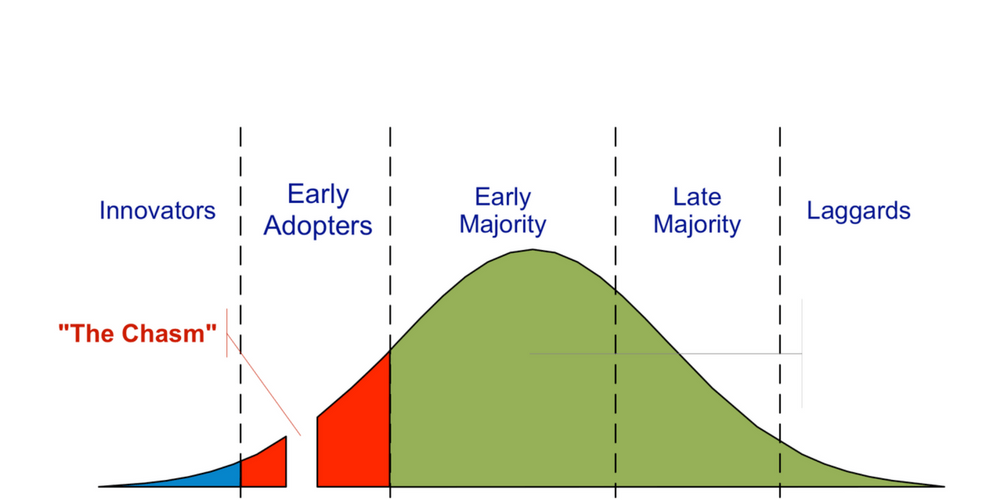

The growth and advancement of technology is a game of inches. No idea springs forth fully formed, ready for adoption by the masses. Everything builds on what came before it due to a process called the “Diffusion of Innovations” a term invented by Dr. Everett Rogers while he taught at the University of Ohio. Rogers was the first academic to research and attempt to understand how and why ideas are spread, dividing these into five categories that can be viewed via a Bell Curve.

First, you have the Innovator(s), then the Early Adopters, the Early Majority, then the Late Majority, and finally you get the Laggards. Each of these groups plays an important role in the process and they tend to correlate with things like education, financial stability, and social class. As always there are outliers, those who don’t seem to fit into the category they are placed in but find themselves there anyway. For instance, Innovators came come from any social strata and may lack any formal education at all but they have an innate sense that something needs to be done and they find themselves doing it. Early Adopters tend to be educated, have financial stability, and as one would guess, come from the higher levels of society.

This is not to say that rich people are smarter than poor people, it just means that rich people are more likely to jump on gee-whiz trends like calculator watches and Google Glass. Both of those inventions were, in a word, garbage, but they paved the way for future technological advances. Neither got past the Early Adopter phase, but they didn’t need to. These devices, and others like them, served as proof of concept and became the building blocks for things like the Apple Watch and the Sony contact lens that can record video. They sparked the imagination and drew venture capital and Innovators who wanted to build something better.

Once you understand the actors, you then need to understand the processes by which the idea is spread out into the public consciousness. How this diffusion takes place is called Communications Channels. There is a common joke among military communications units “You can talk *about* us, but you can’t *without* us” and like the best jokes, it is grounded in a great deal of truth. Unless and until communications channels are firmly established ideas cannot spread and therefore cannot be adopted en masse. Parallel thinking is a real thing, and it does happen at different times in different geographical areas which is why Asia had printing presses centuries before Europe did.

Time is the next factor in the adoption process because new ideas are almost never embraced immediately. There is a common trait among humanity to cling to what we know, to stay close to home, to reject the unfamiliar. It is especially true when one is attempting to disrupt existing socio-economic systems. The Romans rejected the first, exceedingly primitive, steam engine because who needed such a thing when you had slaves? As you may have guessed, this argument was very popular with those who ran the slave markets.

And finally, we arrive at Social Systems, the place we all live in. The society in which you are raised shapes your worldview because your embrace or rejection of the norms and mores of where you live determine your success or failure more than your birth circumstances. History is rife with examples of men and women who have risen from obscurity to positions of vast wealth, power, and acclaim and just as many tales of those who have lost those things because they refused to accept new ideas or because they embraced them.

I am going to attempt to show you how all of this relates to cryptocurrency, making it as clear as possible.

It is hardly a secret that the financial industry is less than enthused about the existence, much less the popularity, of Bitcoin in particular and cryptocurrency in general. Not a week goes by without another article in the mainstream media about banks closing the accounts of crypto exchanges, issuing warnings to their customers about the dangers of these arcane financial instruments, etc. So, for many, it came as quite a shock when the announcement came that huge financial institutions are now planning to open cryptocurrency portfolios.

The people who were not surprised by this news, obviously, were people who knew about the Diffusion of Innovation that I mentioned previously. The fact that powerful investment groups are now looking into crypto shows that we have entered the fourth phase of that model. For those who are unfamiliar, let me give you a quick breakdown as it relates to crypto.

First, we had the Innovator David Chaum the founder of DigiCash, an electronic payment company that used cryptographic protocols to guarantee anonymity. His company operated from 1990 to 1998 and inspired some Fast Followers who went on to create their own variations on the idea.

The next iteration was e-gold in 1996, at the beginning of the buildup to the .dotcom craze that captured the imaginations of so many as the Internet first escaped the confines of academia and big business. That company processed $2 billion a year by 2006 until it was ultimately shut down in 2009. And in 2006 we saw Liberty Reserve briefly make an impact until the US government shut them down as well due to concerns over money laundering.

Not even China, with its extensive control over the online activities of its vast population, could resist the rise of digital currency. In 2005 QQ coins, a digital currency sponsored by a company called Tencent QQ, became so popular that it encouraged speculation not unlike the infamous Dutch tulip craze that everyone in the early days kept likening Bitcoin to. And, speaking of Bitcoin, let’s not forget that one arrived on the scene in 2008, not with a fanfare, but an initial lack of interest. More on that in a minute.

If you pay close attention to the dates of each of these markers you can see that they correspond with the expansion of the Internet deeper into everyday life. This would be the Communications Channel that Everett Rodgers spoke about.

The Early Majority, the 3rd phase of the DoI model, was ushered in by the infamous Dread Pirate Roberts and his drug bazaar The Silk Road. Bitcoin was nothing more than a novelty until someone created a marketplace where it could be used. And nothing sells better than sex and drugs, just ask anyone who has ever taken a marketing class or watched 8 hours of television post-1985.

This success of Bitcoinled to Charlie Lee creating Litecoin for the ostensible purpose of being “Silver to Bitcoin’s gold” which, I think we can all agree, is a pretty sound idea. And of course, that led to Jackson Palmer creating Dogecoin, the copper penny of the cryptosphere.

Since then we have seen literally hundreds of new coins created, each one professing to be the solution to some problem or other, but most fizzling out in days, if not weeks. This is also part of the cycle as the innovation undergoes re-invention as the idea permeates into the public consciousness via the established communications channels and attracts new innovators. That being said, all that glitters is not gold and people should be very wary in how they invest their time and money in these new enterprises.