LEVER crypto price jumped sharply on Wednesday as other coins rebounded. The coin rose by about 15%, according to data compiled by Binance. It was trading at $0.0030, which was about 20% below the lowest level this year. The small-cap coin has a market cap of over $41 million.

What is LeverFi and why is it rising?

The Decentralised Finance (DeFi) industry has seen significant growth in the past few years. While the past few months have been challenging, there are signs that it is bouncing back. For example, the total value locked (TVL) in the sector has risen to over $85 billion.

LeverFi is a relatively small blockchain project in the DeFi industry. The network allows users to yield farm using leverage. In other words, its lets traders to deposit yield-bearing collateral and trade the fluctuations in asset prices with up to 10x leverage.

LeverFi accepts a wide range of assets such as mainstream coins like BTC and ETH and liquidity pool assets like Curve, UNI, and Cake. All these assets are then deployed in platforms like Yearn Finance, Convex, and Pancake to earn yields. These leveraged trades are then settled using the Lever platform.

According to the developers, Lever will be deployed in Ethereum’s blockchain and then scaled in other popular platforms like Avalanche and Arbitrum.

The LEVER crypto price is rose as investors cheered the recent addition to the Binance platform. This means that users can buy and trade the $LEVER coin in its platform. At the same time, Binance Futures recently added the $LEVER perpetual contracts with up to 20x leverage.

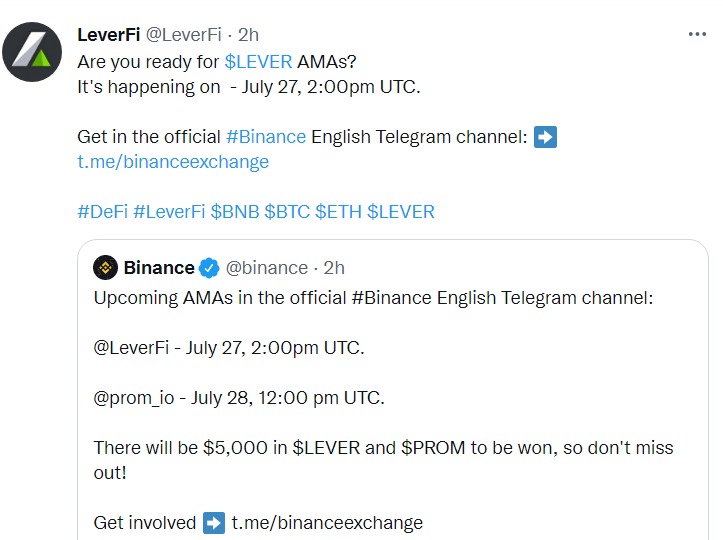

The current rally is mostly because of the upcoming Ask Me Anything (AMA) of Lever’s platform, which will be hosted by Binance. The company will give over $5,000 worth of rewards.

LEVER crypto price prediction

The hourly chart shows that the LeverFi price bounced back on Wednesday ahead of the upcoming AMA It moved slightly above the descending trendline that is shown in blue. It moved slightly above the 25-day moving average while the Relative Strength Index (RSI) moved below the overbought level. The coin will likely resume the bearish trend and retest the key support level at $0.0025.