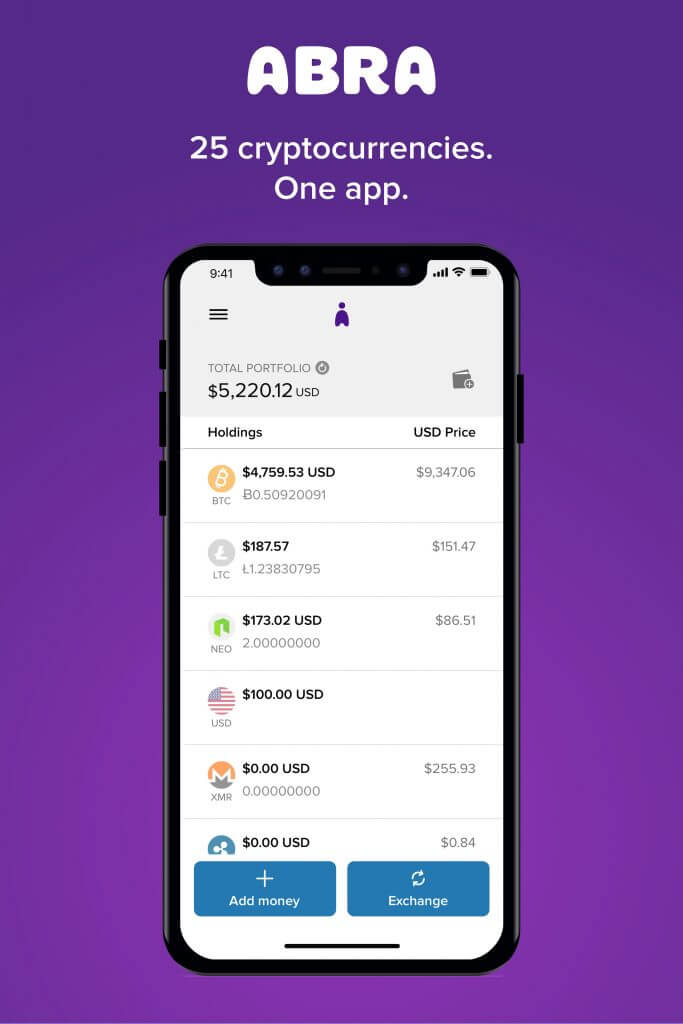

Digital wallet and exchange service Abra has announced the addition of five cryptocurrencies to its platform, now letting users buy, sell and invest across 25 cryptocurrencies and 50 national currencies, the company announced on Tuesday.

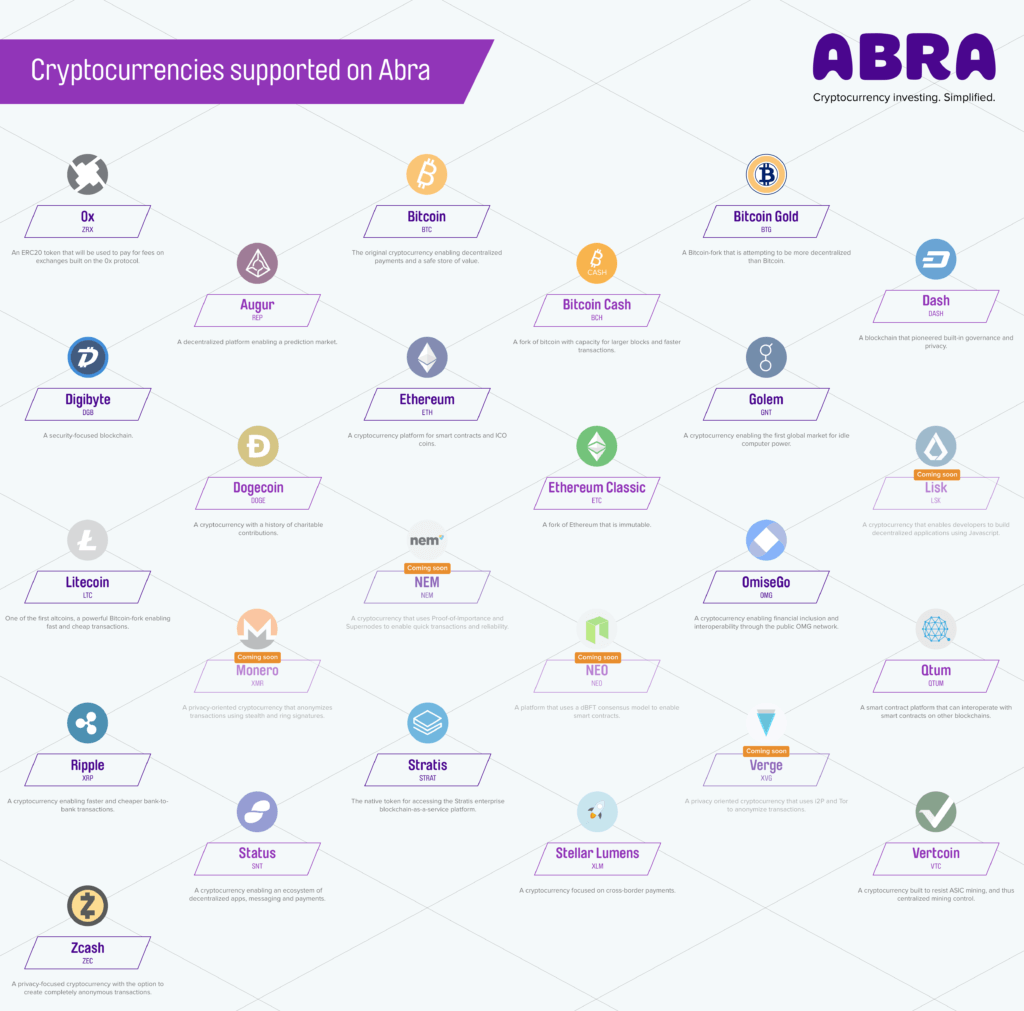

Monero, NEM, NEO, Lisk and Verge are joining 20 other cryptocurrencies including Bitcoin, Dash and Ethereum. The move follows the addition of seven cryptocurrencies which Abra added just last month as the company looks to provide customers with the widest range of cryptocurrencies as well as the easiest way for them to gain access to this emerging market.

Monero, NEM, NEO, Lisk and Verge are joining 20 other cryptocurrencies including Bitcoin, Dash and Ethereum. The move follows the addition of seven cryptocurrencies which Abra added just last month as the company looks to provide customers with the widest range of cryptocurrencies as well as the easiest way for them to gain access to this emerging market.

Bill Barhydt, founder and CEO of Abra, said that by adding five other cryptocurrencies to the already robust list of cryptocurrencies Abra supports, the company continues to offer exposure to assets that have traditionally been difficult to access in a simple and secure way.

“The demand from our users for additional altcoins has been incredibly high, and our goal is to continue adding more cryptocurrency options and ultimately democratize access to financial services and all asset classes,” Barhydt said.

Founded in 2014, Abra is a non-custodial wallet supports both conventional currencies such as USD, EUR and JPY, as well as cryptocurrencies. The platform uses Bitcoin and blockchain technology to allow users to deposit, withdraw and transfer funds using a digital cash wallet stored directly on their smartphones. The model is entirely peer-to-peer with no middleman ever holding, managing or touching the funds at any point in any transaction.

Abra built a platform using stablecoins that facilitates holding both national currencies as well as cryptocurrencies through a combination of Bitcoin and Litecoin based smart contracts. This multi-signature smart contract-based investment platform uses P2SH scripts on the Bitcoin and Litecoin blockchains that simulate investment contracts the way a gold ETF is a contract based on USD. Abra acts as the counterparty to the P2SH scripts, and the company runs a market making operation that hedges away its counterparty risk on these contracts.

“Abra’s contract-based investment platform enables us to quickly add new synthetic assets to the app once they pass our rigid analysis around liquidity, contract market making, and other objective factors,” the company wrote in a blog post. “We are working on adding more digital assets, so feel free to let us know … which cryptocurrencies you want to see on Abra in the future.”

Abra claims to have users from 75 countries transacting on its platform, the most active of which being the US, the UK, the Philippines, Canada, Australia, and Germany. Its most popular cryptocurrencies by transaction volume are Bitcoin, Ripple, Ethereum, Litecoin, and Stellar.