Colu, an Israeli startup offering localized digital currencies based on blockchain technology, is looking to raise US$50 million in an initial coin offering (ICO). Colu had already raised US$12 million in venture capital from Digital Currency Group, Spark Capital, Aleph Ventures, and others, but this time, it opted for a token sale.

“We could have raised VC funding, but we decided to issue a token,” Colu CEO and co-founder Amos Meiri, told CoinJournal. “We knew we needed to raise a big round, or find a business model that will help us create a network effect [and scale up rapidly]. The Colu Local Network token (CLN) model provides both.”

The ICO will see the introduction of CLN. Colu said the token will incentivize communities to engage and consume locally.

CLN will also enable several new utilities such as currency exchange, payments, lending services and KYC – functionalities that will be added into the ecosystem over time, the company said.

“With the new model, users of Colu’s digital wallet will be able to make purchases with fiat money and enjoy the added value of being rewarded in community currencies (cryptocurrencies),” explained Meiri.

“These currencies are built on an open financial infrastructure that represents the community’s financial state. The better the community does, the higher the demand for the specific community currency, and the higher its value.

“This collaborative responsibility and reward mechanism encourages every network member to promote the network, creating a strong network effect, thereby spreading the success of the community among all its stakeholders.”

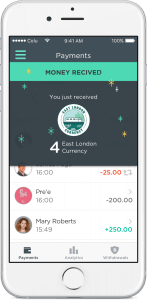

Founded in 2014, Colu uses blockchain technology to create digital, localized cryptocurrencies for communities. The Colu Local Wallet, introduced to its four member communities since January 2017, provides users with access to “community currencies” intended to be the closest digital equivalent of physical cash. The app allows them to connect, discover new shops, and trade with their peers.

Founded in 2014, Colu uses blockchain technology to create digital, localized cryptocurrencies for communities. The Colu Local Wallet, introduced to its four member communities since January 2017, provides users with access to “community currencies” intended to be the closest digital equivalent of physical cash. The app allows them to connect, discover new shops, and trade with their peers.

CLN will represent an index value of the community currencies issued on the network. This will enable communities to raise capital and provide new currencies in local markets with instant liquidity.

Colu said the capital raised through the ICO will help it bolster its efforts to expand to new communities, with plans to expand to new countries in the near term, including the US.

“We have hundreds of communities around the world approaching us on a daily basis looking to issue their own community currency on top of Colu (municipalities, BID’s, universities, etc),” said Meiri.

Colu existing investors including Spark Ventures and Aleph Ventures, but also Tom Glocer former CEO of Thomson Reuters and Prof. Dan Ariely, have committed to participate in the token pre-sale. Bradley Tusk, an entrepreneur and Uber’s political strategist, has also joined Colu as an adviser.