BNB has been underperforming despite Binance burning over $500 million worth of BNB tokens last week.

BNB, the native coin of the Binance ecosystem, is up by less than 1% in the last 24 hours. Over the past seven days, BNB has lost more than 1% of its value.

The coin’s performance is in line with that of the broader cryptocurrency market. The total crypto market cap is down by less than 1% today and has fallen below the $920 billion mark.

Bitcoin is up by 1% in the last 24 hours and continues to trade above the $19,000 support level. Ether, meanwhile, is up by more than 2% so far today and is now trading above $1,300 per coin.

The performance comes despite Binance burning $547 million worth of BNB tokens earlier this month. This was the 21st quarterly BNB token burn carried about by Binance.

Earlier this year, Binance burned over $700 million worth of BNB tokens, one of its highest since the cryptocurrency exchange was established five years ago.

Key levels to watch

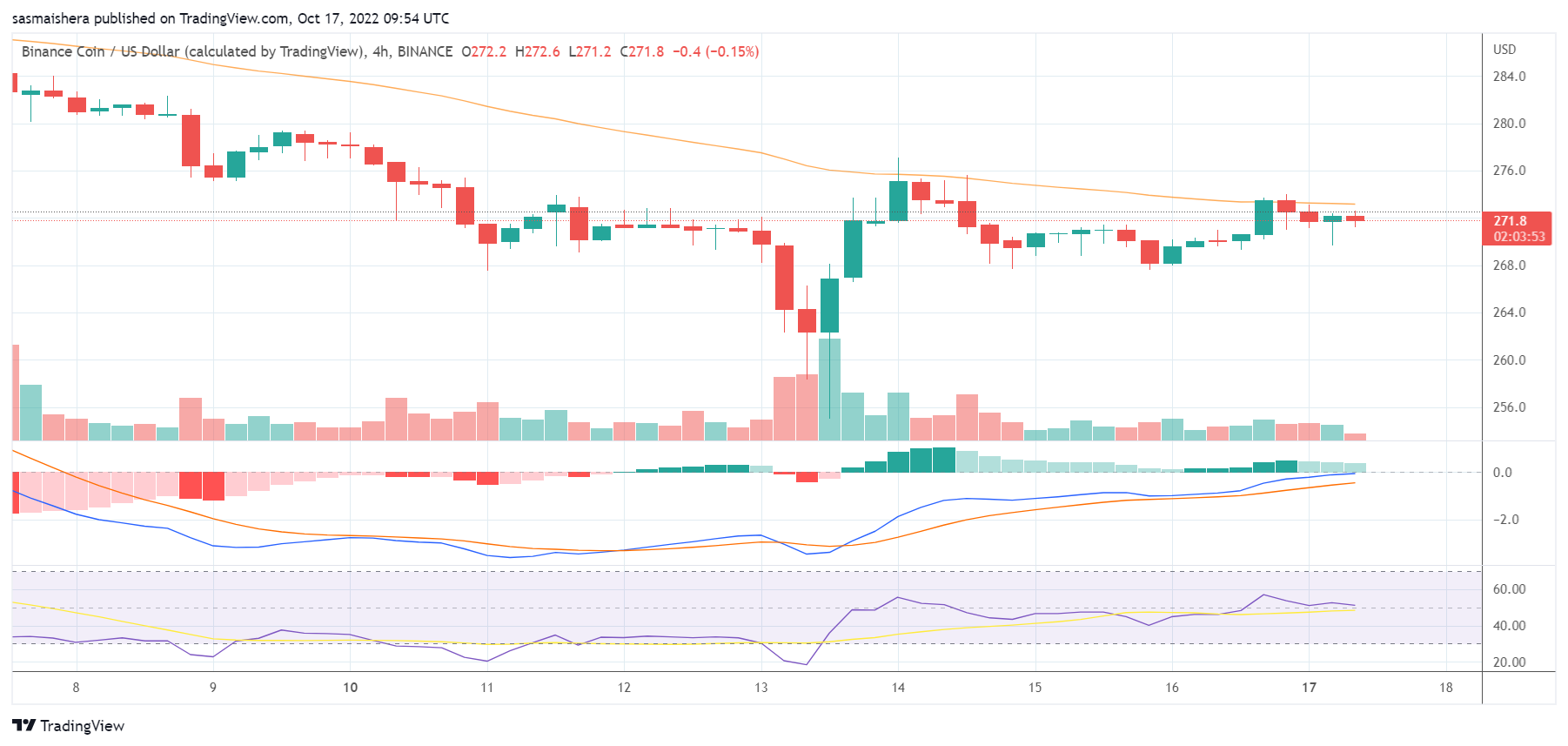

The BNB/USD 4-hour chart is bearish as BNB has been underperforming over the last few days.

The MACD line is below the neutral zone, indicating a bearish trend. However, it is slowly rising and could enter the positive region if the broader market embarks on a bullish run.

The 14-day RSI of 51 shows that BNB is not in the oversold area despite underperforming in the last few days.

At press time, BNB is trading at $272.2 per coin. If the slow market recovery continues, BNB could surge past the $280 resistance level before the end of the day.

However, BNB could struggle to move past the second major resistance level at $293 in the near term.

If the bearish trend persists, BNB could be forced to defend the resistance level below $259 over the next few hours or days.