-

Kava price has crashed by more than 94% from its all-time high.

-

The total value locked (TVL) in its DeFi ecosystem has crashed to $197M.

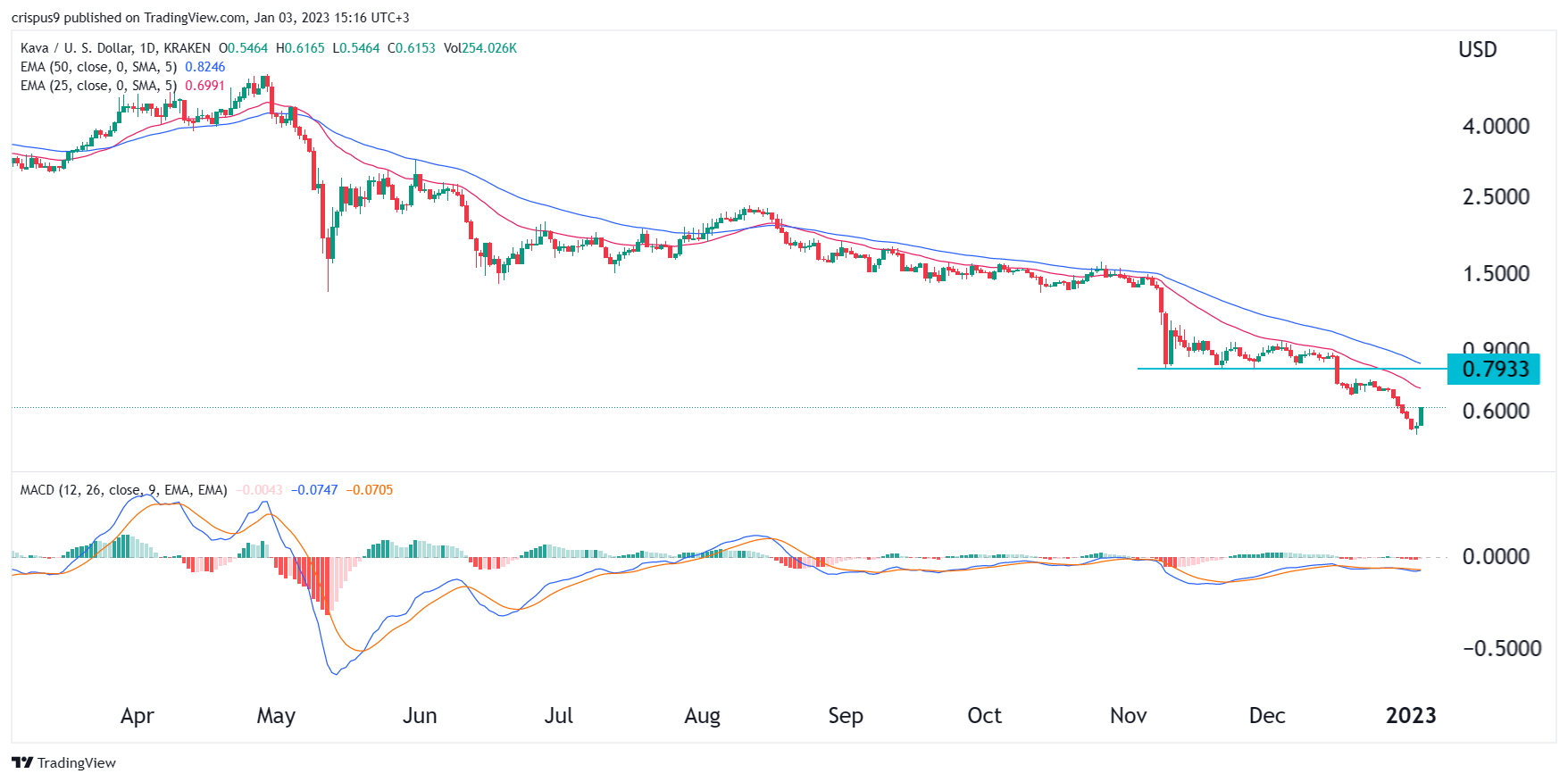

KAVA price has been in a strong bearish trend in the past few months as demand for the token eased. The token crashed to a low of $0.5165 on Tuesday, which was about 94% from its highest level in September 2021. Its market cap has crashed to about $224 million, which was lower than its all-time high of more than $1 billion.

Kava total value locked has crashed

Kava is a blockchain project that is relatively unique from other popular platforms like Cardano and Aptos. It is a dual platform that combines features found in Ethereum and Cosmos. Ethereum, the biggest smart contract project in the world, is known for its stability and power. Cosmos, on the other hand, is significantly faster and has additional features than other blockchains.

Kava has seen remarkable developer interest in the past few months. This interest is partly because of its $750 million developer incentive fund. People who deploy on Kava receive developer incentives worth millions of dollars.

Kava has over 100 projects, mostly in the DeFi industry. Recently, however, activity in the network has been in a downward trend. The total value locked (TVL) in its ecosystem has plunged to about $197 million from its all-time high of almost $700 million.

Most applications in its ecosystem have lost money in the past few months. Some of the most dominant players in its ecosystem are Kava Mint, Kava Lend, Kava Earn, Kava Liquid, Kava Swap, and Kava Boost have struggled to attract inflows. Kava Mint, which has a TVL of over $84 million and a market dominance of 43%. The most recent high-profile platform in its ecosystem was Curve.

It is unclear why KAVA price has risen by more than 12% on Tuesday. A possible reason is that the developers are about to make a major announcement on the ecosystem.

Kava price prediction

The daily chart shows that Kava price has been in a strong bearish trend in the past few months. As it crashed, the coin managed to move below the important support level at $0.80, which was the lowest level on November 9. It has also moved below the 25-day and 50-day moving averages while the MACD remains below the neutral point.

Therefore, the downward trend will likely continue falling as sellers target the next key support level at $0.500. A move above the resistance point at $0.70 will invalidate the bearish view.