- The Galaxy Digital CEO says the implosion is a reminder to investors to manage their risks

- He acknowledged that the algorithmic stable TerraUSD was a big idea that failed to live up to expectations

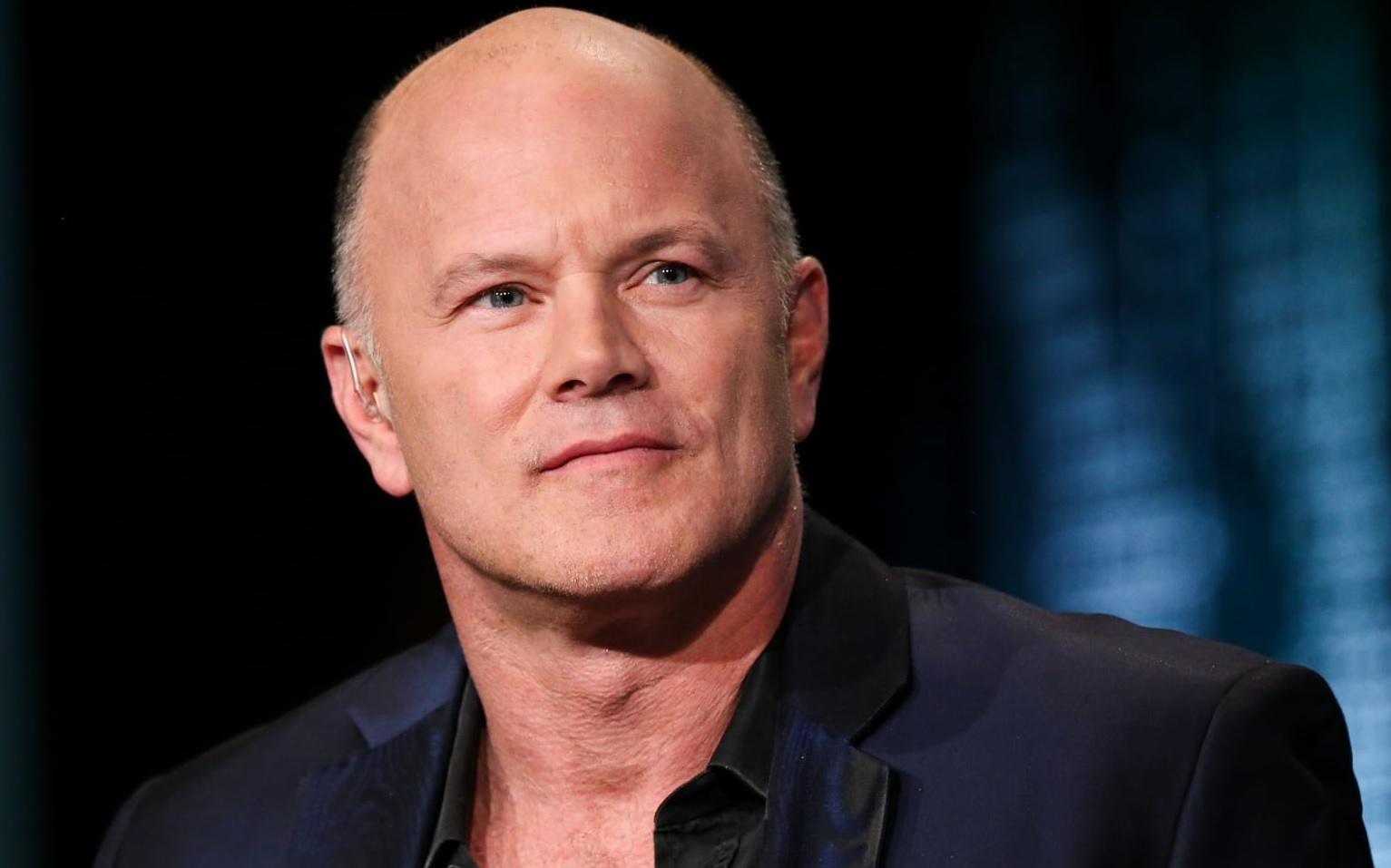

The recent implosion of stable coin TerraUSD has demonstrated that cryptocurrencies still rank high among risk-on assets with extreme volatility. UST’s breakdown swept both retail traders and industry giants, and one CEO who’s felt the effects firsthand more than most is Galaxy Digital’s Mike Novogratz.

The American investor was a recognised LUNA enthusiast before the breakdown of Terra, but he now says recent events are a reminder to remain humble in investments. Breaking a Twitter hiatus that lasted about ten days, Novogratz shared a link to a letter addressing the recent harrowing experience of the Terra ecosystem.

Novogratz denounced Terra, saying that the collapse, which saw as much as $40 billion in market value just vanish, hurt user confidence in crypto.

A failed project

The Galaxy Digital CEO said that UST was a “big idea that failed” in its attempt to create an algorithmic stablecoin to serve a digital world. He noted to the community that UST’s failure was due to the inadequacy of Bitcoin reserves committed to back the stable coin. With reserve assets enduring downward pressure and there being an increased need to dispose of UST, the network eventually caved in.

“What’s important to understand about Terra/Luna is that the mechanism that was intended to keep UST stable was public, transparent, and hotly debated in many forums. UST was an attempt at creating an algorithmic stable coin that would live in a digital world. It was a big idea that failed,” he noted.

He revealed that Galaxy Digital’s treasury never incorporated algorithmic stables.

Manage the investments

Galaxy Digital’s involvement with LUNA had grown over the last two years, and Novogratz evolved to a king lunatic in that time. Novogratz said that the tattoo he got to show his dedication to the LUNA token now sticks out as a reminder always to stay humble with venture investment.

Further, the disintegration reinforces some critical tenets of investments – maintaining a diversified portfolio, deriving profits over time, understanding that investments operate outside the bounds of a micro-framework and that a risk management strategy is all-important.

The former hedge fund manager confirmed that Galaxy Digital had implemented all these for its LUNA engagement, thereby advising the under-experienced/ average investor to dedicate only what they can afford to lose.

Even with the current situation, Novogratz insists that crypto will rise again as there’s increasing capital into the sector and growing decentralised infrastructure. He, however, warned that the road back up won’t be easy or direct.

“This does not mean the crypto market will bottom and head straight back up. It will take restructuring, a redemption cycle, consolidation, and renewed confidence in crypto. Crypto moves in cycles, and we just witnessed a big one.”