[Full Disclosure: Magnr signed an advertising deal with CoinJournal. This interview was not a part of the deal (we do not sell any articles to any advertisers) Oliver, who deals with advertising, spoke with Colin Kwan. After their talk Oliver thought Kwan would be a good interview and passed him onto me. I was not required to write this interview and was allowed to ask any questions that I wanted. I found Kwan’s thoughts on regulation and the future of bitcoin to be unique and interesting, so I went forward with the interview.]

If the late, great George Carlin were alive today and revamping his classic “seven words you cannot say on television” sketch for Bitcoin, it wouldn’t be a surprise if he put “bank” on top of the list. Banks and “Bankers” are the evil villain in the Bitcoin world: the guardians of the keys to the doors Bitcoin is trying to break down. It has been unsurprising that most services have avoided the term “bitcoin bank” even when oftentimes that would be the best descriptor. Magnr is not scared of the term “bitcoin bank” and have seemingly embraced it.

It is important to remember why we are “fighting” this war on actual banks. It wasn’t because they gave us savings interest rates or because they managed our money competently. Those are services that even bitcoin holders could benefit from. Magnr is trying to bring some of those benefits to the cryptocurrency world.

The problems associated with the modern day banking services, have little to do with the access they provide and a lot more to do with the access and transparency they don’t provide. Allowing a banker to put your savings into a low-risk investment is a good idea, unless you find out that investment was actually put into risky sub-prime mortgage packages, as many investors found out in 2008.

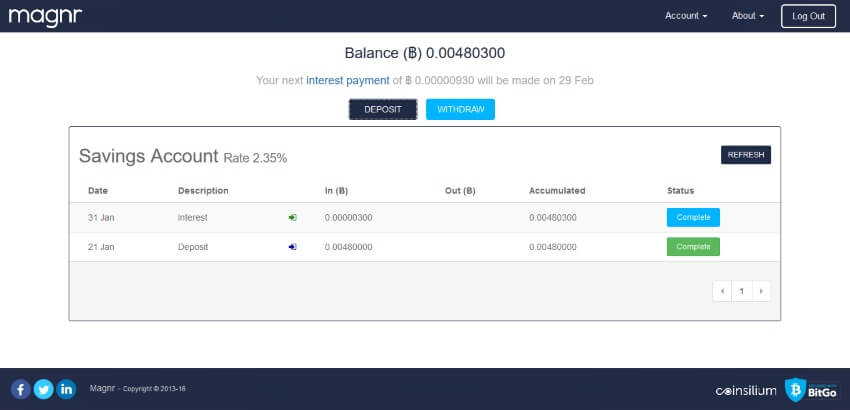

Magnr offers what probably remains the banking industry’s most popular product: the old fashion savings account. They offer a rate of 2.35%, much higher than a standard bank savings account interest rates that generally sit between 0.001% and 1%. They also offer leveraged trading across three major exchanges (Bitfinex, Bitstamp and itBit) at a 10:1 ratio. The fees generated from leverage trading pays for the savings account interest rate, which will eventually change dynamically depending on how many active traders there are.

I spoke to Magnr CEO Colin Kwan, who also happens to be on the board of the UK Digital Currency Association (UKDCA). As you might expect, we talked about Magnr’s past, present and future as well as how he thinks bitcoin regulation should be handled and where the digital currency will be in the future.

Ian DeMartino: Why the name switch from btc.sx to Magnr?

Colin Kwan: Initially BTC.sx was intended as a starting project. It quickly gained a lot of traction and followers, but it was not the overall direction we wanted to go. When we came out with the savings platform, we decided to rename the brand. At the time, there was a concern over if BTC or XBT was going to become the currency ticker of choice.

Besides, we wanted to be cryptocurrency agnostic. We never know what will be big in the future. It could be Litecoin, it could be Bitcoin, it could be Ethereum that is used in the future. The new branding also means that we can start looking at digital asset classes other than bitcoin. Maybe something wrapped around futures and options.

DeMartino: Is that a definite plan for the future, or just something that you are thinking about?

Kwan: No, we are definitely going to continue moving towards that. Btc.sx became Magnr trading, we created Magnr savings. We are looking at creating further investment products other than savings.

DeMartino: I mean specifically with the altcoins and the assets?

Kwan: We could do that. we just haven’t because of the market volume. People like the altcoin exchanges, but we are not trading those because the market volume is not high enough.

That said, we can allow that to happen. In the future, digital assets could be based on different cryptocurrencies than just bitcoin.

Let’s say the Bank of England comes up with their own version of bitcoin to manage their currencies. We could start trading that.

DeMartino: There has been a lot of talk about the UK possibly making a central bank cryptocurrency, do you think something like that could be successful?

Kwan: It is something that has been talked about rather openly. I am the CEO of Magnr and the director of UK Digital Currency Association, and part of our mission at the UKDCA is to talk to the treasury, the Bank of England and the policy makers. We explain to them what digital currencies actually mean to the UK and how the UK can even benefit from these types of currencies.

One of the discussions that the Bank of England brought up was whether they could start issuing GBP on the blockchain. That is different than creating their own currency, but it would be significant.

However, a lot of governments have been toying with the idea of how to do something like this. The biggest issue with their currency, is that they know how much they have printed, but they don’t know how much is really in circulation.

A lot of these bills have been washed away, burned, destroyed, taken to different countries, and used in foreign countries, like we see with the dollar. They don’t know where these notes are and they want to be able to track them. That is essentially the whole point of them creating these digital currencies.

DeMartino: Do you think that this would be a good development for the larger cryptocurrency community, or do you think it would steal some of Bitcoin’s thunder?

Kwan: Well, the thing is, Bitcoin is a global currency. At least, I view it as a currency. Some people might not, but it is an asset of value that people can transfer around and barter with, so it is an asset of value at least.

Now, for an example, Japan was also talking about doing something similar. So there is a network effect going on here. Bitcoin is a network people can use all over the world.

Not everyone can use Japanese Yen, not everyone can use the GDP. If it were available as an altcoin on the global market, then potentially it could disrupt bitcoin’s thunder.

I don’t see that as likely, because of the nature of every government jurisdiction and how they treat their currency. Currency manipulation is one lever that governments use to control their populations. They can change interest rates, they can do all that through the manipulation of the currency. Humans generally dislike that type of control.

DeMartino: Getting back to Magnr, I was trying to figure out what your fees are on leverage trading, can you explain that to me?

Kwan: Our trading fees are 0.45% for opening and 0.45% for closing, because every trade we make goes off to the market. It goes to Bitfinex or Bitstamp or itBit and there are commissions on those trades. There is also a daily fee of is 0.3% that is only charged after a 24 hour period. If you close you position before 24 hours, you don’t have to pay that daily fee.

DeMartino: BitGo just announced zero-confirm transactions, considering how important speed is in day trading and that you guys work with BitGo, is that something you are considering implementing?

Kwan: We are looking to utilize some of that. It is something new that they came out with and we would like to try it and see how it works with us. That will definitely help people that are doing day trading. The difference with Magnr is that a lot of people have savings with us, so with them switching between internal accounts is something we would have to consider also.

DeMartino: Will non-leverage trading be coming to Magnr?

Kwan: We are looking at that as one of our next tier products to come out. Effectively, you could utilize the high volume trading that we have. We have such high volume trading that we can get a lower rate with some exchanges, so we are looking into doing that.

We have had a lot of inquiries about that, it is something we have on our timeline, it is just a matter of getting some other things out of the way first. They are nearly done, it is just a matter of creating these kinds of tiered features.

DeMartino: The IMF recently recommended international cooperation when it comes to Cryptocurrencies? Do you think Bitcoin would benefit from a some international regulations or a best practices policy or something like that?

Kwan: There is definitely a need for an international standard. Being a part of the UK DCA, we are looking to help establish what we call the IBC, the International Blockchain Committee. We want to have international bodies as representatives and create a standard across all blockchain systems.

The key aspect here is the underlying technology and how it is used. One of the problems is that we are talking about international institutions and each jurisdictions has its own stack of regulations. One of the main issues with regulations across borders, is trying to get two governments to agree.

At times, that seems next to impossible. So the job of the IBC will to create standards that will start as optional, but eventually we will be able to say “everyone should abide by these.” Hopefully, that will increase the trust and use of Bitcoin and related technologies.

In my opinion, Bitcoin is still in its infancy in how it is used. There are a lot of issues that governments have with their own currencies that don’t apply to bitcoin. Slapping on regulations for the sake of having regulations is probably not the best practice. You need to have some proper use cases to really figure out how it should be regulated or even to make standards. You need to create standards based on usage.

DeMartino: In the same IMF report, it mentioned that since cryptocurrencies themselves are resistant to regulation, related crypto services, like yours, should be the subject of regulation. Any thoughts on that?

Kwan: I wouldn’t say that cryptocurrencies are resistant to regulation. I think current regulations have been created to manage existing problems. A lot of regulations started out a hundred years ago. Then someone did something and a new regulation was made to deal with that. Over the years, more and more regulation was piled on top of it.

If you look at the underlying regulations, they could probably be limited to three or four pages of what the regulation was supposed to be. But when you add all the nuance and differences and new cases and problems that came out of it, you got a regulation that if you put each piece of paper end to end, would probably reach to the moon.

Current regulations aren’t designed to be slapped on top of cryptocurrencies. They need to re-review what their regulations are about and figure out how it can be applied to cryptocurrencies. They also need to figure out how it can be applied to something that is on the internet and no one really has control of.

Cryptocurrencies are not resistant to regulation. From a customer/consumer perspective, there should be some regulation, but who is going to regulate that?

So far, we have seen a lot of self-regulation, which is both good and bad. People are getting more intelligent with how they spend their funds. With social media and things like that, if a company does something horrible, then people don’t do business with that company anymore. That is a form of self-regulation.

DeMartino: During the MtGox fiasco, you only used that one exchange, now you have three of them, does that make incidents where you had to halt trading, a thing of the past? [Writers note: Magnr took the Mt Gox loss on itself, and no customers lost any funds, something very few companies burned by Mt Gox can say]

Kwan: Yes. There were a couple instances where Bitfinex had a problem, later Bitstamp had some issues. We still had at least two of the other exchanges up, so that allows people to continue to trade. The only issue here is that if people had an open position with the [affected exchange] then that was a difficult situation for us. Essentially, when the price opened up again and traders couldn’t actually do anything, we again, took the losses. In that instance, we deemed it unfair to the traders to not be able to trade.

Now, that was a cost to us. However, as a company that is trying to grow and be as transparent as possible, that was the best way for us to be more customer driven.

DeMartino: What are the plans for Magnr going forward?

Kwan: We are looking to build what is essentially the next phase of financial services, creating a bitcoin bank. At Magnr, we are looking at creating a lot more investment products, as I mentioned not just the savings products, but higher return products as well.

DeMartino: Speaking of that, how have Magnr users been enjoying the savings feature?

Kwan: People love it. A lot of our traders have asked for this before. They don’t always trade so whatever is sitting there just sits dormant.

If you know day-trading, you know that you sometimes find a stagnant market and therefore you don’t do many trades. During the time frame where that is happening, traders want to be able to hold their bitcoin somewhere, rather than keeping it in a wallet doing nothing. A lot of the traders move their funds into the savings and then when they want to trade, they move it back into trading.

We have also seen a lot of people just looking to park their bitcoin, because they are hoping that the price will go up, but at the same time they want to get some sort of return on their funds for parking them somewhere. That is what we started. The reason we came up with the 2.35% is because it is something we can afford, however it is a promotional rate.

We set that as an industry first mover rate. We are looking to create a lot more products like that, not just to encourage people to use our products, but also to prove to people that you can earn a lot more in Bitcoin than you can in your current currency’s markets.

DeMartino: You mentioned other products coming to Magnr, could that be something where you manage funds and invest them on P2P lending sites, or a package of loans that have a higher upside but also higher risk?

Kwan: Yes, we will be looking into things like that. With P2P lending sites, you are essentially dealing with another peer and that peer may default on you, so you are taking the risk. Not to say that isn’t a good thing, P2P systems are good for that if you are willing to take that risk.

We have found that some people don’t want to take the risk. It is human nature, they don’t know how to manage that risk. So they are saying “here is a sum of money and I want to get a certain return, can you manage that for me?” and those are the kind of products Magnr will be creating, managed funds.

DeMartino: Where do you see the bitcoin ecosystem in five years?

Kwan: The rate of adoption in bitcoin is increasing rapidly. Now you might not think that is the case, especially in the western world, but that is because in the west we have our credit cards, we have our bank accounts, we have faster payments, we even have the technology for tap and pay.

A lot of countries are still working on Checks, but that is still a system that works. Apple Pay is showing that you can do everything digitally, so why do we need anything else? We aren’t very open to new ideas because we already have things that help us.

Meanwhile in emerging markets, in the Philippines and Kenya and even China, which has a lot of its population outside of the cities, they don’t have the infrastructure we have in the first world. They sometimes have to go hundreds of miles to get to a bank. They don’t have the infrastructure we do, but they do have mobile phones.

Mobile technology is advancing the way we do commerce. Today, you can’t send Kenyan Schillings through the mobile network, but a company created M-Pesa. M-Pesa is similar to a digital currency and it can be converted into Kenyan Schillings.

What that means is that people in that region, using that network, can transact in M-Pesa in between eachother. That is a true usecase, they don’t have to hold Kenyan Schillings.

Now, enter a company called Bit-Pesa, which allows people to transfer bitcoin from the UK and the US, back to Kenya using Bitcoin. The Kenyans then change that bitcoin back into M-Pesa or Kenyan Schillings.

Something to note here, is that these community based countries, once they find a new technology or service that they can use in the community, they gravitate towards it very quickly.

Sellers and buyers no longer have to meet in centralized marketplaces every time they want to make a deal. A leather producer who already has a relationship with a goat seller can make a purchase without carrying what may be a large amount of money to the marketplace, and can instead send bitcoin and wait for the goats to be delivered or pick them up himself.

The risk for the seller and buyer is now cut in half, rather than having to worry about something going wrong with the transfer of the money and the goats, now only the goat’s travel has to be considered. Additionally, if the leather producer held his money in a bank, that is another, potentially lengthy, trip that the producer gets to skip thanks to bitcoin.

Another example of that is Kenyans going to Uganda, which is just across the border. [Writer’s note: There is a lot of trade and business, both recorded and unrecorded, between the two countries.] They have to go through money exchanges and change their Kenyan Schillings into Uganda Schillings and the exchanges are charging a 20% commission because there are no banks at the border to compete with them.

Ugandans are starting to learn about bitcoin, so instead of dealing with the 20% fee, they are just doing the exchange in Bitcoin. And this is happening all over Africa, which has the highest rate of bitcoin adoption, followed by Asia. The rest of the world will catch up later.

So, my short answer, is that Bitcoin will be huge in five years.

Ian DeMartino: Anything else you would like to say to our readers?

Colin Kwan: Well, I guess this is more of a marketing ploy, but if you have bitcoin, go to Magnr, save your bitcoin there and you can earn an interest rate. If you are an avid trader, you may like our trading platform, we have over 20,000 registered users who love the platform and I don’t anticipate you’ll experience any issues.

We want to thank Colin Kwan for taking the time to be interviewed by us. You can follow Kwan on Twitter @colinkwan. You can join Magnr here and keep up with the UKDCA through their official website.

[Photo Modified From: Jason Baker, Theodore Scott]