The price of Cardano (ADA) has risen to highs of $0.1140, with bulls likely to push towards the psychologically important level of $0.1250

Cardano is trading around $0.11395, up nearly 5% on the day and about 9% in the past 24 hours. ADA/USD is posting a strong surge that includes five straight green candles on the daily time frame.

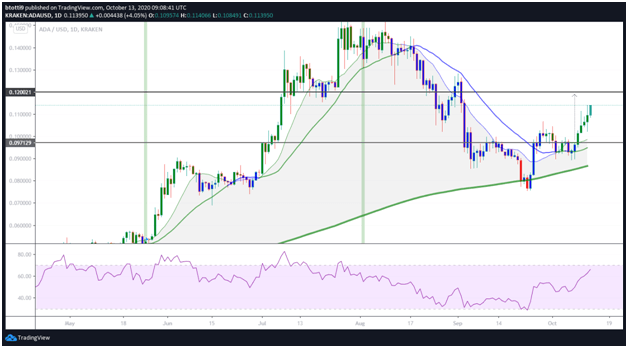

The cryptocurrency has built some momentum since cracking resistance around $0.0800 on September 24. A breakout above an ascending triangle pattern has yielded higher highs, with $0.0950 now a major support zone.

As can be seen in the chart below, a break above the $0.0970 price level was critical to the bullish run. The uptrend then confirmed with a breakout above the $0.1000 resistance level that means a sustained rally as seen over the past few days could see ADA/USD test bears’ resolve around $0.1200.

This is a legitimate target, so improved market sentiment coupled with strong technical and fundamental indicators could see the next target of $0.1250 very much within bulls’ reach.

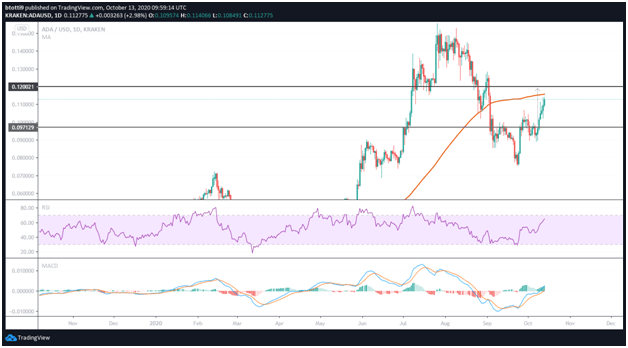

As of writing, the ADA/USD pair is trading higher. Bulls are looking to build momentum above the previous resistance line at $0.1120, which means turning the level into a support zone. Above this level, bulls will target the 100-day SMA level at $0.1150.

The next hurdle is at $0.1155, a price level that also marks the 76.4% Fibonacci retracement level. This price level provided the previous swing low from $0.1280 to $0.0755 lows. It is a key area for bulls, and barring a significant downturn, should provide the last significant hurdle en-route to $0.1250.

If buyers sustain the uptrend, the next major resistance line will be at $0.1280, with a successful close above this on higher time frames providing the foundation for an attempt at $0.1350.

Looking at the daily chart, the MACD is strengthening its bullish divergence, while the upturning RSI lends further credence to the upside call.

On the downside, ADA/USD will likely hold around $0.1100. But if there’s sustained selling pressure, a decline to $0.1075 will be more probable. Beyond this, any further rot faces a strong wall of support near $0.1020.

A breakout below the psychological $0.1000 level could spell more damage to the gains made and see bulls forced to defend the area near $0.0800.