Ripple has been granted a “BitLicense” to sell and custody XRP, the digital asset native to the Ripple Consensus Ledger, becoming the fourth company involved in the digital currency business to receive approval by the New York Department of Financial Services (DFS) to operate in New York.

The company, which was granted an additional institutional use case of its digital asset, said it now aims at institutional investors and financial institutions located in the state.

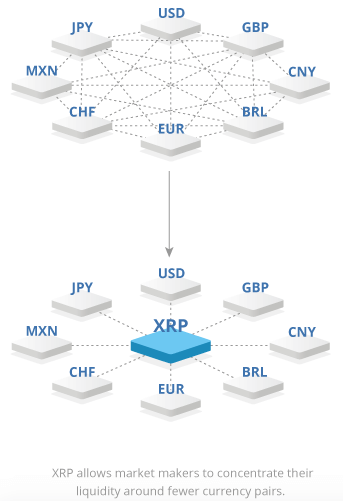

Ripple’s native digital asset, XRP, can be used as a bridge asset for the execution of cross-currency payments, helping banks improve currency liquidity and lower the capital costs of cross-border payments.

In report released in February, Ripple claims that, taken together, the Ripple Consensus Ledger and XRP can help banks minimize settlement risk, reduce settlement costs and allow for the saving of up to US$23 billion annually.

But cross-border payments aren’t the only possible use case as Ripple and XRP can offer the same benefits of cost savings and collateral elimination to many other areas of the global financial system. These possible applications include global disbursements, international cash pooling, low-value remittances and micropayments.

“In the end, the exciting potential of the new technology lies not just in the cost savings banks can extract from the old system but the possibility to enable new models and businesses entirely,” the company claims. “It’s these new business models that will catalyze development of the Internet of Value.”

Ripple’s technology has already been adopted by a number of financial services firms and institutions including CGI Group, Earthport, Expertus, and Santander UK.

Australia’s ‘Big Four’ banks Westpac, ANZ and Commonwealth Bank are all trialing the Ripple protocol for real-time global currency settlements.

Commenting on the DFS approval, Ripple co-founder and CEO Chris Larsen, said:

“Earning the BitLicense is incredible validation of the institutional use of digital assets by DFS, one of the most influential state regulators […] With the BitLicense in hand, we look forward to working with our New York bank customers seeking to use XRP for liquidity and cost savings.”

Ripple, which applied for a license in August 2015, underwent a scrupulous review of its technology by DFS, including but not limited to the company’s anti-money laundering, capitalization, consumer protection, and cyber security standards.

Acting DFS Superintendent Maria T. Vullo expressed commitment to “foster the growth of the New York virtual currency marketplace and industry through thoughtful and appropriate regulation.”

So far, four companies have been granted a BitLicense by NY’s DFS. The authority said it has received 26 BitLicense applications and has already denied two applications from California-based bitcoin merchant solution Snapcard Inc., and OKLink Pte. Ltd., a bitcoin startup led by the OKCoin team.