Hong Kong’s Open ANX Foundation has unveiled openANX, a project aimed at building a new decentralized cryptocurrency exchange and trading platform built on the Ethereum blockchain.

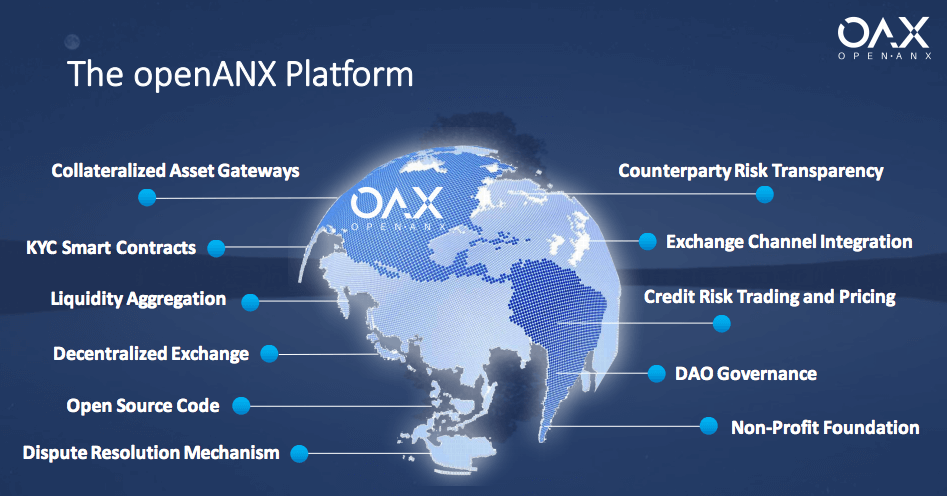

The open source, decentralized exchange platform promises both the liquidity of a centralized exchange and the security and transparency of existing decentralized exchanges.

“Up until now, the cryptocurrency trading space has been dominated by centralized exchanges,” said Hugh Madden, technical director for openANX, and co-founder and CTO of blockchain startup ANX International. “Customers aren’t adequately protected in the current environment.”

Throughout the years, a significant number of centralized exchanges have been compromised resulting in the loss of approximately 925,000 BTC, or about US$2.1 billion.

Yet, centralized exchanges play a critical role in the cryptocurrency ecosystem as they bridge traditional financial services and currencies to the blockchain world. “This problematic isn’t going to go away. You need market participants to provide these infrastructures,” Madden said.

“Centralized exchanges need to be pure asset gateways. And all the matching engine software and blockchain software should actually be developed in the open source world.

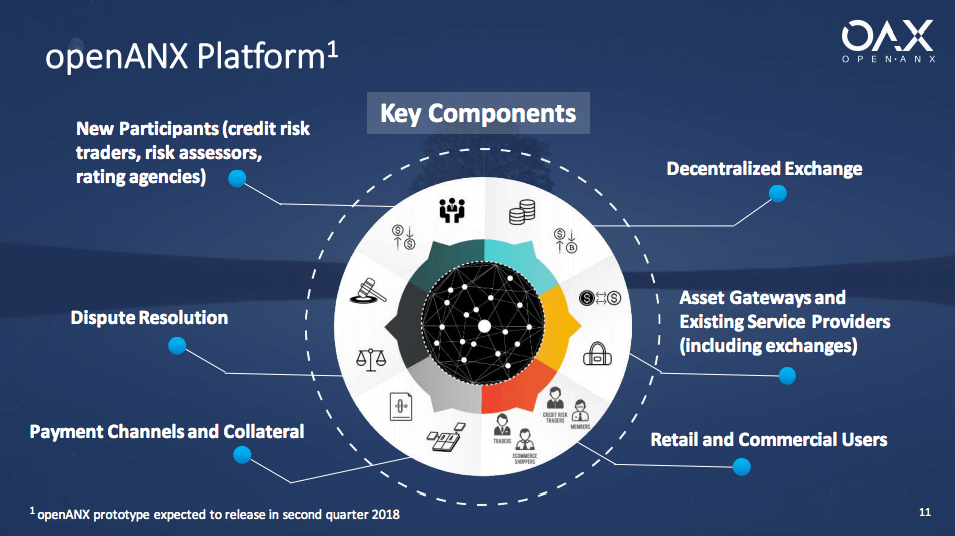

“What we’ve set up is a platform for centralized exchanges to provide their asset gateway services, so they take and hold real world customers’ assets and funds, and issue tokenized representations onto a blockchain which can then be traded in a decentralized exchange.”

The openANX platform will request asset gateways to post ether, the native cryptocurrency of the Ethereum network, into a smart contract as collateral for dispute resolution before they issue tokens.

These tokens could then be used for trading against existing tokens but also provide credit risk trading markets.

“In traditional financial markets, the ability to trade credit risk is taken for granted. In the cryptocurrency space, no one has figured out a way to address these issues, much to the detriment of the community,” Madden said.

Customers will have the ability to look for any range of asset gateways and access key information such as their participation, dispute resolution, the amount of collateral they have posted onto the blockchain, and see how many assets they’ve got tokenized.

“From there, they can view quite a quantifiable metric for the asset gateway credit risk,” Madden said.

At the core of the openANX platform, there will be the openANX DAO, a decentralized autonomous organization run by smart contracts. The Open ANX Foundation, a non-profit organization with the mission of promoting the openANX platform, is responsible for developing the DAO.

The openANX project is being coordinated by ANX International, a blockchain startup based in Hong Kong.

“ANX firmly believes decentralized exchanges will dominate the cryptocurrency market. We plan to lead the march toward this future through openANX, which will be fully open sourced, transparently governed, and kickstarted by ANX’s technology, experience in operating an exchange, infrastructure, and wide network of users,” said Madden.