Key Takeaways

- Crypto volatility has picked up in the last two weeks

- A positive court ruling regarding the conversion of Grayscale’s Bitcoin trust into an ETF propelled markets last week

- Gains have since been given up as SEC pushed out assessment date for ETF filings

After a long period of calm, the crypto markets have finally shown signs of life in the last couple of weeks. First, the price of Bitcoin fell from $29,000 to $26,000 two weeks ago, including a 7% dip in ten minutes, as markets recalibrated to more hawkish interest rate expectations.

Last week, the price rose back up to $27,000, buoyed by a seemingly positive ruling in the courts. A federal court ruled last Tuesday that the SEC was wrong to reject an application from Grayscale Investments to convert its trust into an ETF, the judge saying the regulator failed to “offer any explanation” following its ruling.

While this does not guarantee the eventual conversion of the trust into an ETF, it is nonetheless a big win for both Grayscale and traders who were betting on a positive outcome, with a firm recommendation to the SEC that it should review its decision to reject.

Previously, the SEC rejected Grayscale’s application on grounds that the products were not “designed to prevent fraudulent and manipulative acts and practices.” Grayscale subsequently sued.

However, the boost to markets ended up being short-term, for reasons again related to the SEC. The regulating body delayed its decision on all ETF applications, including those filed by Blackrock and Fidelity, to October. Soon, Bitcoin was back down at $26,000.

The week sums up the year so far for Bitcoin, an asset that has been tossed about by developments in the regulatory sphere all year.

However, assessing the price of GBTC, and comparing it to Bitcoin, does show that the market feels more regulatory clarity is on the way – and potentially in a positive way. In the next chart, we have plotted the performance of GBTC against Bitcoin since the latter’s all-time high in November 2021.

Throughout the bear market, as well as the rebound in 2023, Grayscale investors have suffered worse than counterparts who invested in Bitcoin directly. But in recent months, the discount has been declining, with the court ruling pushing a substantial convergence last week.

If we plot the same two assets again but instead of going back to Bitcoin’s all-time high in Q4 of 2021, we look at returns since the start of the year, it is GBTC that outperforms.

The jump in mid-June stands out, which coincides with the filing of multiple spot Bitcoin ETFs, led by Blackrock. This led the market to move towards the assumption that conversion of Grayscale’s trust into an ETF is more likely – something which has become more real again following the ruling last week against the SEC, and hence caused even further outperformance by GBTC.

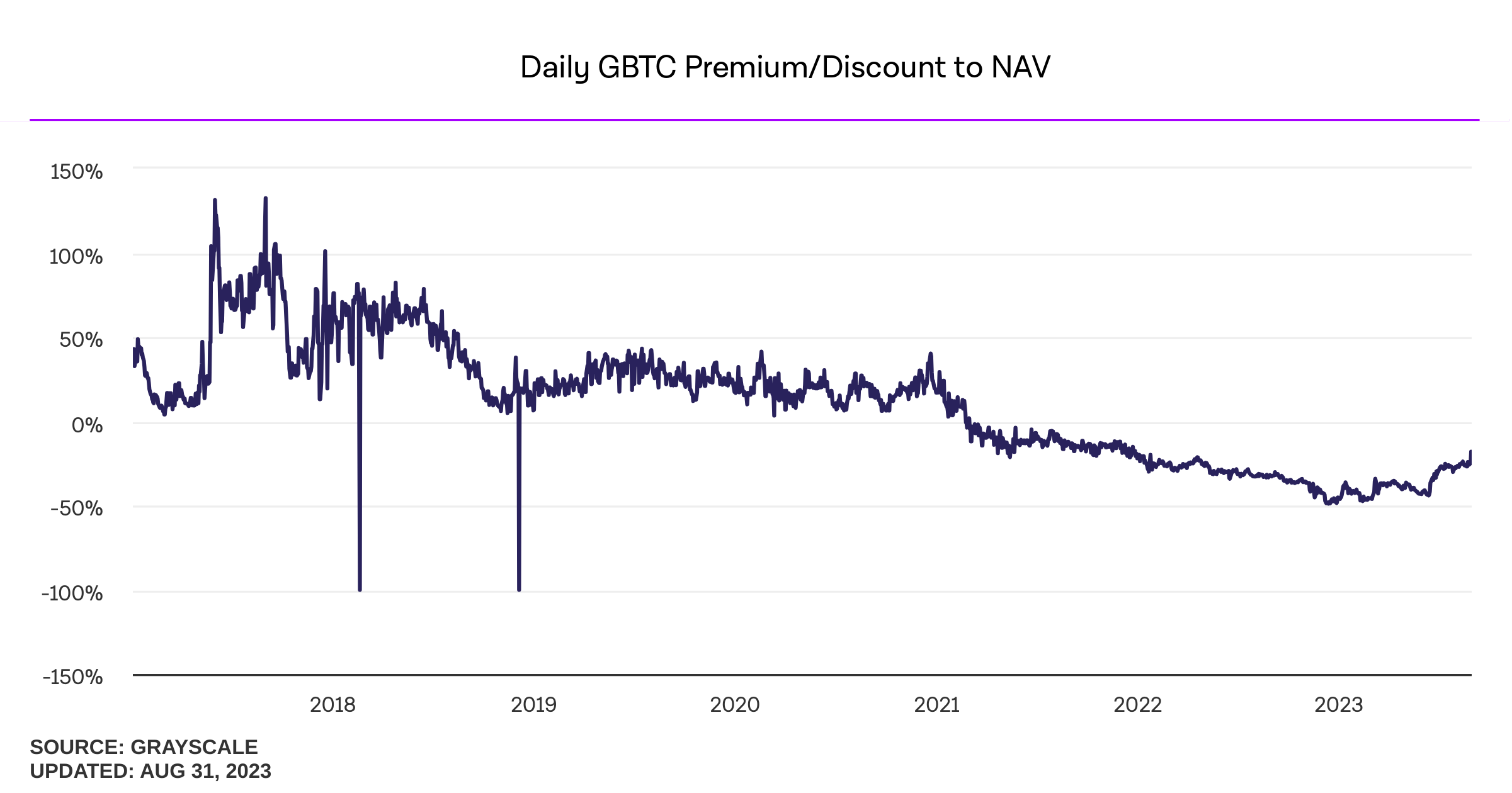

Following the ruling last week, the discount of GBTC to its net asset value has narrowed to 19%, the lowest since 2021.

In truth, the conversion of GBTC to an ETF feels inevitable, the court ruling summising what most around the market would believe should happen at some stage.

JP Morgan agrees, and also speculated positively about what the ruling means for other ETF filings, with its analysts writing this week that “[The delay] likely points to approval of multiple spot bitcoin ETF applications at once rather than granting a first-mover advantage to any single applicant.”

The market doesn’t lie, and with the discount on GBTC down to 19%, it represents substantial progress. However, 19% is still an enormous chasm, highlighting that there remains a way to go before all this is resolved.