Fintech startup Blackmoon Financial Group has announced the launch of its platform services, a new product that aims to bridge the traditional investment world with the cryptocurrency world.

Founded in 2014, Blackmoon specializes in tokenized investment funds and vehicles. The company has developed a platform that allows asset managers to create and manage tokenized investment funds in a legal and compliant manner.

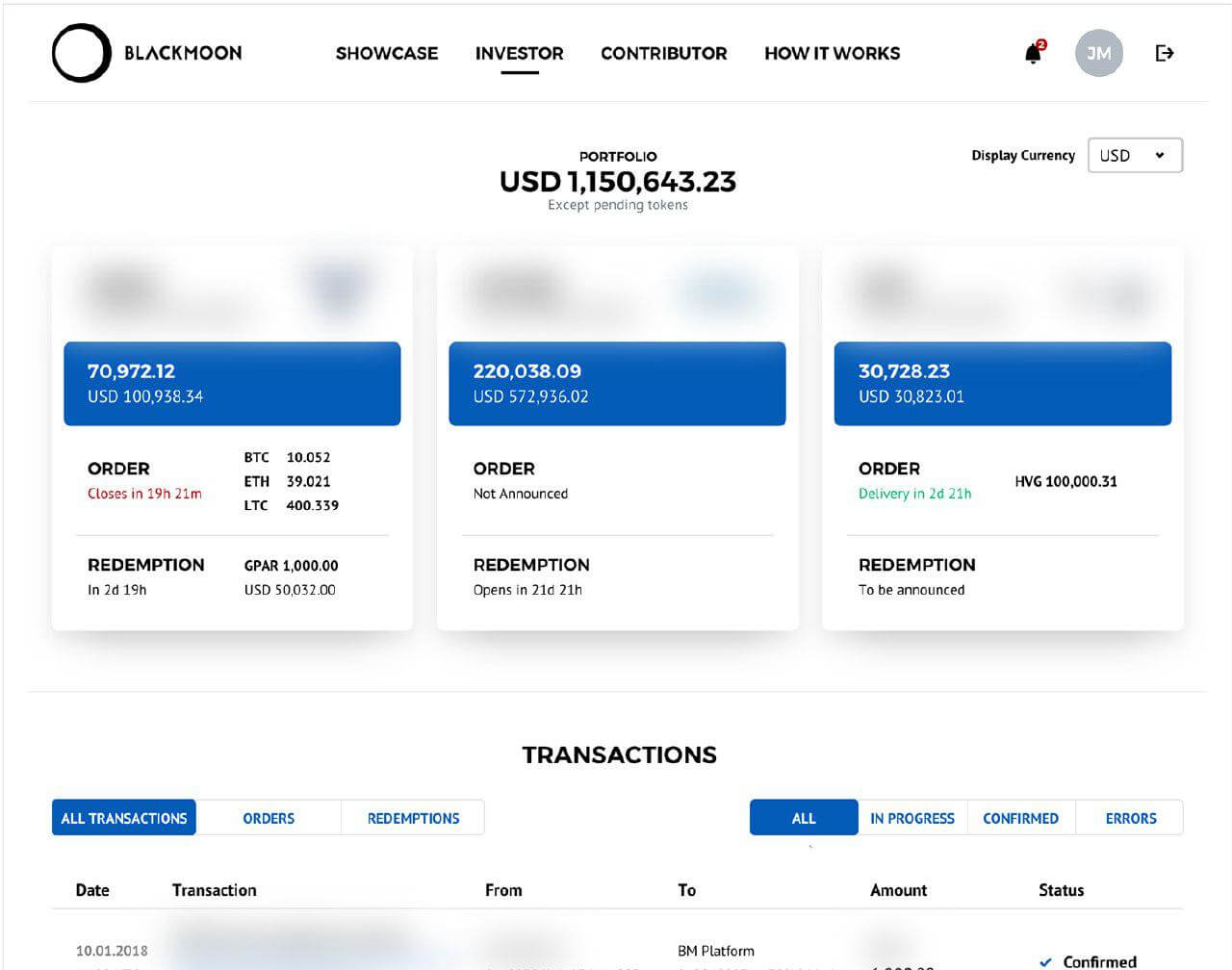

Users can now register and complete KYC procedure to get full access to the information and, upon verification, become eligible to purchase asset tokens. Asset tokens provide their holders with access to the performance of the wide variety of funds investing in fiat and crypto-oriented strategies without leaving the blockchain ecosystem.

One of the first asset tokens available in the platform will track the performance of the S&P 500 Index, the company said. The token will allow holders to gain exposure to the US large cap space.

One of the first asset tokens available in the platform will track the performance of the S&P 500 Index, the company said. The token will allow holders to gain exposure to the US large cap space.

Created in 1957, Standard and Poor’s 500 is an American stock market index based on the market capitalization of 500 large companies which have common stock listed on the New York Stock Exchange and NASDAQ.

Blackmoon COO Sergey Vasin said two other asset tokens that provide exposure to US-based hedge funds will be listed on the platform in the coming months. Blackmoon also plans to launch a token that would gives access to emerging markets ETF indexes.

The release of the Blackmoon platform comes just a few months after the company raised US$30 million in a 20-hour token sale last September.

“The (Blackmoon) platform has been under ongoing development these past 7 months. During this time, we have dedicated our effort and signed several strong partners, including banks and brokerage firms, to ensure that our service provides the necessary tools for asset managers that are willing to take the industry to the next level,” said Oleg Seydak, CEO and founder of Blackmoon Financial Group.

“Since our initial token sale, the (blockchain) industry has developed at high speed, and we have made sure that the underlying benefits of our value proposition have been up to par, especially our continuous goal to ensure we provide a fully compliant solution for the asset management industry.”