blockchain startup Bloom on a solution to streamline customers’ journey and lending experience, Bloom said in a blog post on Tuesday.

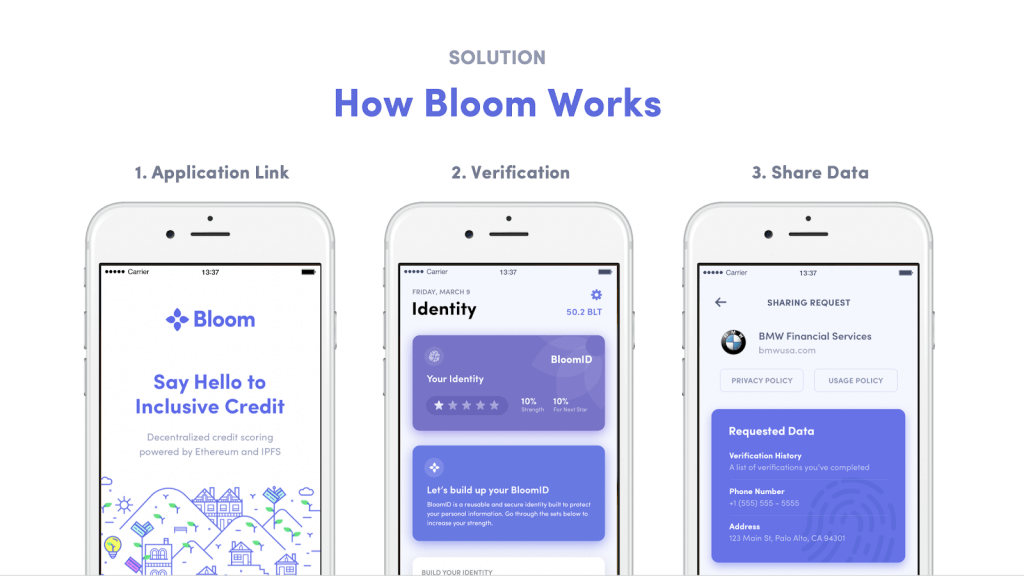

Bloom uses public-private key encryption underpinning blockchain technology to allow individuals to secure their data on their local device and easily apply for credit. It claims its blockchain-based mobile app streamlines customers’ lending experience and facilitates the onboarding process.

The partnership seeks to use Bloom’s technology to verify customer identity and to attest the accuracy of credit history without storing customer raw data on the servers.

It is taking place as part of the BMW Financial Services Collaboration Lab, a 10-week acceleration program at the firm’s Ohio offices, to which Bloom, along with five other startups, have been selected to participate in.

The program is articulated around four key categories: building a blockchain strategy, digitalizing the customer journey, data analytics and insights, and wildcard.

On the topic of blockchain technology, the firm claims it is “looking to examine any and all methods of how blockchain ledgers could support the transformation of current data warehousing, payment and customer information tracking.”

The goal ultimately is to “enable BMW to automate a lot of processing and increase the tracking and security of information,” according to the webpage.

Besides Bloom, Supermoney is the other blockchain startup that got in into the accelerator. Supermoney is developing a digital wallet allowing for in-store and online purchases using QR codes. The product runs on a system of smart contracts that effectively and efficiently manage counterparty risk, protecting both buyer and seller.

The six startups, selected among a total of 212 applications, are currently working alongside BMW staff to co-create innovative solutions that could potentially be integrated into the firm’s business. A Demo Day on November 19, 2018, will showcase the startups’ solutions.

The Collaboration Lab, run in collaboration with corporate innovation specialize L Marks, was designed “ensure the alignment and enhancement of our overall vision of transforming how people access and enjoy personal mobility, today,” Ian Smith, CEO of BMW Group Financial Services USA and Region Americas, said in a statement. “This will have long-lasting effects on our business and positively impact our customers and dealer partners.”

“The BMW Group Financial Services Collaboration Lab is an exciting way to unearth and nurture talent and develop new solutions to some of the challenges the industry is facing,” said Stuart Marks, chairman of L Marks, adding that BMW was also “looking for solutions to engage new potential targeted customer demographics such as Millennials with the BMW brand, as well as owning a BMW vehicle, in a very different way.”

BMW has been exploring the use of blockchain technology through numerous initiatives. The firm is one of the founding members of the Mobility Open Blockchain Initiative (MOBI), alongside Bosch, Ford, General Motors, Groupe Renault and others, which was launched in May this year to accelerate adoption and promote standards in blockchain, distributed ledgers and related technologies for the benefit of the mobility industry, consumers and communities.

BMW Group UK ran a pilot project earlier this year to test a blockchain platform that tracks mileage in leased vehicles. The effort was carried out in partnership with blockchain startup Dovu and Alphabet.