Despite the Mt Gox trustee seemingly ready to sell a significant amount of Bitcoin the cryptocurrency markets are showing Bullish signs. A reassuring portent for investors is the volume of Wall Street purchases via CME Group Bitcoin futures trading, say eToro.

Bitcoin reached $9,740 USD this week, the closest it has been to the $10,000 mark for nearly two months. Moving above $10,000 would be a critical sign of positivity for the cryptocurrency market.

“Psychological resistance remains at $10,000, which oddly enough is almost exactly where the 200 Day Moving Average (blue) is right now,” explains Mati Greenspan, Senior Market Analyst, eToro. “A break above that would be a very good sign.”

As yet the news of the Mt Gox bankruptcy trustee, Tokyo lawyer Nobuaki Kobayashi, moving 16,000 Bitcoins worth around $141 million USD out of cold storage, has yet to stall investors. The Mt Gox addresses still hold around 146,000 Bitcoin. Kobayashi revealed in March he had sold around $400 million Mt Gox Bitcoin and BCH in September 2017. Many Mt Gox creditors have yet to recoup their investments after the Mt Gox exchange ceased trading in 2014.

The move of Bitcoin from the cold wallets could indicate Kobayashi is ready to liquidate more of the coins, however the amount moved may signify some care is being taken to slowly sell the Bitcoin stash rather than flooding the market and causing a further depression.

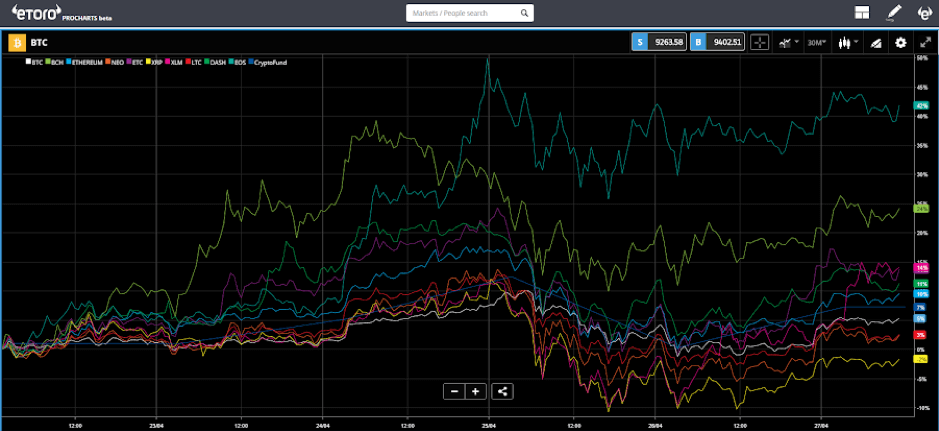

eToro illustrate a very positive trend for the market as a whole in the following chart, detailing the spread of performance between altcoins. The “fanning” out shows coins are performing more independently, and on their own merits.

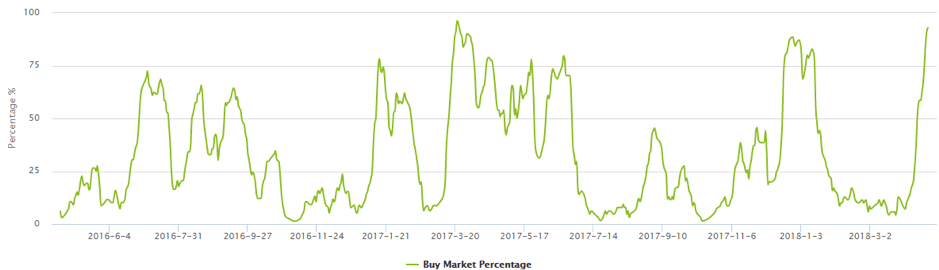

Stellar and IOTA are top performers in recent days with Stellar duelling for 7th place by market capitalization with Cardano. Cryptoslate also report positive trends this week. Figures from TurtleBC confirm that the buy market percentage across a range of coins including Bitcoin, Ethereum, Ripple, Dash and NEM is currently at 92.86%, which is actually higher than the December peak of 88%.

Total market capitalization is back above $400 billion USD again for the first time since early March, a further sign of what is potentially a sustained recovery for the cryptocurrency market.

“I’m not surprised to see bitcoin’s price exceed $9,000 this week,” Rodrigo Marques, CEO of investment platform Atlas Quantum, told The Independent. “Rumours of a price explosion seem to have been driven by more and more institutional buyers getting into cryptocurrencies.”

Indeed, institutional acceptance seems to be on the increase with Nasdaq on Wednesday confirming that they would move into cryptocurrency markets if regulatory issues were ironed out.

German bank and securities trader VPE have also this week become the first German bank to offer cryptocurrency trading to institutional investors.