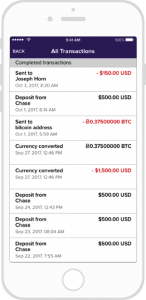

Peer-to-peer money transfer app Abra has launched a new Bitcoin-based multi-signature wallet for holding, sending and exchanging between digital assets, starting with ether and 52 conventional currencies as the first supported assets types. The new wallet, currently live for a limited number of users, will be rolled out to all users next week.

Founded in 2014, Abra uses Bitcoin and blockchain technology to allow users to deposit, withdraw and transfer funds using a digital cash wallet stored directly on their smartphones.

The company says its long-term vision is to have “a completely decentralized system for storing, managing and exchanging between digital assets for investing, payments, and money transfer.”

Unlike most wallets, Abra does not take custody of consumer funds or private keys in the management and storage of digital assets. The solution uses a “2 of 2” multi-signature model that requires both Abra and the consumer to sign a transaction when the consumer is holding anything but bitcoin.

The bitcoin-based multi-signature wallet allows a consumer to hold fiat currency or ether while Abra ensures that the value of bitcoin the consumer is holding stays fixed to the amount of ether or fiat currency that the consumer wishes to hold.

“We call this a synthetic currency [which is] basically the digital equivalent of hedged gold,” explains Bill Barhydt, founder and CEO of Abra.

“If I owe you US$100, in theory I could hand you US$100 worth of gold [based on the spot price of gold at that moment]. But, of course, if you couldn’t sell the gold immediately, you’re taking volatility risk on the price of gold. I could hand you some type of [contract for difference (CFD)] or put option on the gold that would more or less eliminate the downside risk to you. A CFD would eliminate the risk in both directions… We could more or less agree that I was handing you US$100, even though no paper money was changing hands.”

Today, Abra acts as the counterparty to the consumer in all cases and does offline hedging to mitigate counterparty risk. In the future, the company says it may open up the system so that others can act as counterparties to these contracts once a full smart contract implementation is in place.

“We’ve been testing this model using a 100% server-based solution for a few months to verify the logic before expanding to a true multi-signature model in order to make sure that we had the software and financial engineering right,” the company says.

“Now, after running our service for the past few months with tens of millions of dollars of funds, we’re ready for commercial deployment of our multi-signature solution. We’ve chosen ether and fiat currencies as the first digital assets that we will enable using this new model.”

In the next few months, Abra says it will migrate to a full 2 of 3 multi-sig smart contract solution that will enable a Contract Oracle to sign in lieu of either counterparty. This will provide more protection to both the user and Abra in case either party disappears, it says.

Alongside the Abra app, the company also has a network of tellers where users can deposit and withdraw digital cash. Abra Tellers can be individuals or businesses. Each teller can charge a fee, which they set on their own.

The multi-sig wallet comes shortly after Abra raised US$16 million in its Series B funding round. The round, led by China’s Foxconn, included participation from Silver8 Capital, Ignia, Arbor Ventures, American Express, Jungle Ventures, Lerer Hippeau Ventures and RRE Ventures.

The round brought Abra’s total funding to date to US$30 million.