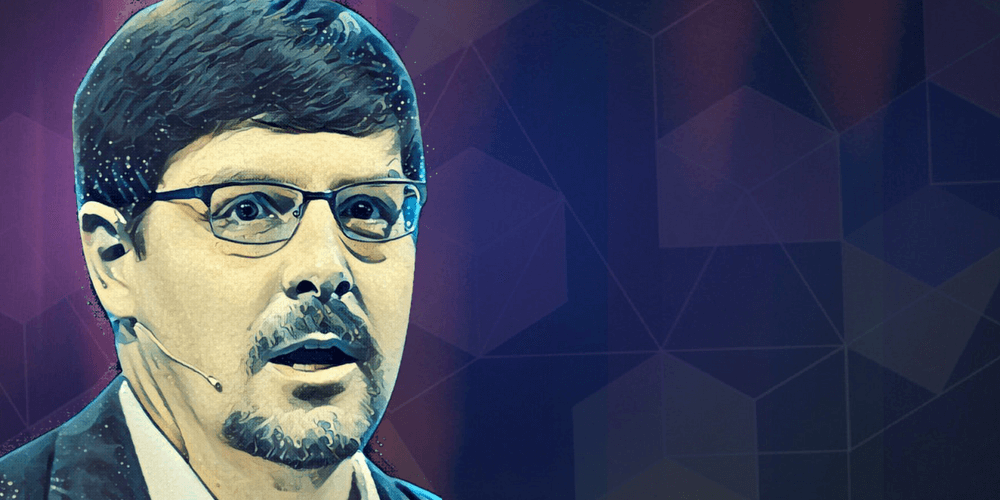

After a bit of a break from the Bitcoin world, former Bitcoin Core lead maintainer Gavin Andresen recently re-emerged on an episode of The Bitcoin Podcast. In one of his first public appearances since publicly backing Craig Wright as the creator of Bitcoin, Andresen discussed a variety of topics related to the current state of the Bitcoin ecosystem.

One of the more interesting segments of the interview had to do with further adoption of bitcoin as a currency. When asked to comment on this topic, Andresen responded, “The big problem with massive adoption is this chicken and egg problem of: How do people earn bitcoin?”

Why People Need to Earn Bitcoin

While bitcoin offers a variety of potential benefits to its users, a number of those benefits are weakened or completely removed when users are required to move in and out of the Bitcoin network. “You really need to get people earning bitcoin directly somehow,” said Andresen. “I don’t know how that will happen — if that will come about.”

A few years ago, many Bitcoin enthusiasts were touting the low fees associated with the peer-to-peer digital cash system as a reason for merchants to make the switch from credit cards. While accepting Bitcoin payments made sense from the merchant’s point of view, the reality was that not many people were holding bitcoin, which meant consumers would have to pay an exchange fee before the merchant could gain the benefits of Bitcoin as a payment network. Merchants were also usually converting back to fiat after receiving the payment, which resulted in another exchange fee.

General friction also exists in getting people to move from fiat currencies to bitcoin, even when the exchange fees are ignored. Many people don’t want to take the time to enter a large amount of personal information into a website just to get some bitcoin to make payments online.

These days, some users are able to hold fiat balances on certain Bitcoin services, such as Circle and Coinbase, who will make Bitcoin payments on the user’s behalf; however, fees are still involved and most merchants will still want to convert back to fiat on the other side of the transaction. Having said that, there may still be promise in the concept of using the Bitcoin network as a settlement mechanism between a buyer and seller who don’t wish to hold any bitcoin as these exchange fees continue to decline.

Who Has a Reason to Earn Bitcoin?

Up to this point, the people who earn their paycheck in bitcoin have been a variety of different niche groups. There are international freelancers, online drug dealers, hackers, and those who work at Bitcoin companies, but having the average person take a portion of their paycheck in bitcoin is still a hard sell.

During his recent interview on The Bitcoin Podcast, Andresen mentioned countries that don’t have functioning banking or payment systems as areas where bitcoin could possible take off as a currency. He wondered if some people in those countries may decide to get paid in bitcoin rather than their local currency. If that scenario were to play out, it’s also possible that people who were visiting that country would also need to have some bitcoin during their stay.

Micropayments for Mainstreaming Bitcoin?

Outside of developing economies and darknet markets, there are a few projects in the works that could put bitcoin in the hands of the average persons in the western world. Yours was one such project mentioned during the recent episode of The Bitcoin Podcast, but others, such as Joystream and PopChest, are also in the works.

“I love those services,” said Andresen in regard to new applications that intend to use layer-2 Bitcoin protocols for micropayments. “I love those experiments. [But] it might be too early. I don’t know; we’ll see.”

Yours allows content creators to earn a bit of bitcoin for their new creations, while Joystream allows individuals to get paid for seeding torrents. Brave is another project worth mentioning in this space. The company, which is run by the creator of Javascript, intends to provide users with privacy and some bitcoin in return for viewing advertisements on websites through their browser.

“It could even be a tiny amount of value. It doesn’t need to be paycheck level, but microtransactions that pay for my web browsing level,” noted Andresen.

Andresen also discussed the potential promise of 21, which is a company that wants to have everyone mining a little bit of bitcoin on their home devices. The idea is to have users pay a little bit of extra money on their electricity bill in exchange for value (bitcoin) that can be easily transferred via the Internet. Andresen noted:

“Raising your electricity bill a little bit, which you probably won’t notice, to create some bitcoins is an awesome way for people to earn bitcoins in a completely painless way. That solves that chicken and egg problem.”

Up to this point, bitcoin has done well in areas where it is simply the best or most practical option available. In other words, greater adoption takes place when people need to use Bitcoin. For now, it seems micropayments, mostly made via the Lightning Network, are the next area to watch for further expansion of the Bitcoin user base.