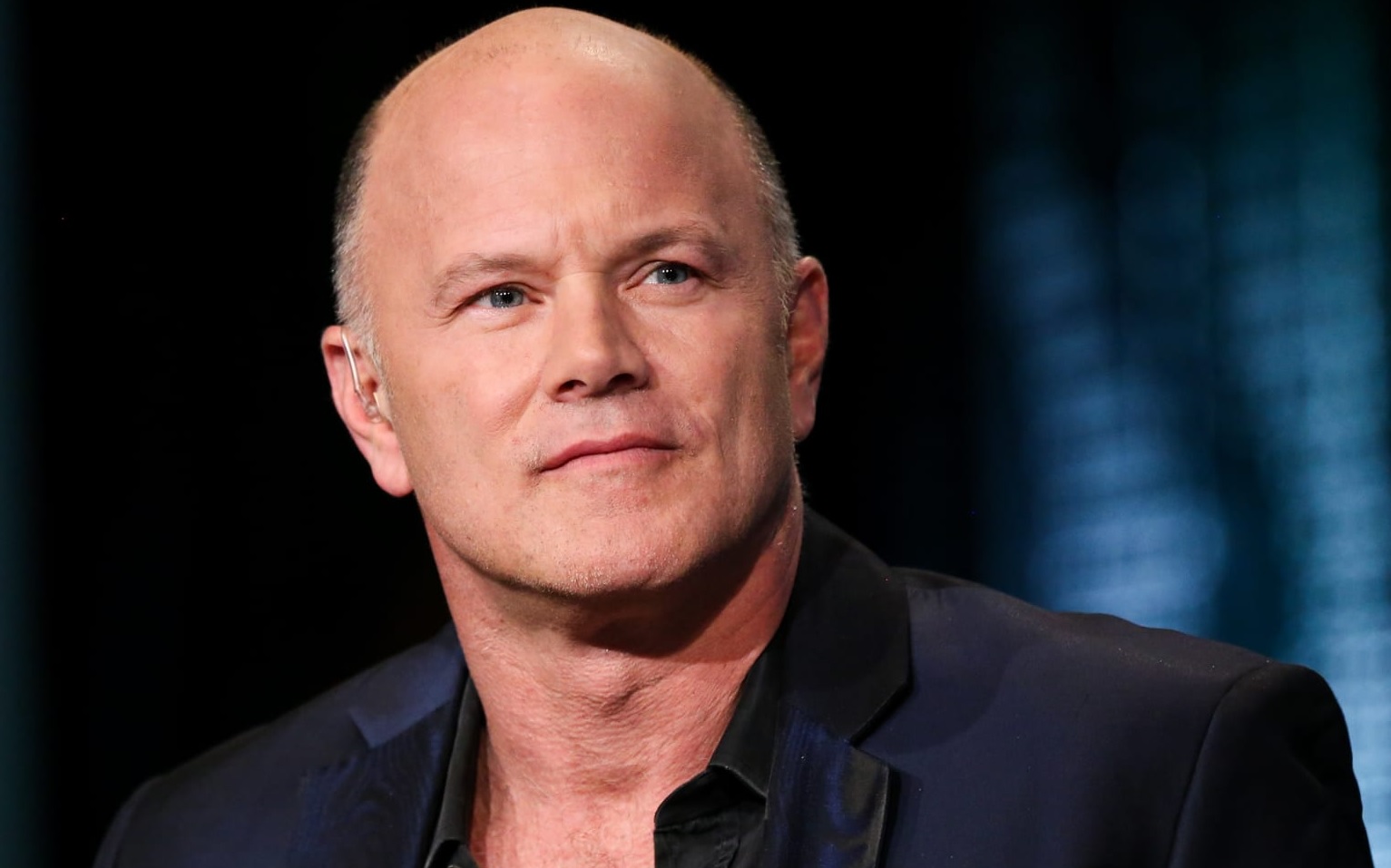

Crypto billionaire Mike Novogratz says markets are now in bear territory after recent sell-offs.

In December last year, Galaxy Digital CEO Mike Novogratz said Bitcoin needed to hold support at the $42,000 level or risk further declines below $40,000. In a bullish outlook for crypto, the crypto billionaire noted that the pullback would however present a decent buying opportunity for institutional investors.

This week has seen the broader crypto market track sell-off pressure in the equities, with Bitcoin and Ethereum both sliding below key support levels.

According to Novogratz, the tumbling stocks have exacerbated the negative outlook across crypto and the drawdown seen in Nasdaq and other stock indexes means the bear market is here.

Commenting on the crypto market outlook as well as the sell-off on Wall Street, he noted:

“The Russel index broke a major support and today’s roll over confirmed it’s broken. This is now a bear market. There is 1.2tr of bad equity longs above the market. Sell rallies. Don’t buy dips.”

Earlier, he had pointed to the retreating yields and the general downturn in the bond market and the impending interest rate hikes as spelling bad news for Nasdaq and cryptocurrencies.

However, he stated that the stock market and crypto would remain vulnerable to further rot if rates went up. To him, higher rates would see the 10-year Treasury yields jump to 2%, squeezing crypto and stocks lower.

Despite this projection, the Galaxy Digital chief believes cryptocurrencies have a chance at bouncing from recent lows. He notes that the crypto space has already felt the pain and currently looks set for “some buying pressure.”

But he warns the expected upside might not come unless the stock market stems the slide seen year-to-date. If the stocks continue to tank, Novogratz forecasts a “hard time.” He believes that a scenario where stock markets sink even deeper would limit any potential rally for crypto.

2) crypto will have a hard time rallying until stocks find a base. That said, crypto already had a decent sell off and is running into some buying support.

Finally, the best traders get good at gallows humor 😂

— Mike Novogratz (@novogratz) January 20, 2022

All the top ten cryptocurrencies by market cap are currently down double digits. The sell-off has wiped billions off the total crypto market capitalisation, cutting it by 11% to push it below the $2 trillion mark.

According to Stash CEO Brandon Krieg, the sharp declines across crypto offer a "perfect" opportunity for retail investors to get exposure to cryptocurrencies.

In stocks, the Nasdaq is down 2.4% on Friday after entering a correction earlier in the week with a 10% slump. The S&P 500 is also tracking huge losses for the week, currently 1.4% down.