The New York Department of Financial Services (NYDFS) has authorized Gemini Trust Company LLC, the cryptocurrency exchange platform founded by the Winklevoss brothers, and Paxos Trust Company LLC, formerly itBit, to offer a price-stable cryptocurrency pegged to the US dollar.

Commonly known as stablecoins, these aim to offer a liquid, digital alternative to cash that’s available 24/7 for instantaneous transaction settlement and fully redeemable.

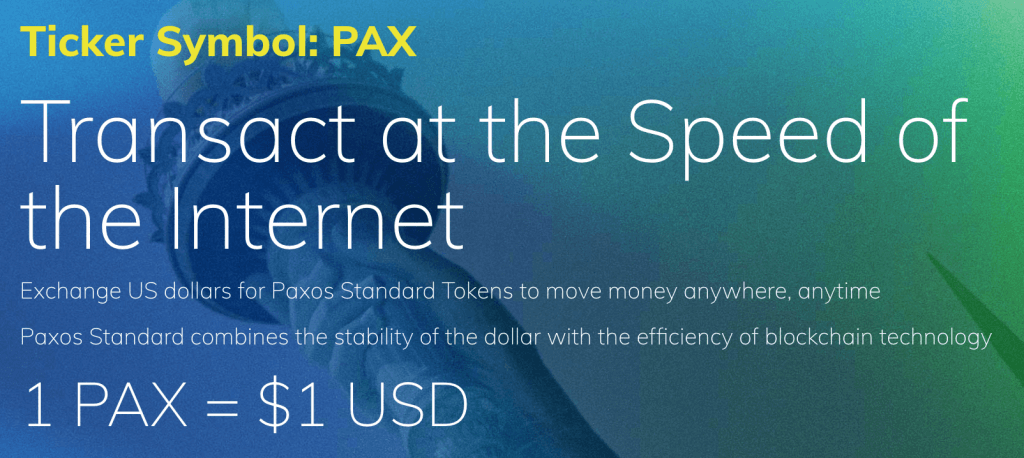

The Gemini dollar and the Paxos Standard token are both collateralized 1:1 by the US dollar and ERC20 tokens, which make them transferrable on the Ethereum network. The tokens are created at the time of withdrawal from the platforms and redeemed or “destroyed” at the time of deposit. The US dollars that correspond to the tokens issued and in circulation are held at FDIC-insured US-domiciled banks.

“To date, there has been no trusted and regulated digital representation of the US dollar on the blockchain,” said Tyler Winklevoss, CEO of Gemini Trust Company, LCC. “We are excited to bring the Gemini dollar to market, a stablecoin that combines the creditworthiness and price stability of the US dollar with blockchain technology and the oversight of the NYDFS.”

Charles Cascarilla, CEO and co-founder of Paxos Trust Company LLC, commented:

“With Paxos Standard, we hope to enable a truly frictionless, global economy by offering a token that is stable, fast, redeemable, audited, and most importantly, approved and regulated. This is a digital asset that can be trusted.”

The approvals follow a comprehensive and rigorous review of both applications. These are based on stringent requirements for these products include:

- Ensure that authorized stablecoins are fully exchangeable for a US dollar, with conditions to ensure monitoring and recordkeeping;

- Implement, monitor and update effective risk-based controls and appropriate BSA/AML and OFAC controls to prevent these tokens from being used in connection with money laundering or terrorist financing;

- Implement, monitor and update effective risk-based controls to prevent and respond to any potential or actual wrongful use of stablecoin, including but not limited to its use in illegal activity, market manipulation, or other similar misconduct;

- Compliance with DFS’s transaction monitoring and cybersecurity regulations;

- Post terms and conditions in a prominent location on websites, and in any other form or manner required by DFS; and

- Maintain policies and procedures for consumer protection and to promptly address and resolve customer complaints.

Commenting on the announcement, NYDPS superintendent Maria T. Vullo said the regulator was “committed to fostering innovation while ensuring responsible growth.”

“These approvals demonstrate that companies can create change and strong standards of compliance within a strong state regulatory framework that safeguards regulated entities and protects consumers,” Vullo added.

Gemini and itBit, now Paxos Trust Company, were granted a BitLicense in October 2015 and May 2015, respectively. The charter allows them to offer services for buying, selling, sending, receiving, and storing virtual currency.

Other cryptocurrency businesses licensed by the NYDFS include Coinbase Inc., BitFlyer USA Inc., Square Inc., and Bitpay Inc.