Oanda is a global broker that offers access to global markets through a simple, easy-to-use platform. Traders and investors can profit from currency pairs, stocks, precious metals, commodities, indices and cryptocurrencies at low cost.

The global powerhouse was founded in 1997 by computer scientist, Dr. Stumm and economist, Dr. Olsen, as a company that published currency conversion prices online free of charge.

Over the years, the company grew to accomplish impressive feats like introducing fractional pips (called pipettes) and becoming the biggest FX broker in Japan. Now, they stand as a multi-asset brokerage house that is plugged into global markets and offers its services to individuals and institutions worldwide.

This review dives into Oanda’s trading platform, the assets it offers, and how individuals and institutions can benefit from it.

How It works

Oanda US is primarily an FX trading platform that offers three major services: FX trading, currency conversion quotes, and FX data services.

Forex currency pairs

Oanda offers 70 currency pairs including majors like EUR/USD, minors like GBP/CAD, and exotics like USD/MXN. Its spreads range from 1.4 pips on major pairs to 4.1 pips on more exotic ones.

Alternatively, traders can opt for a core pricing system where they get the raw interbank spread and instead pay a commission per trade.

The broker derives their FX prices from liquidity providers and aggregates them to find a middle point. This mid-price isn’t fixed but fluctuates throughout the day, however, Oanda claims that its providers are top-tier banks and, as such, provide favourable pricing compared to its competitors.

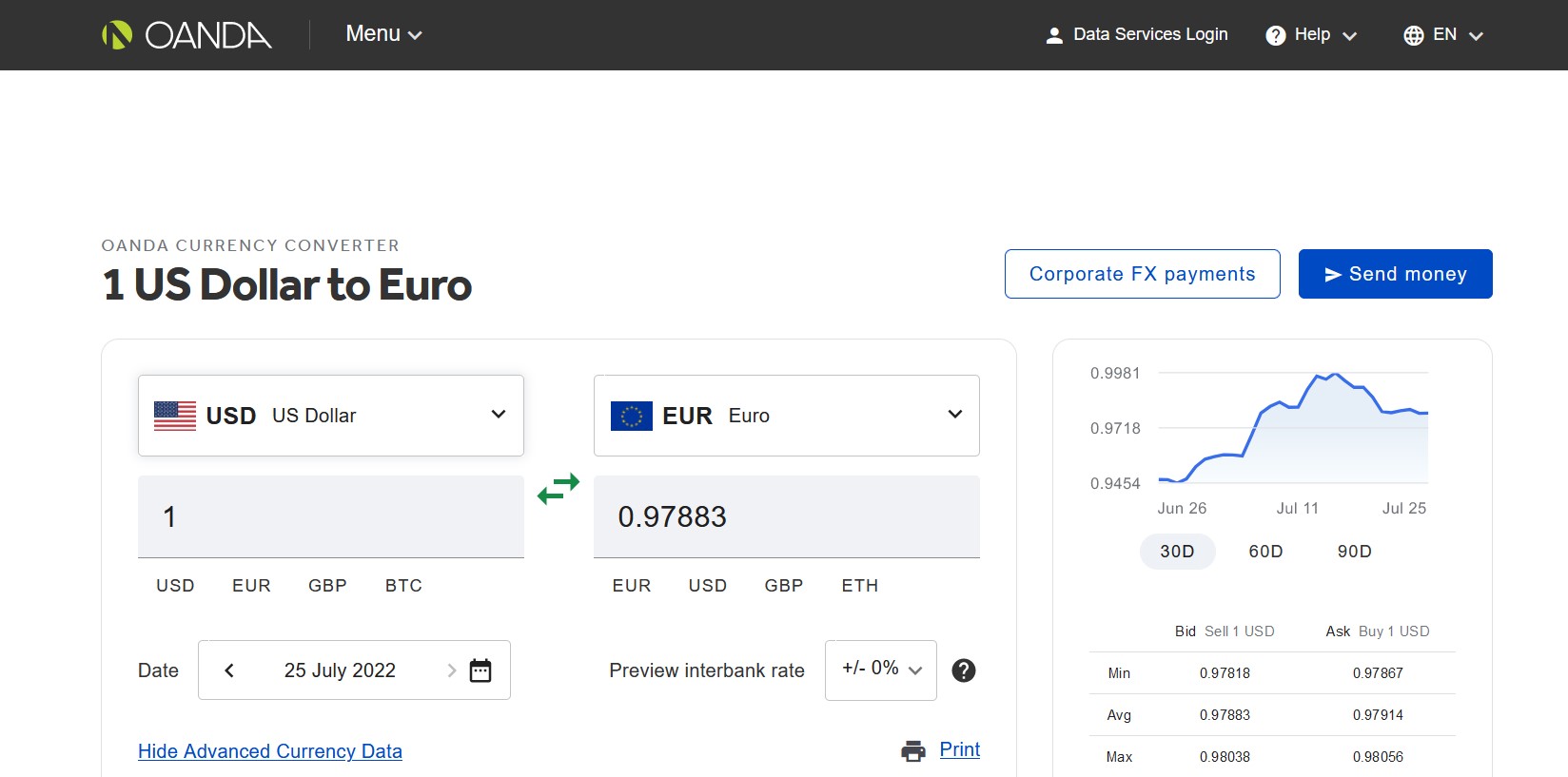

Currency Conversion Quotes

Oanda publishes currency conversion rates at or close to interbank raw rates, allowing individual traders, investors, and small businesses to convert currencies at some of the lowest rates on the market.

The currency service also partners with online banks and money transfer services to enable immediate conversions.

FX Data Services

Oanda’s FX data services are geared towards large organisations with complex ongoing currency conversion needs. These services include conversion APIs that can be integrated into custom apps, historical rate data, and secure FX payments and money transfer services through trusted third parties.

Key Features

Multi-Platform Trader

Oanda’s trading terminal has web, desktop, and mobile versions for traders in their homes or on the go. The broker also integrates directly with the popular charting software, TradingView, to allow traders to execute trades directly from their favourite trading software.

Flexible Deposit and Withdrawal Options

Oanda accepts deposits through payment channels like bank transfers, wire transfers, Visa, Mastercard, checks, and automated clearing houses (ACH). Withdrawals are processed through the same channels for US users.

Dual Pricing System

Traders can choose how they pay Oanda’s broker fees with the dual pricing system. They can either pay a small markup to the raw spread or trade at the raw spread and pay a commission per trade.

Customer Support

The Oanda support team is available 24/5 via live chat to help meet users’ needs. For those who prefer a personal touch, human agents are available via email 24 hours a day, 5 days a week.

Pros and Cons of Oando

Pros

-

Favourable spreads on CFDs

-

An automated trading facility is available

-

Access to real-time news feed and expert technical analysis on the desktop trader

-

Low fees

-

Pricing flexibility

Cons

-

US version only offers FX trading

Why Should You Use Oanda?

Oanda is home to traders who want low spreads, quick executions, expert tools, and the best rates when trading currencies

One way Oando stands out is in its use of technology to improve the currency trading market. It did this first at its inception, publishing currency exchange quotations for free before developing a trading system that allowed investors to get started with as little as $1.

Now, their trading terminal is cross-platform and supports variable contract sizing. Their FX spreads are favourable, as low as 1.4 pips for major pairs and 4.1 for more exotic pairs. Their 70-pair collection is large enough to cater to traders who want multiple options.

The Verdict

If a globally-recognised broker with an innovative technology platform complete with expert analysis, premium charting software, and up-to-date news feeds is what you seek, then Oando is a great option.

The broker has come a long way from being a tech startup to a global financial trading powerhouse. However, remember that even with sophisticated trading tools and robots, CFD trading remains a risky venture that 76.6% of retail Oanda account holders lose money doing.