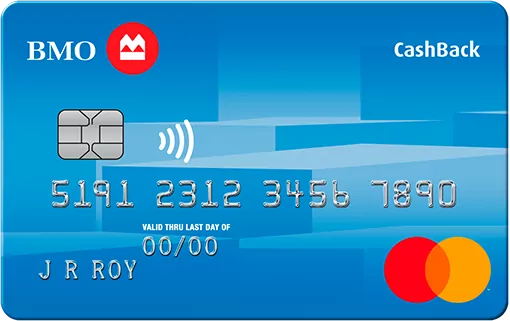

A Canadian bank has announced it will no longer allow its customers to purchase cryptocurrencies using its credit and debit cards.

“I can confirm that we no longer allow the purchase of cryptocurrencies via Interac Online Payments or by using a retail consumer Mastercard-branded credit or debit card,” a spokesman for the Bank of Motreal said in a statement.

The statement confirms rumours of the imminent ban that have been floating on Reddit. Snapshots of an email allegedly sent to employees about the decision have been doing rounds on the discussion site.

Volatile Nature

The bank cites the highly volatile nature of cryptocurrencies as the reason for the move. Major banks in the UK and the US have also banned customers from using the credit cards to purchase cryptocurrencies for similar reasons.

“This decision was made due to the volatile nature of cryptocurrencies, and so to better protect the security of our clients and the bank,” the email said.

Joining the Bandwagon

Other banks have recently joined in with warnings against investing in cryptocurrencies. Danske Bank recently published a statement urging customers to refrain from “investing in the field.”

The statement noted the fact that cryptocurrencies are not backed by central banks and the lack of consumer protection that is “typically connected with traditional currencies and investments.”

It also cited the highly volatile nature of cryptocurrencies and the little insight customers have over the market.

The statement took a direct hit on Monero as one of the cryptocurrencies that lack transparency and that could be used for criminal activity.

“The lack of transparency and regulatory control have made cryptocurrencies a target for criminal purposes and we know that they on several occasions have been involved in criminal transactions like money laundering or extortion, the statement by Danske Bank went on.

The bank outlined its “obligation” as a financial institution to fight money laundering as one of the justification for the move to ban cryptocurrency transactions on its platform.

“At the current stage, cryptocurrencies do not offer the sufficient level of transparency in order for us to live up to our obligations within anti-money laundering regulation.”

The bank does not however bar its customers from purchasing cryptocurrencies using their cards or making deposits to their accounts from cryptocurrency investments as long as they comply with anti-money laundering procedures.

“If you as a customer wish to deposit funds originating from cryptocurrency investments, we will treat it in the same way as deposit funds stemming from other types of investments. Accordingly, we may accept the deposit, if it complies with current regulation and anti-money laundering procedures,” the bank said.

Furthermore, we do not block the usage of a Danske Bank issued credit card in connection with trading cryptocurrencies. However, as with all credit card transactions, customers should comply with current anti-money laundering procedures and regulation.

The news might seem gloomy for the cryptocurrency market but there is light at the end of the tunnel. The bank is monitoring the situation and may review its stance “if the market becomes more transparent and mature.”

More Woes

This latest news adds to the woes of a market that has been reeling from sustained pressure from governments and financial institutions since the beginning of the year. Leading cryptocurrency Bitcoin is struggling to stay above $7,000 as increased scrutiny continues to take a toll.

Market Cap Steadily Declining

The to total cryptocurrency market cap now stands at $258,767,414,011 according to CoinMarketCap.

This translates to a decline of 45% of its value from about $472 billion a month ago.

Overview

Regular crackdowns on cryptocurrency exchanges in the US, South Korea and Japan have helped to further erode the confidence in the market.

This week, cofounders of Centra whose ICO was promoted by the boxing star Floyd Mayweather and rapper DJ Khaled were arrested for the fraudulent ICO. They face various charges including selling unregistered securities to the public.

![]()

In South Korea, Youbit, the exchange that was hacked twice within a year is facing new trouble after its insurer declined its claims.

The insurer claimed the exchange rushed the process and did not disclose important details before taking the policy.

A takeover of the now bankrupt exchange is in the offing but it is not clear how the latest development will affect the bid. It had been hoped that the funds from the insurer would be used to compensate customers who lost their money during the hack.

In recent weeks, Binance, the fifth largest exchange worldwide by market capitalisation was banished from Japan for operating without a valid license. It is reportedly planning to make Malta its new home.

Bitfinex is also making plans to move to Switzerland as it seeks a friendlier jurisdiction. Currently based in Hong Kong, Bitfinex is one of the largest exchanges. Chinese authorities have however been cracking down heavily on the sector since 2017. Cryptocurrency transactions are banned in the country and an orderly exit of cryptocurrency mining activities in underway.