Any blockchain developer will tell you that at the core of Bitcoin’s innovations is the solution to the Byzantine Generals Problem. In simple terms, this means that it allows large-scale cooperation between groups of people who don’t know each other nor need to trust each other.

Any number of people can now run complex financial transactions safely online.

Blockchain trading markets leverage this breakthrough. They’ve become exchange platforms that open exciting new possibilities for both investors and startups. Through the process popularly called Initial Coin Offering, any project is able to gather funds by giving individuals a chance to participate in the future creation of value of their venture. Private investors all around the world can now buy stakes in new startups in the form of utility tokens, security tokens, or virtual currency. These investments are recorded in a way that is anonymous, immutable and transparent. In this sense, blockchain enables the democratization of venture capital. The investment process is now available online, to anybody.

Major exchanges such as Binance, Bittrex, and Huobi, already enable the trade of over 500 of these ICO’s stakes that help fund the development of promising new protocols and applications. Thanks to the ease of the process, they have created a flow of over $20 billion in capital that benefits both private investors and innovative new startups.

However, this does not paint the whole picture. According to blockchain investment expert Nick Evdokimov, the blockchain industry actually holds up to $400 billion in total. That’s 20 times the amount that is actively traded. This is due to the fact that a very large market segment is not participating in trading markets for a lack of time, knowledge, or for fear of being scammed.

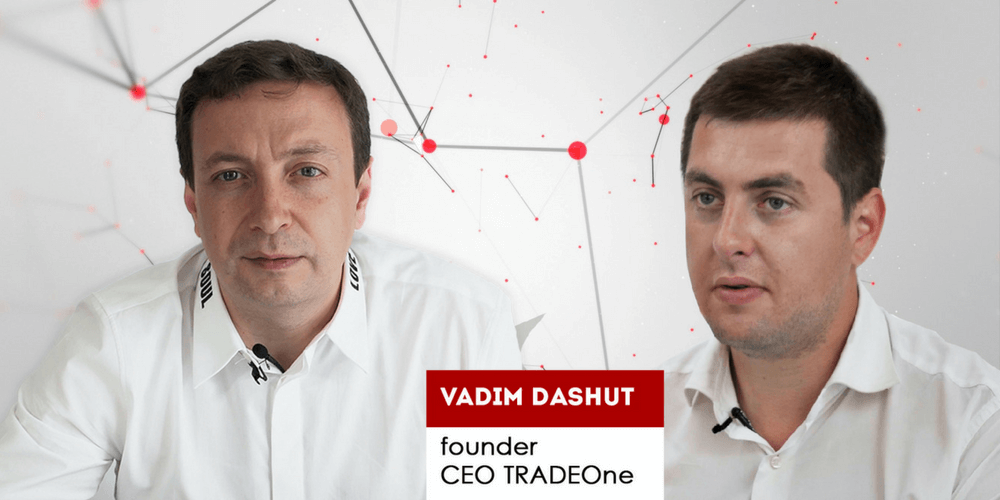

Some believe there are solutions that could mobilize the growing mountain of over $380 billion in idle capital. One, in particular, is a new trading market called TradeOne. Founded by investor and entrepreneur Vadim Dashut, the platform is designed to create connections between investors and experienced traders, allowing both to profit. This solves a problem for the majority of investors who have the capital but don’t have the time or knowledge to make savvier investments in blockchain. It also solves the problem for seasoned traders who have the necessary skills to allocate funds properly but lack the amount of capital needed to do so. In doing so, both help up and coming startups who desperately need funding to execute their vision.

Some believe there are solutions that could mobilize the growing mountain of over $380 billion in idle capital. One, in particular, is a new trading market called TradeOne. Founded by investor and entrepreneur Vadim Dashut, the platform is designed to create connections between investors and experienced traders, allowing both to profit. This solves a problem for the majority of investors who have the capital but don’t have the time or knowledge to make savvier investments in blockchain. It also solves the problem for seasoned traders who have the necessary skills to allocate funds properly but lack the amount of capital needed to do so. In doing so, both help up and coming startups who desperately need funding to execute their vision.

Through blockchain trading markets such as TradeOne, investors, startups, and even traders are able to cooperate more effectively. An opportunity of $380 billion in the form of capital that is already in the blockchain market but needs better allocation.

Visit Nick’s website to learn more.

Disclaimer:

This information is the opinion of the provider and is for informational purposes only. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any securities to any person or a solicitation of any person of any offer to purchase any securities. This information should not be construed as any endorsement, recommendation or sponsorship of any company or security. There are inherent risks in relying on, using or retrieving this information. Seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information provided.