By leveraging blockchain technology, Maecenas aims to democratize access to the art market and lower entry barriers by allowing investors to own shares in pieces of art.

Maecenas is a new marketplace for fine art investment that uses blockchain technology to revamp what its founders claim to be a market that has largely remained unchanged for more than 300 years.

Beside the aesthetic return, art is also attractive from a financial investment point of view over the long run as it is a store of value that generates positive return. Art has a low correlation with stocks and bonds, which offers diversification possibilities, and can provide a hedge against inflation and currency devaluation.

Beside the aesthetic return, art is also attractive from a financial investment point of view over the long run as it is a store of value that generates positive return. Art has a low correlation with stocks and bonds, which offers diversification possibilities, and can provide a hedge against inflation and currency devaluation.

But investing in art comes with considerable risks, from sophisticated forgeries to illiquid markets, and can incur high costs, whether that is fund charges, or associated transaction, insurance and storage costs. Furthermore, art markets are unregulated, opaque, and at the mercy of erratic public taste and short-lived trends.

Yet, the global art market is booming and investors are increasingly recognizing art as an investment asset class.

Prior to Maecenas, co-founder and CEO Marcelo Garcia Casil founded DXMarkets, a startup specializing in blockchain-based products for the financial services industry. In 2015, DMXMarkets was selected to join Fintech Fusion, a 12-month acceleration program in Switzerland.

With his new venture, Casil said he wants to modernize an industry that is ripe for disruption.

“It is time for art to be become a first-class citizen within capital markets, and to have rich market data feeds, order books, indices and even derivative markets,” said Marcelo Garcia Casil, co-founder and CEO of Maecenas. “A blockchain-enabled marketplace can make it happen.”

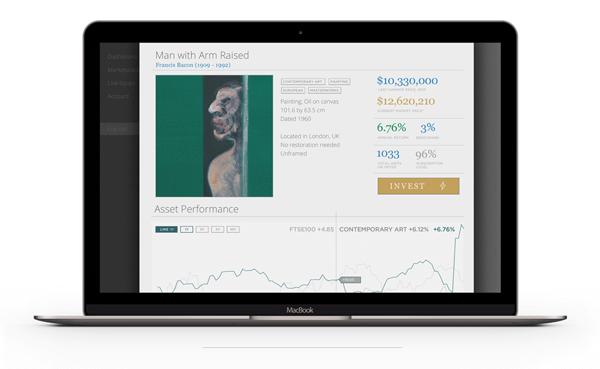

On the Maecenas platform, expensive and illiquid artworks are converted into smaller and more liquid tradable financial units. The platform allows art investors, collectors and owners to trade shares of artworks – very much like they would trade shares of a company.

Maecenas matches art owners with investors and creates an open market where both parties can meet directly, eliminating the need of expensive intermediaries. Investors are charged a 2% fee per transaction while owners pay 6% of the listed amount for their piece of art. Auction house fees can be as high as 30%.

Furthermore, blockchain technology enables real time digital settlement of transactions and creates tamper-proof verifiable provenance, bringing transparency to a traditionally opaque world.

Maecenas focuses on masterpieces and proven successful artists. The platform only lists art pieces worth US$1 million and above.

Each piece of art goes through a validation process that involves external independent and trusted third parties. The validation process includes provenance analysis, document validation and physical inspection.

Once the validation process is satisfactorily complete, the piece of art is listed on the platform and investors can bid for it, choosing the amount they want to invest and their desired price.

Currently, only accredited investors can invest through the platform. The minimum investment is US$5,000 and at least US$50,000 must be deposited in order to open an investor account.

Over the last few months, Maecenas has been working on finalizing fundraising from Swiss venture capital firm Polytech Ventures. The fundraising is currently running on Seedrs and open to the public to participate.