Cardano users look more likely to sell their ADA than stake for rewards as price drops to $0.092 or 33% over the past month.

Cardano’s price has dropped by about 33% since hitting a multi-year high in late July when the launch of its staking network saw bulls push ADA/USD to highs of $0.155.

After a brief slowdown, the cryptocurrency traded as high as $0.126 before declining to lows of $0.085, with subsequent recovery attempts falling at resistance above $0.09. Cardano price has printed a series of lower highs and lower lows, likely to consolidate the downtrend momentum since the launch of its proof-of-stake mainnet.

Cardano technical analysis

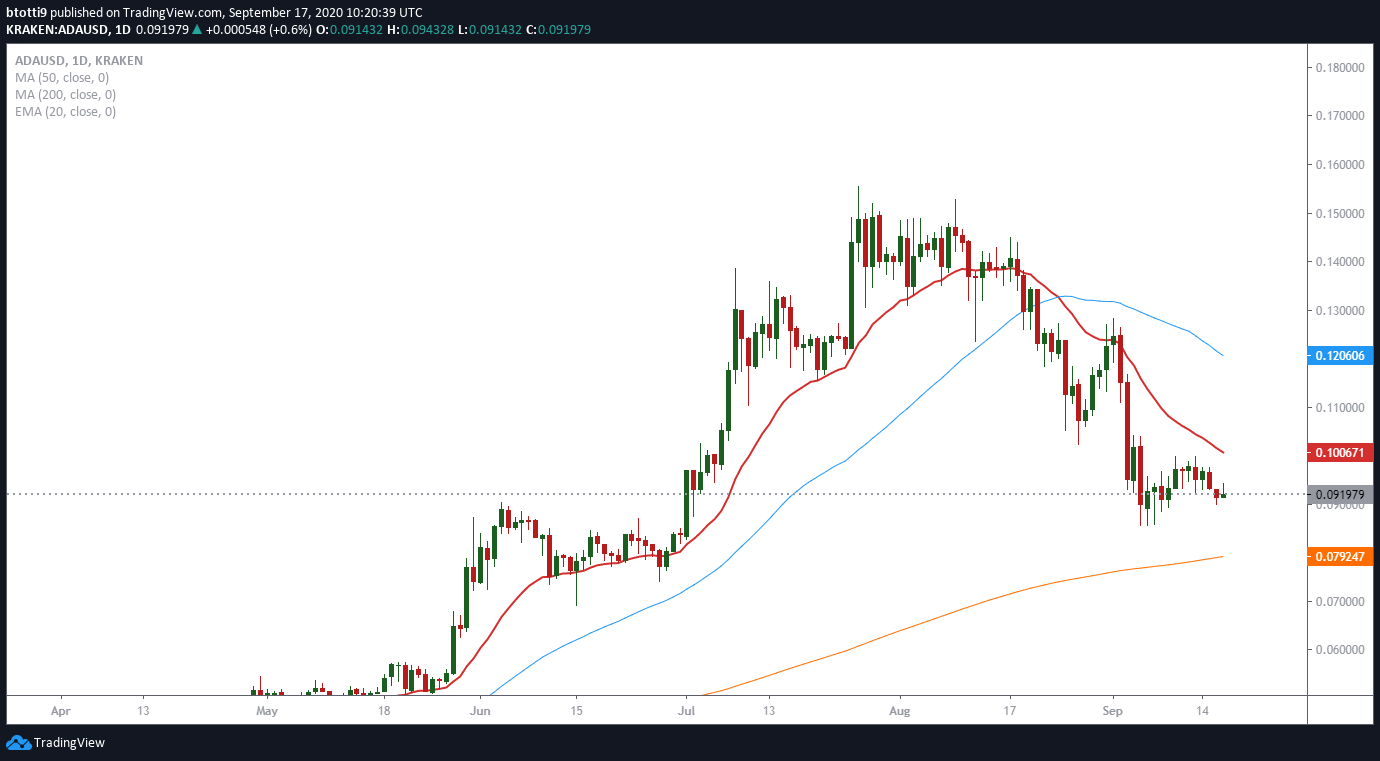

Despite ADA/USD flipping positive on the hour-to-hour time frame, the technical picture suggests the token’s price is still in a downtrend and a retest of lower levels cannot be discounted.

A look at the daily chart shows that prices have been in consolidation below the middle curve of the 20-day Bollinger Bands. The recent bearish move also saw ADA/USD drop below the 50-day simple moving average, with both the RSI and MACD suggesting a continuation of the bearish run that started on September 2.

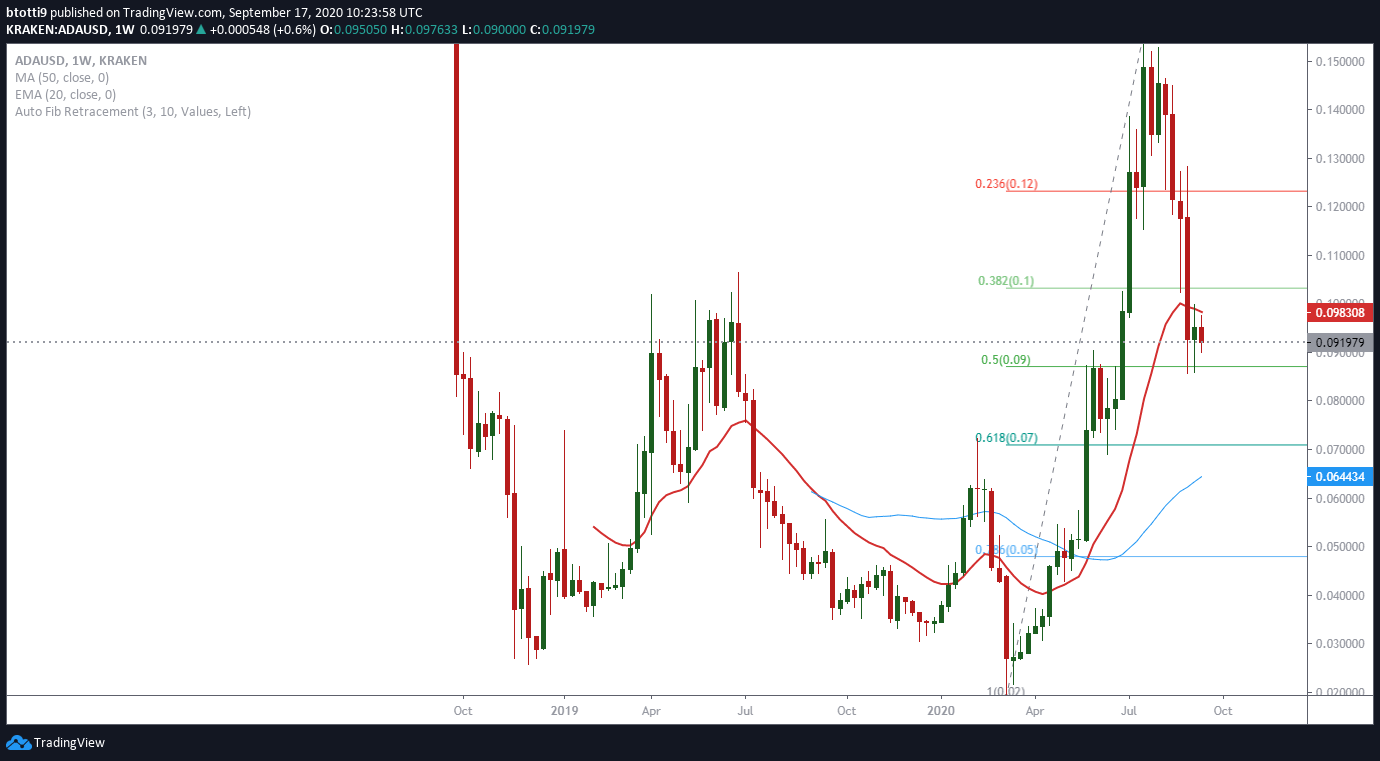

Bulls also face a tough hurdle at the 23.6% Fibonacci retracement level at $0.100. If they clear this level, a run to the 38.2% Fibo at $0.11 and 50% Fib level at $0.126 would confirm a bullish reversal. Here bulls will have to hold the 50 SMA at $0.12 to maintain the momentum to early August prices.

As of writing, the pair is trading around $0.0926, up 1.11% in the past 24 hours, but down on a day-to-day basis. Cardano touched highs of $0.0977 on Wednesday, and the indication is that if bulls lose any more support, the resulting bearish move could push prices to $0.090 and even lower

According to data on Flipside Crypto, users held nearly 11 billion of 30-day active supply in mid-August.

However, over the past month, that supply has steadily moved to Binance, to see users hold 1.4 billion of active supply on September 16. Binance on the other hand had 7.4 billion of the 30-day active supply to suggest users are likely looking to sell more of their ADA holdings.

Any further retreats in price from current levels will therefore likely mean bulls will need to defend the 200 SMA at 0.792