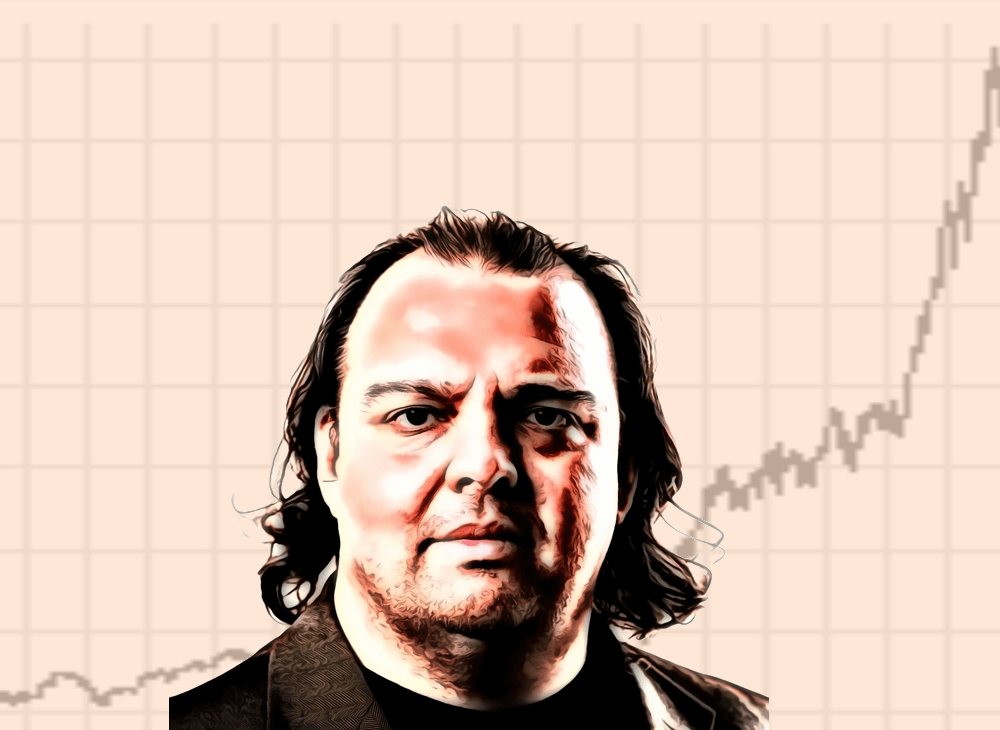

2015 was Bitcoin’s biggest year thus far when it comes to startup investments, and the industry as a whole has been able to raise roughly $1 billion in venture capital funding up to this point. While this may seem like a solid step in the right direction to some, Cypherpunk Vinay Gupta sees things getting much crazier in 2016. On a recent episode of Epicenter Bitcoin, Gupta claimed there will be $10 billion in funding for blockchain-related startups this year.

Money Won’t Be Hard to Find for Blockchain Projects

During the early portion of Vinay Gupta’s interview, he noted he’s currently looking at the trends in the blockchain ecosystem and trying to figure out what will take place in 2016. One of the first things he pointed out is the lack of funding for most blockchain-related startups up to this point. He noted:

“I think, up until now, the entire field has been largely limited by available money. It’s been quite hard to raise funds for projects; there’s been a lot of curiosity from funders, but not very much action.”

Gupta then pointed out that R3, the startup building a permissioned blockchain for a consortium of the world’s largest banks, has the power to reverse this trend. He stated:

“I think that R3 has kind of tipped the entire ecosystem into a different gear. It’s legitimized this notion that blockchains are a technology that is critically important to banking, and at that point, the money is seriously beginning to flow into the field.”

Although banks now believe blockchain technology could help them cut costs and provide more efficient money flows, faith in the Bitcoin blockchain and bitcoin as a currency still seems rather low. Having said that, many Bitcoin supporters, including Digital Currency Group Founder Barry Silbert, believe banks will eventually come back to Bitcoin after realizing the benefits of an open, permissionless ledger.

Blockchain Talent Will Be Hard to Find

Vinay Gupta also made the point that talent may soon be hard to find in the blockchain industry. With tons of new money pouring into the space, it may be difficult for startups to find individuals who have the necessary experience with this new technology. Gupta explained:

“So I think that this is the year where we’re going to go from it being scarce money and abundant talent to it being abundant money and scarce talent. And I don’t think any of us really know how to operate in that environment — we’re so used to having to bang on the doors. Now that the doors are largely auto-opening, I think we’re going to have a fair amount of chaos.”

Now that R3 has essentially brought blockchain technology into the mainstream, it’s possible that a number of startups will be created that don’t make much logical sense, much like the early days of the Internet.

The Coming Blockchain Bubble

At this point in the interview, Epicenter Bitcoin Co-Host Brian Fabian Crain asked Vinay Gupta if he was predicting a blockchain bubble similar to the dotcom bubble of the late 1990s. Gupta responded:

“It’s already started. I mean, my estimate is that we’re going to see $1 billion come into the Ethereum ecosystem in 2016 alone, and the general estimates for the amount of money going into the entire blockchain ecosystem, including Bitcoin, is on the order of $10 billion.”

Crain was shocked by Gupta’s response, but the longtime cypherpunk used two pieces of evidence to back up his claim. Gupta first pointed to a leaked JPMorgan report that revealed the bank’s plans to “aggressively pursue” innovative technologies such as blockchains, big data, and robotics. According to Business Insider India, JPMorgan has put aside $9 billion for such investments.

Gupta then pointed to Singapore and their $7 billion smart cities program. He added, “[Singapore] is seriously interested in blockchain stuff. There’s just a really, really broad-based push for large entities to get this technology into their systems.”

Investments in blockchain technology do not necessarily lead to investments in Bitcoin, so the community will have to wait to see how much of that possible $10 billion finds its way to startups building around the world’s first blockchain.