Equity crowdfunding platform BnkToTheFuture will launch a public token sale in February 2018 to fund the development of a tokenized platform for equity tokens trading. According to a report by Bloomberg, the company hopes to raise as much as US$33 million in its initial coin offering (ICO).

The company said its new token, called the BF Token (BFT), will support deal flow analysis, due diligence and investor relations on the platform.

It will grant existing users access to the platform’s multi-tiered membership for qualifying investors to access priority deals. It will also act as a reward to other BFT token holders who conduct, on behalf of the platform and community, due diligence on prospective deals, such as sourcing prospects or managing investor relations by giving status updates on a listed company’s progress.

Simon Dixon, CEO of BnkToTheFuture, said:

“Investors want a trustworthy trading platform that gives first-mover access to new investments while complying with regulatory requirements.

“We have engineered the BnkToTheFuture platform to provide this, along with the added benefits of employing the latest technology and incentives for participants to make updates about investments, so investors can track both the performance of their portfolios as well as other equity-backed tokens they consider to be prospective investments.”

Executives from Civic, Smith + Crown, Abra, BitAngels, Rootstock (RSK), Unocoin, Huobi, and others, have joined BnkToTheFuture’s token sale advisory board to help the company launch its secondary market.

“While building BnkToTheFuture’s advisory board for our upcoming token launch, we sought leaders in the blockchain industry and those who have been consistently involved advocating for Bitcoin from very early on to help guide our efforts to further develop a transparent platform compliant with regulatory requirements,” said Dixon. “We’re confident that our advisory team of experts will be instrumental in this process.”

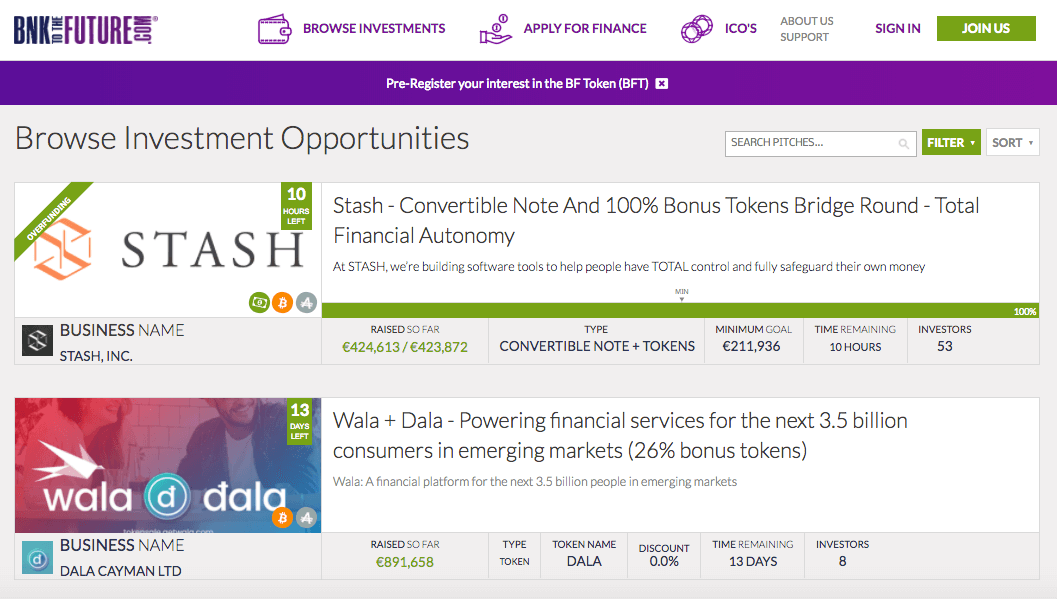

BnkToTheFuture is an online investment platform focused on fintech, blockchain and cryptocurrency ventures.

The company claims it has 45,000 accredited investors on the platform and over US$240 million invested in rounds listed including companies like Kraken, Bitstamp, ShapeShift, and Bitfinex.

Startups that wish to raise funding through platform must fill an application form online, send a set of mandatory documents, schedule a call with the BnkToTheFuture team, and pass the due diligence process.

Dixon told Block Tribune in a recent interview that they currently had a rejection rate of about 95% as only 5% of applicants would actually meet the platform’s criteria.