One of the most recurring problems of the contemporary trader is detecting price movements before it is too late. In the cryptocurrency market, which trades tirelessly in an environment where volatility reigns, the challenge of identifying price actions in time can be even more difficult. However, there are several strategies that can help you be one of the first to enter at the right time. Find out how to identify when a cryptocurrency is about to skyrocket.

Technical breakouts: the most accurate signs that something big is about to happen

If you have technical analysis knowledge, you will know that there are a series of signals and indicators that can help the investor understand which direction the price of an asset is likely to take. In the case of the ‘crypto’ industry, it is very important to detect them in time, since market cycles are usually shorter and less stable.

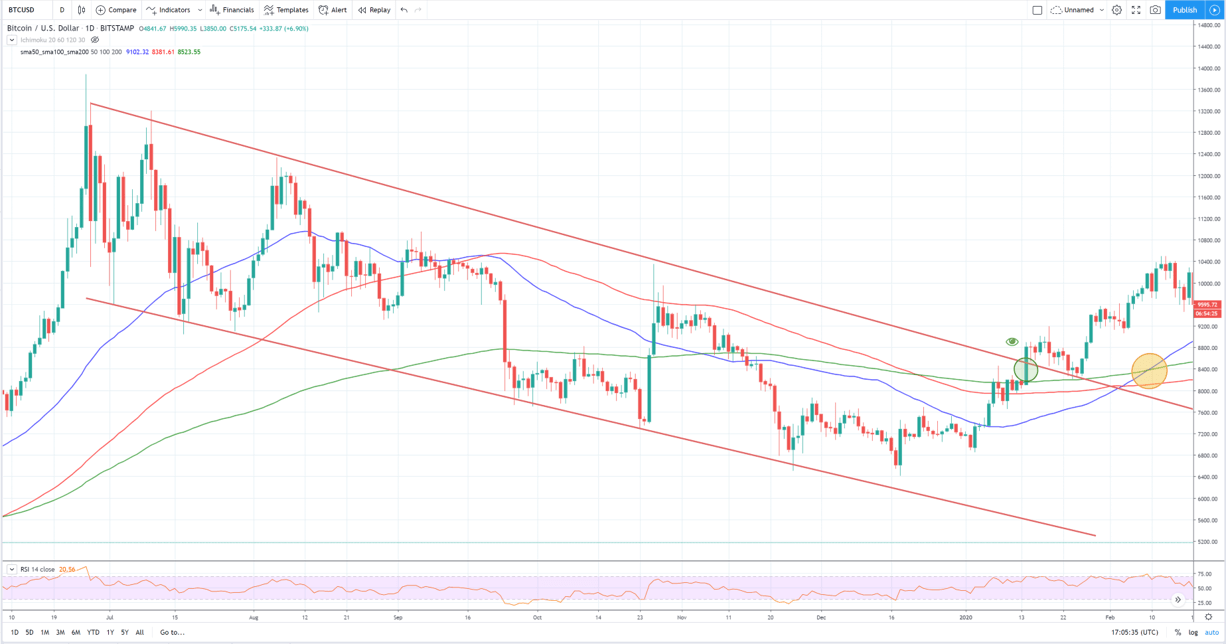

There are different types of breakouts. For example, when the price of a digital currency demonstrates a clear bearish channel, a bullish break is said to have been reached. When the opposite occurs and a well-established bullish guideline is broken, analysts call the case a bearish breakout. But these are not the only cases to identify. There are simple moving average crosses for different periods that allow changes in price movement to be detected. The crossing of death and the golden crossover are very important.

Alarms and notifications

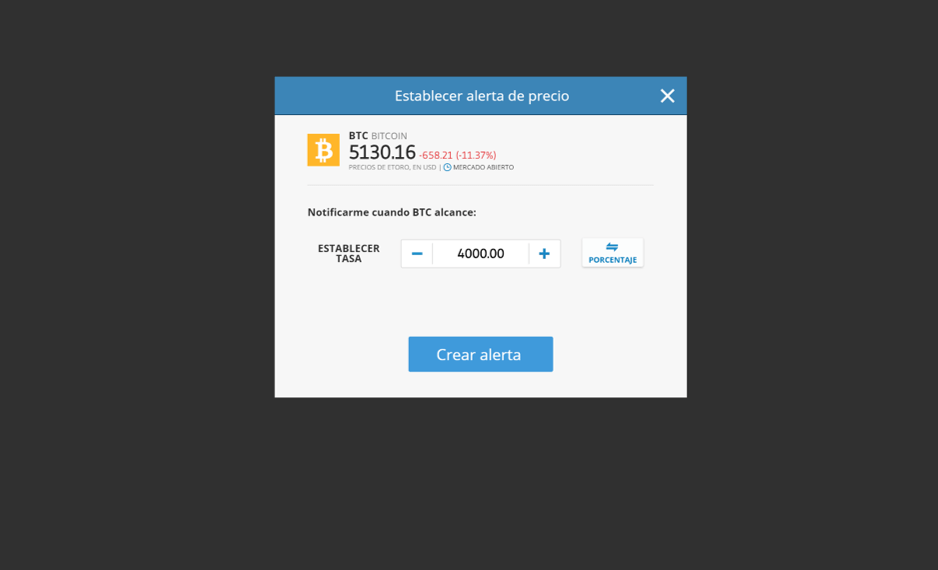

In any case, these will require some experience, or the follow-up analyses published by experts. Also, some of the more advanced platforms allow you to configure price alerts once you identify interest levels. This is an extremely useful tool, but it is only recommended to use for analysis with larger time frames in order to receive notifications that are really worthwhile.

TradingView charting platform allows you to configure notifications in your browser. Other investment platforms are even more powerful and allow you to configure notifications that you can receive through your mobile phone. Some examples include Coinbase and the eToro exchange platform.

Identifying trends in the cryptocurrency market

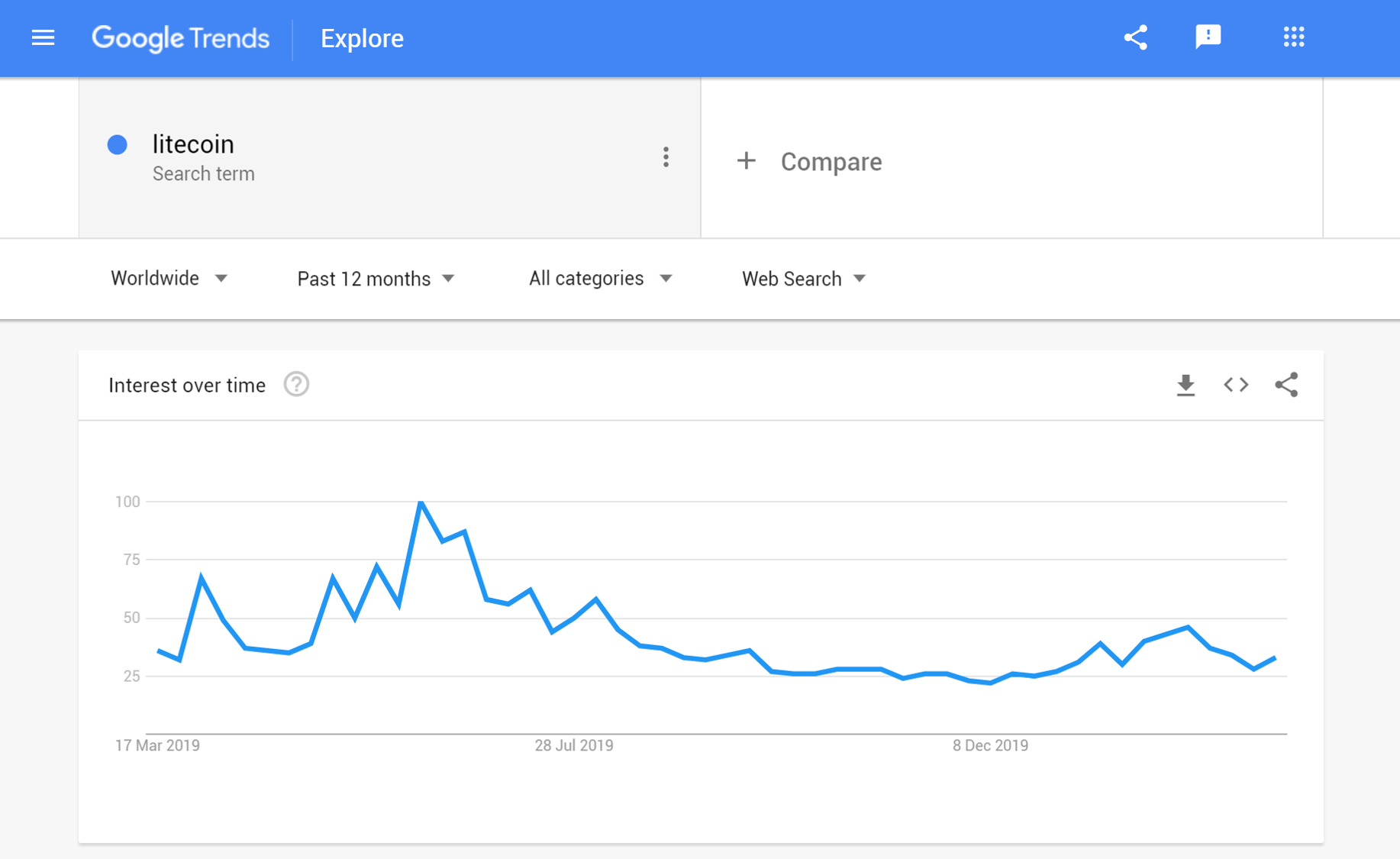

The Internet is used to heavily influence the media and social networks. Thus, it is important to identify which digital currencies are setting the trend. Many analysts find a correlation between price movements and search interest on a digital currency through Google, for example.

In this case, Google Trends can be a strong ally to identify search interest in specific cryptocurrencies. In relation to social networks, the most important discussed topics related to bitcoin, blockchain and altcoins are often found on Twitter and Telegram. If you make a living through trading, then you will want to be subscribed to the most important cryptocurrency forums.

General overview of movements in trading

A little-known tool of CoinMarketCap is the summary of winners and losers over a given period. This shows a list of the cryptocurrencies with the highest percentage movement in three different time frames: 1 hour, 24 hours and 7 days. With this tool, the user can get an idea of where there is a significant price action, both up and down. However, to narrow the sample more precisely, we suggest filtering those currencies with very low trading volume. The latter are more volatile and the risk when investing rises considerably.

Other similar portals like Coin360 can also give similar metrics that help identify which cryptocurrencies are experiencing significant moves.

The arrival of small cryptocurrencies to large exchanges

The list closes with the favourite of those who prefer to opt for smaller alternatives. When a small-cap cryptocurrency hits a large exchange like Coinbase or Binance, its price tends to gain traction. These platforms follow a rigorous process to admit new currencies into their offerings, a factor that may be considered positive and encourages them to invest in smaller projects that could gain importance in the future.

Making the analogy to the great market leaders, it is the equivalent of what happens when BTC or Ethereum start trading on institutional financial platforms, for example, futures at Bakkt or the CME Group in Chicago.