Dogecoin price has crawled back in the past few days as the market reflects on the collapse of FTX and Alameda Research. DOGE has also been under pressure following Elon Musk’s acquisition of Twitter, the giant social media company. It was trading at $0.081, which was slightly above this week’s low of $00729.

Elon Musk’s Twitter acquisition

Dogecoin price jumped sharply in October after Elon Musk concluded his Twitter buyout. At the time, most analysts and investors believed that the buyout will have a positive outcome on Dogecoin and other meme coins like Shiba Inu and Tamadoge.

Elon Musk, the wealthiest person on earth, has been one of the biggest advocates of Dogecoin. Indeed, the coin’s price jumped sharply in 2021 as he promoted it on Twitter and Saturday Night Live (SNL).

As such, by buying Twitter, investors believed that Musk will integrate Dogecoin and other coins to the company. For example, people and companies would be able to pay for Twitter’s subscriptions using Dogecoin.

Recently, however, Twitter’s business has come under intense pressure. He has laid off thousands of employees while the number of advertisers using the platform has dropped. Firms like Volkswagen and General Motors have suspended marketing on Twitter.

Twitter is in a difficult place since its total debt has jumped to over $13 billion while its revenue growth has slowed. And Musk has warned that the company could go bankrupt soon. He has also delayed the launch of Twitter Blue product while his net worth has plunged by $100 billion. This is one reason why Dogecoin price has stumbled.

Like other coins, Dogecoin price has also crashed because of the ongoing fallout of the FTX and Alameda crash. The two companies collapsed, leading to billions of dollars in loss. As a result, many crypto holders have dumped their coins in most exchanges. There is also a lingering fear of contagion in the industry.

Dogecoin price forecast

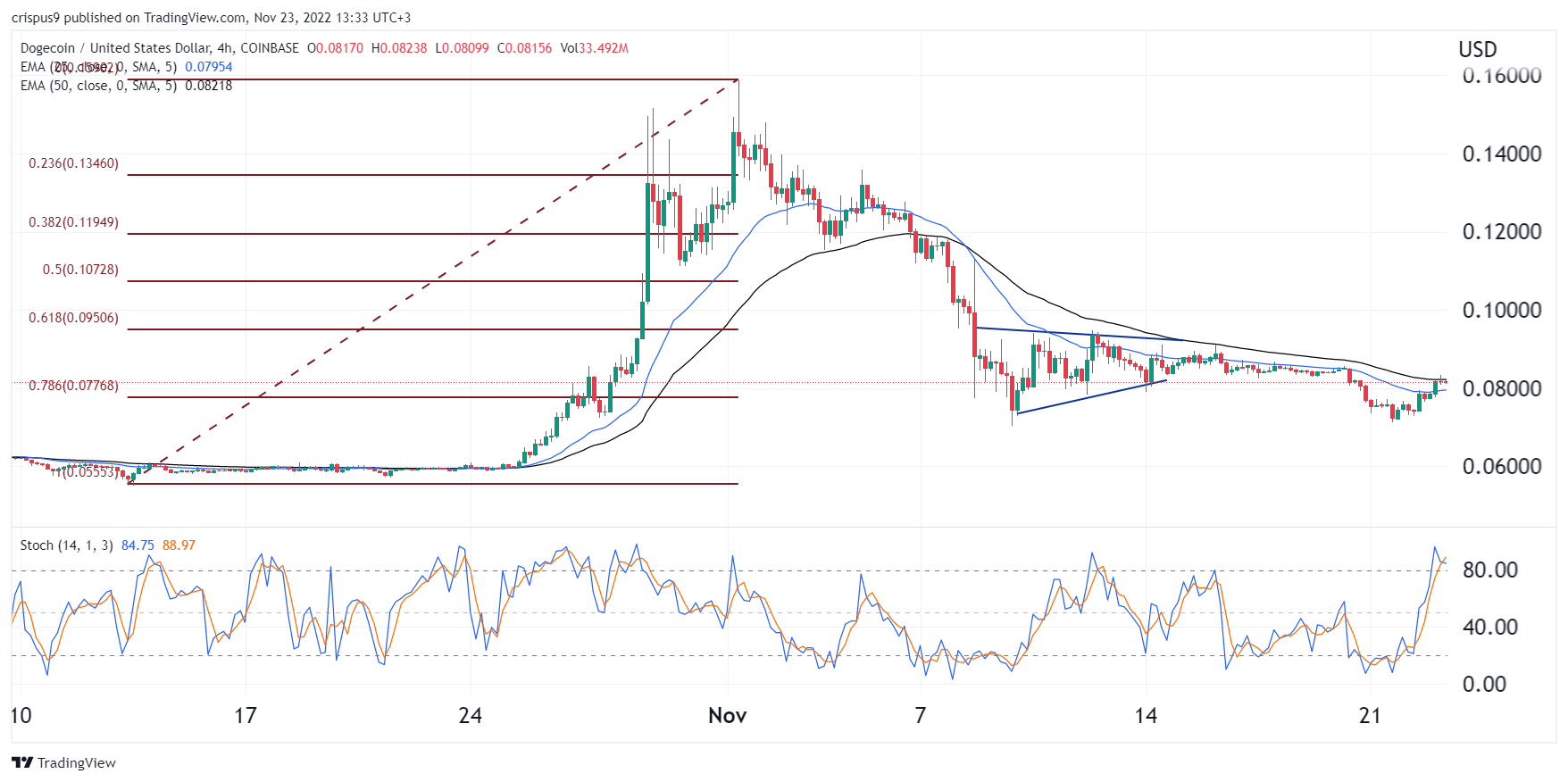

The four-hour chart shows that the DOGE price has been in a downward trend in the past few weeks. In this period, it has plunged from a high of $0.1595 to the current $0.081. The coin has moved slightly above the 78.6% Fibonacci Retracement level while the Stochastic Oscillator has moved above the overbought level.

Therefore, the coin will likely resume the downward trend as sellers target the next key support level at $0.070. A move above the resistance at $0.10 will invalidate the bearish view.