The lending DeFi protocol has seen an upsurge in trading activity over the last 48 hours, sending its price to an ATH

The open-source non-custodial protocol has set a new price and total value locked high. This comes on the back of a strong performance over the weekend. Aave recorded a peak trading volume of over $1.2 million at the end of yesterday. This is more than double the trading volume it had recorded on either of the previous three days.

At its $3.25 billion market cap, Aave ranks 16th among the largest blockchain networks. The protocol’s price significantly soared, setting a high of $216.93 on Saturday before surpassing it with a record high of $285.43 yesterday. The token is currently changing hands at $268.71, having gained 1.7% on its last closing price. This record high price coincides with the growing value held on the platform.

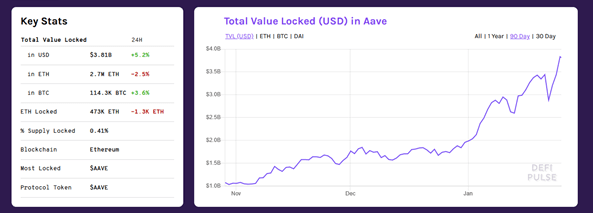

Aave’s total value locked (TVL) is still rising, as observed by the DeFi data aggregator DeFi pulse. The protocol’s TVL has steadily grown since Friday, with the most significant TVL change coming on Saturday. The protocol gained $325.04 million on Saturday, followed by $232.47 million yesterday.

Aave’s TVL chart. Source:DeFi Pulse

Coming off the weekend, Aave had a TVL north of $3.4 billion. This figure has since risen to $3.91 billion as of writing. This is Aave’s highest TVL figure since its launch. There’s a likelihood that it won’t remain a record high for long as the protocol is poised to break into $4 billion if the uptrend continues.

Today’s activities will be crucial in sending the protocol above the $4 billion level – a feat that has, so far, only been achieved by the decentralised credit platform Maker. The lending protocol has a total value locked of $4.8 billion and tops the list of largest DeFi projects with a market dominance of almost 18%.

Aave took two weeks to cross from a TVL of $2 billion to $ 3 billion. The protocol is on course to cross another $1 billion in TVL in a shorter period if it touches $4 billion today or tomorrow.