Abra users outside of the US can now fractionally invest in stocks

and ETF products using Bitcoin, the company announced on Wednesday.

Bill Barhydt, CEO and founder of digital wallet and exchange

services provider Abra, said the new product is targeted at users who would

otherwise not have access to US financial markets, enabling them to build

personal wealth affordably and in a convenient manner.

“The focus of this launch is to make financial markets of the developed world more accessible and affordable to those in emerging economies,” he said.

Through the Abra app, international users can now start investing

with as little as US$5 per investment through a fractionalized investment model.

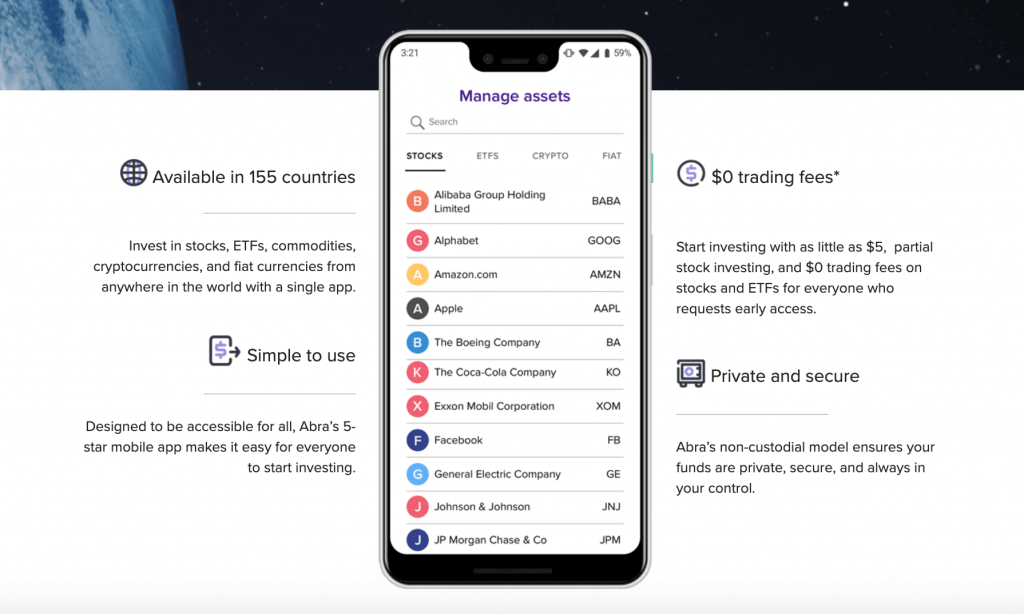

The platform currently supports more than 50 stock and ETF products including

indexes such as Vanguard Growth and S&P 500, commodities like SPDR Gold

Trust and oil, international markets including Asia, Australia, Mexico, and

Emerging Markets index funds, and popular stocks such as Tesla, Uber, Apple,

Amazon, Google and Netflix.

Abra announced

the investing offering earlier this year. Barhydt stated in a blog post that

the company would begin with US products before adding more global assets in

the following months.

“Many consumers in the US and other countries already have access to stocks and mutual funds via online brokerages,” he wrote in a post in February.

“However, many people (billions actually) are shut out of these investment opportunities due to their geography, financial status or lack of accredited investor status, income level, or lack of trust for their local financial institutions.

“We’ve heard from many of our users that they would love to have one stop shopping from the Abra app for all of their investment needs. This new product release makes this wish a reality.”

According to Willie Wang, vice president of product at Abra,

tens of thousands of investors from around the globe had signed up for the waitlist.

Founded in 2014 and headquartered in California, Plutus

Financial, Inc., doing business as Abra, operates a mobile-based app that

allows users to buy, sell, store and invest in cryptocurrencies. The platform

is based on a non-custodial architecture, meaning that Abra doesn’t control or

have access to users’ funds. Instead, Abra uses Bitcoin and its blockchain

technology to store and encrypt cash deposits on the user’s mobile device.

As a special promotion for the launch of the investing product,

Abra is offering zero trading fees for the rest of 2019 on stock and ETF

investments.