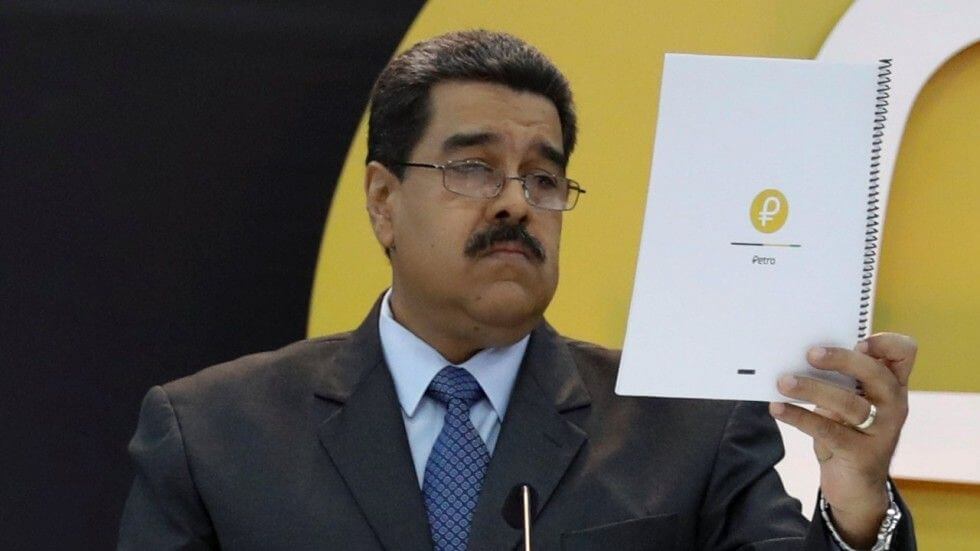

In one of the highest moments in the cryptocurrency world, the Venezuelan government launched its own digital currency, the Petro yesterday. The government of Nicholas Maduro is banking on the cryptocurrency to come to the rescue of its struggling economy hit by debt and crippling sanctions.

Authorities are now announcing they have raised more than $735 million only a day into the presale. If true, it will be one of the highest amount raised in an ICO. The presale ends on March 19. The presale price for a unit is $60.

Petro Solution to Financial Woes?

While making the announcement, the president hailed the petro as a solution to Venezuela’s financial woes. Its economy has shrunk by about a third within the last five years. There is no end in sight yet for the hyperinflation. The inflation rate has been estimated at 13,000% in 2018 according to the IMF.

Venezuela has huge oil reserves but this has not helped the situation. Now, the government is pegging the Petro on its oil reserves in a bid to attract investments into the country.

In one of the boldest moves, authorities launched the Petro presale on Tuesday. The digital currency will be used to pay taxes, fees and other government services according to its website. Petro’s price will be calculated from the price of a barrel from the previous day, the website says. Petros are capped at 100 million although 82.4 million will be initially issued.

“The State shall promote and encourage the use of Petro with a view to consolidating it as an investment option, savings mechanism and means of exchange with State services, industry, commerce, and citizens in general,” the whitepaper reads in part.

Petro will also serve “as a platform for the growth of a fairer financial system that contributes to development, autonomy and trade between emerging economies.”

Petro Criticism

The move has not however gone without criticism. The opposition is accusing the government of corruption for effectively borrowing against the country’s oil reserves without the necessary legislative approval.

US lawmakers have similarly hit out. Senator Marco Rubio has called on the Treasury to restrict the use of the petro as it is meant to circumvent US sanctions against Venezuela.

It is not however clear how this can be enforced. Petros are set to start being used by April, the same time the country will go for elections. It’s existence will more or less depend on who will ascend to power.

Up to now, it is not clear which platform will run on. The whitepaper states it will be built on ethereum with the ERC20 standard.

The buyer’s manual however states the token will be generated using NEM blocks. NEM is a private blockchain built from the ground up allowing for scalability and high transaction rates. Its modular system allows businesses to build real world applications. Mijin, a commercial blockchain being tested by some financial institutions is based on NEM.

An exchange for the token will be launched next month which will coincide with the private sale. Adjustments on the network will also be expected during this period.