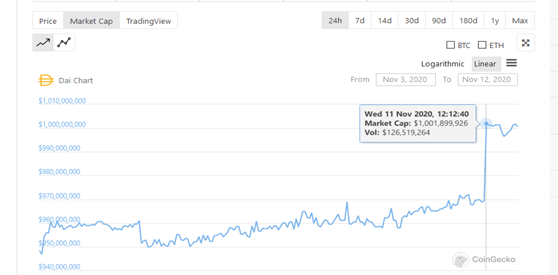

MakerDAO’s DAI stablecoin yesterday reached a market capitalisation of $1 billion for the first time

The new valuation is according to data obtained from the crypto analytics firm CoinGecko; the stablecoin has had a relatively quiet week, with only minor action until yesterday’s spike. Before the $30 million jump that took the coin to $1 billion, the market cap revolved around $960 to $975 million.

The feat now puts Dai’s overall market dominance at 0.22%. Dai’s current trading volume is over $81m and, as of writing, DAI trades at just above $1.00. Eight hours after breaking the $1 billion mark, Dai’s market cap briefly fell to $996 million before recovering three hours later. Today, the market cap has stayed around the $1billion area although signs indicate that it may fall again.

The MakerDAO Foundation has not yet made any official communication regarding the milestone so far. Analysts have quickly drawn a comparison between this achievement and that of DeFi hitting $1 billion in total value locked (TVL).

The latter broke the $1 billion mark back on February 7. Since then the DeFi space has recorded explosive growth with only September and October being the months with poor activity. The DeFi sector has managed to record several peaks within this period i.e. between February and November. As of writing, the TVL lifetime high – set earlier today – is at $13.7 billion according to DeFi Pulse . Yesterday, the total value locked across all DeFi protocols topped 1$2.98 billion.

MakerDAO sits second place in the DeFi sector in terms of total locked value with $2.3 billion. Uniswap has the highest TVL at $3 billion which represents 22% of the entire DeFi space. Maker’s percentage supply locked stands at 2.3%.