Trading cryptocurrency, and especially margin trading, is an inherently risky endeavor, and every trader should always be mindful of the risks they’re taking. In order to properly manage and stay aware of your trading risks, keep the following tips in mind:

Keep your initial trades small

No one expects you to be an expert trader overnight. If you’re just starting out, don’t rush in and start placing large trades all over the place. Start small – put only 1 or 2 percent of your trading account in open positions each day and use any losses you incur as training opportunities. Trading is a hard skill to master, but if you put the time and effort into it, it can be very rewarding – and profitable!

Stay humble

It may sound strange, but humility is just as an important skill for a trader as being able to spot trends. Humility allows a trader to learn from their mistakes, and not overcommit. If you’re feeling confident, that’s good – but overconfidence can push a trader into making risky and reckless trades and end up losing more money than they can afford. Never trade more than you can afford to lose.

Take expert advice

One of the best ways to minimize your trading risk is by following the advice of more experienced traders. Luckily, Monfex – a leading trading platform – publishes high-quality market analysis on a daily basis, covering Bitcoin, omiseGO, Dash, and more! By following Monfex’s trade ideals and analytics, you stand a much higher chance of avoiding common risks and mistakes and making profits over the long-term!

Keep a trading journal

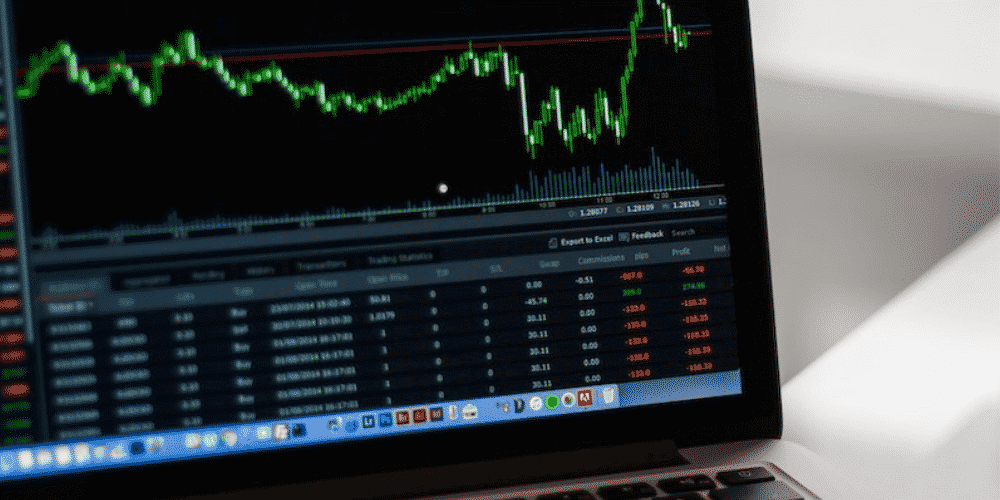

If you’re trading on a Monfex’s trading platform, then you’re probably trading with leverage. What is leveraged trading? It’s a way to trade with more money than you have in your account in order to maximize your potential profits. At the same time, this can be risky.

By keeping a trading journal and diligently tracking your trading ideas, decisions, and strategies over time, you’ll develop a much better sense of exactly when and where to enter and exit trades, vastly improving your profitability.

You’ll learn what indicators to pay attention to, what rules to follow and develop a personalized trading strategy that works for you.

Don’t get emotional

It’s often said that the best traders are unemotional, and don’t react strongly to wins or losses. The reason is that emotion often clouds your judgment, causing you to rush into trades that you otherwise may have not made.

For example, if you’ve made a few big wins during a day, you may want to keep pushing when it would be better to consolidate and stop trading. Alternatively, you may get flustered after taking a few losses in a row and miss out on a profitable opportunity. Staying calm and level-headed reduces the risk of making emotional trades.

Stay focused

While some traders prefer active trading, where they open and close a large volume of trades per day, many traders like to be more leisurely in their trades, opening only one or two positions and holding them for some period of time. However, even if you’re not tracking your open positions every second of the day, you still should be concentrated on making sure that your trades don’t start moving in a direction you don’t want them to.

A loss of focus can lead to large losses, so it’s a good idea to be as alert as possible regarding your open positions. Markets can change in a heartbeat and staying on top of these changes is the key to profitable trading.

Trade only one or two instruments

On Monfex, you can trade the 12 most liquid cryptos, open long and short positions, and magnify potential gains with up to 50:1 leverage. We offer margin trading on the most popular cryptocurrencies, including Bitcoin, Dash, Ethereum, omiseGo, and more. But sticking to just one or two of those pairs, such as BTC/USD or ETH/USD will let you focus your attention much more effectively. Choose a cryptocurrency pair you like, and just trade on it, at least until you get a feel for the market.

Don’t trade every day

Unless you’re a professional trader, trading every day can be overwhelming. Instead, trade just a few times a week, and try to do so early in the day, when your concentration and focus is highest. While margin trading can make you profits even when volatility is low, getting an intuitive sense of how the market tends to move is crucial to developing a good sense of risk as a cryptocurrency trader.

Now that you’ve read these recommendations from a professional trader, you’re ready to start trading yourself. So don’t wait and open a trading account at Monfex today! Monfex is the ultimate cryptocurrency trading platform, allowing to trade non-expiring futures contacts on twelve most popular cryptocurrencies, including Bitcoin, with the power of up to 50:1 leverage!

Monfex’s Analytical Department: www.monfex.com

Official Telegram Channel: https://t.me/monfexofficial