Bitcoin continued to fluctuate heavily on Wednesday, falling to lows near $20,000 before bouncing above $21K, amid broader market reaction to US Federal Reserve’s 0.75% rate hike.

There were gains for Ethereum and other cryptocurrencies too. Overall, however, the crypto market remains in a downtrend and more weakness in price is likely.

Fidelity’s Jurrien Timmer on BTC price

Jurrien Timmer, the Director of Global Macro at Fidelity Investments, says BTC may actually be undervalued at the moment.

Basing his assertion on on-chain metrics, the analyst opined:

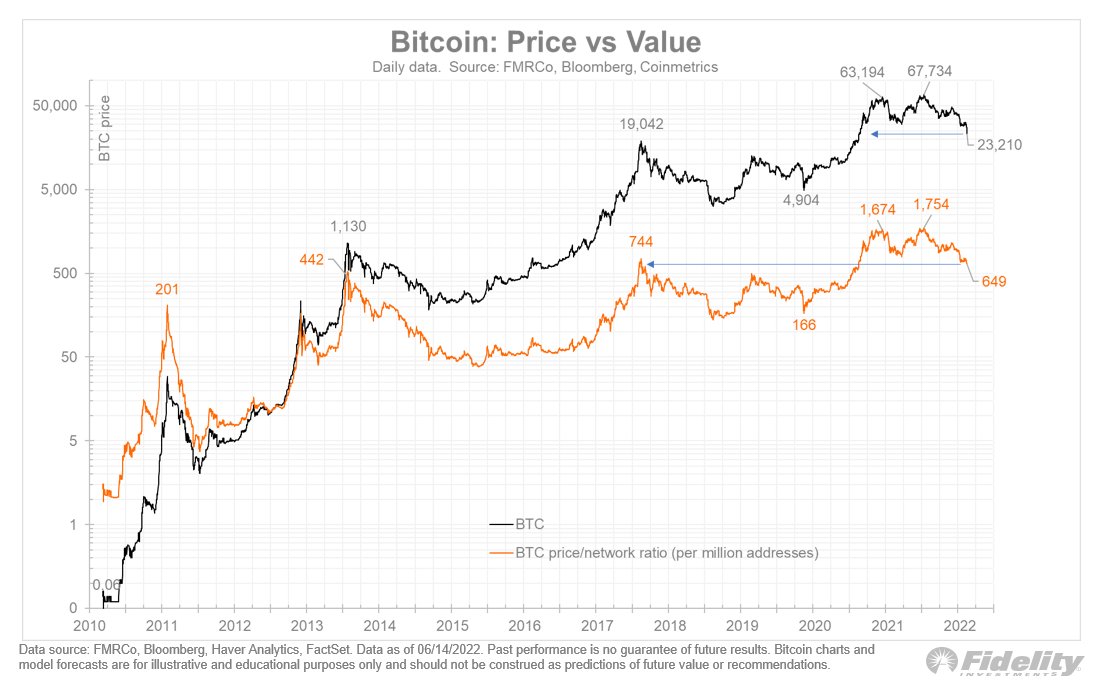

“Is BTC cheaper than it looks? If we consider a simple “P/E” metric for BTC to be the price/network ratio, then that ratio is back to 2017 and 2013 levels, even though BTC itself is only back to late 2020 levels. Valuation often is more important than price.”

In the stock market, analysts use price to earnings (P/E) ratio – for Bitcoin it’s price/network ratio – to gauge a stock’s market value. A high ratio often suggests the asset is overvalued, while a lower value points to an undervalued asset.

The chart below shows this is the case for Bitcoin.

Bitcoin: Price vs. Value chart. Source: Jurrien Timmer on Twitter.

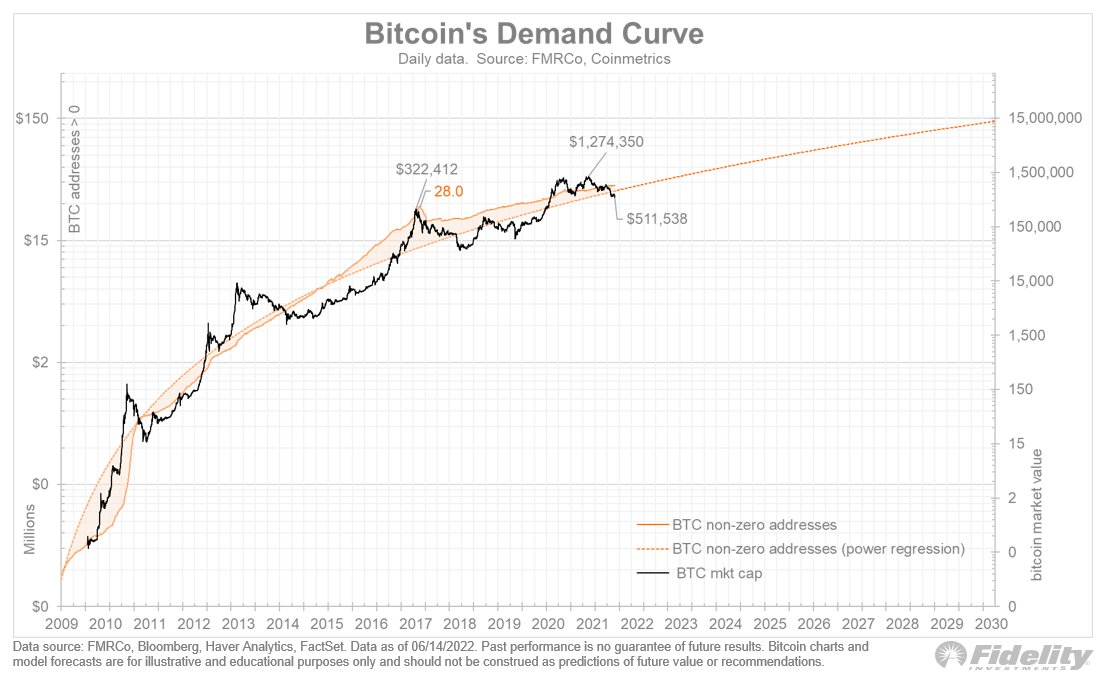

Bitcoin’s demand curve

Timmer also examined Bitcoin’s price against the non-zero addresses. According to him, BTC price has moved below the network curve to suggest more room to grow as price has historically moved back above the curve to set a new high.

Bitcoin’s demand curve chart. Source: Jurrien Timmer on Twitter

Bitcoin’s demand curve chart. Source: Jurrien Timmer on Twitter

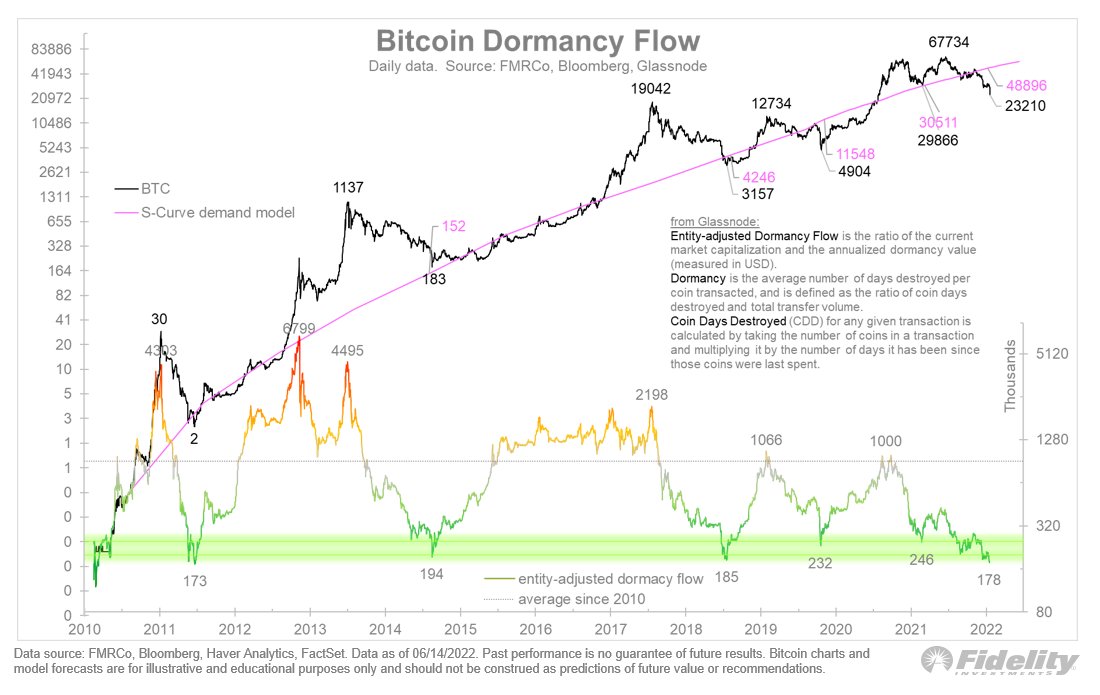

Bitcoin’s dormancy flow

The third on-chain metric the Fidelity macro analyst looked at is the dormancy flow. For Bitcoin, this is a metric that simply looks at how long coins held on-chain remain unmoved. It’s a good indicator of whether the coin is oversold or not.

“Glassnode’s dormancy flow indicator is now to levels not seen since 2011,” Timmer noted.

Bitcoin network curve showing dormancy flow.

Bitcoin was trading around $21,800 on Wednesday evening, about 30% down in the past 24 hours. The benchmark cryptocurrency’s price is 68.8% off its all-time high of $69K reached in 2021.