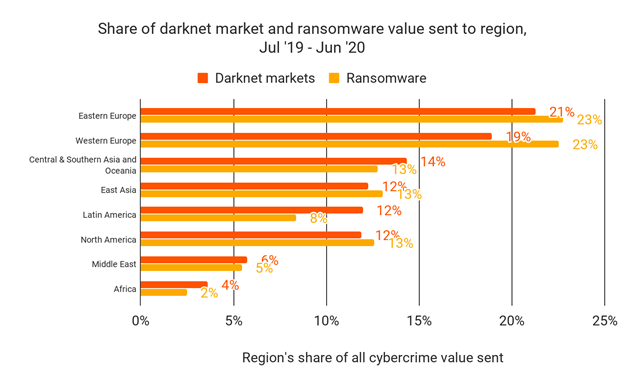

A recent report from Chainalysis has revealed that Eastern Europe tops other regions in terms of ransomware volume and darknet activity

Data from the blockchain forensics company showed that the darknet markets have an inordinate existence in Eastern Europe’s crypto sector. The firm’s 2020 Geography of Cryptocurrency Report, which is still yet to be fully released, has an excerpt claiming that the Eastern Europe region holds “more global darknet market activity than any other region”.

The anonymous free market Hydra is responsible for the region’s sixth-largest crypto service. Chainalysis believes that Eastern Europe has 1.4% of its $41 billion crypto volume during the study period forwarded to unwarranted, illegal operations.

From a percentage perspective, this puts the region at second position behind Latin America, which has 1.6% of its volume forwarded to illegal operations. In terms of volume, however, Eastern Europe beats Latin America, whose volume is significantly smaller.

The Chainalysis report further approximates that Hydra spawned over $1.2 billion in crypto revenue in the study period i.e. June 2019 and July 2020. Although the platform primarily serves the Eastern Europe region, it is the biggest darknet marketplaces globally.

In addition, the region is also synonymous with “the highest-earning ransomware network administrators and ransomware-as-a-service operators”. According to the report, the Eastern Europe region draws and pockets 23% of all global transfers sent to ransomware addresses. One would argue that the region is now home to high levels of crypto-powered cyber-crime.

It’s not all bad news for Eastern Europe, though. The Chainalysis report points out that the region has witnessed massive embracing and adoption of crypto assets for purposes that are warranted.

Ukraine and Russia are first and second in the Chainalysis’ Global Crypto Adoption Index with a score of 1 and 0.931 respectively. Belarus, also in the region, comes in at position 19 with a score of 0.241.

The blockchain analysis firm also notes the tremendously growing company of crypto fund managers within the region.