NEO, Binance Coin (BNB) and Uniswap (UNI) all bearish heading into the weekend and could sustain further losses in the coming hours

The cryptocurrency market looks to be continuing its descent into red territory heading into the weekend. All cryptocurrencies in the top 20 are down by over 10% in the past 24 hours, as we witness perhaps the strongest correction in months. Binance Coin (BNB) is down by 14% in the past 24 hours and risks dropping below $450 during the weekend. NEO lost nearly 20% of its value in the recent correction and could face further decline to $70 unless the market recovers. Uniswap is still in the top ten after losing 15% of its value and will need to defend the $29 support area to avoid further losses.

BNB price outlook

#bnb isn't bad.

A daily close over say $583 would be no downtrend.

Still over the daily 21 MA at $473.

The price action has been wild.$bnb has on it's side the value & returns you get from being a bnb user. People want & use this crypto. pic.twitter.com/NVshDBWsIf

— Crypto ₿ethany (@CryptoBethany) April 23, 2021

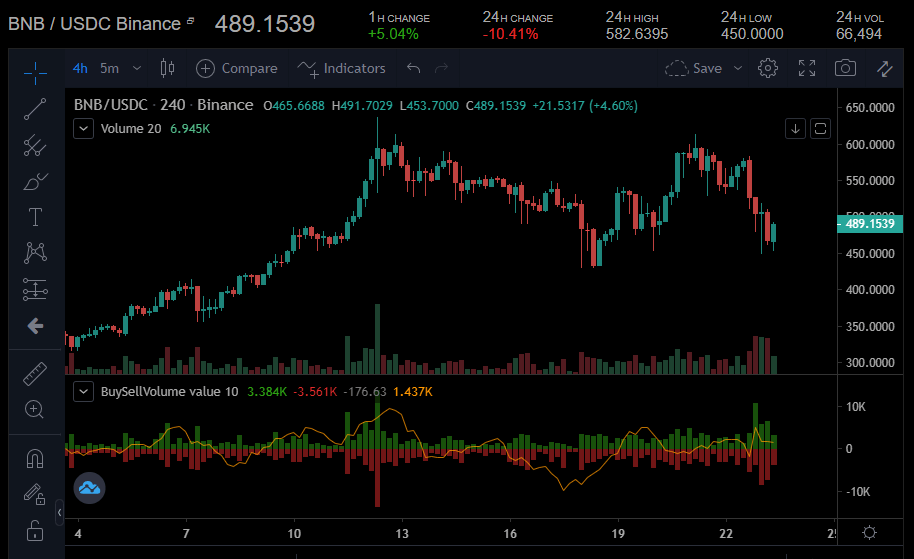

A look at the BNB/USDT 4-hour chart shows that Binance Coin is still in a bearish mode despite rising by 5% in the past hour. Bulls have been able to defend the $452 support, allowing BNB to recover towards $490. It is still trading within its 100-day simple moving average region ($490). If it builds on the recently-found momentum, it could attempt to climb above $511 this weekend.

BNB/USDT 4-hour chart. Source: Coinalyze

However, the RSI and MACD show that bears are still in control and could spark a further correction. If the correction continues, BNB could lose support at $452, bringing the support found at $430 into focus.

NEO price outlook

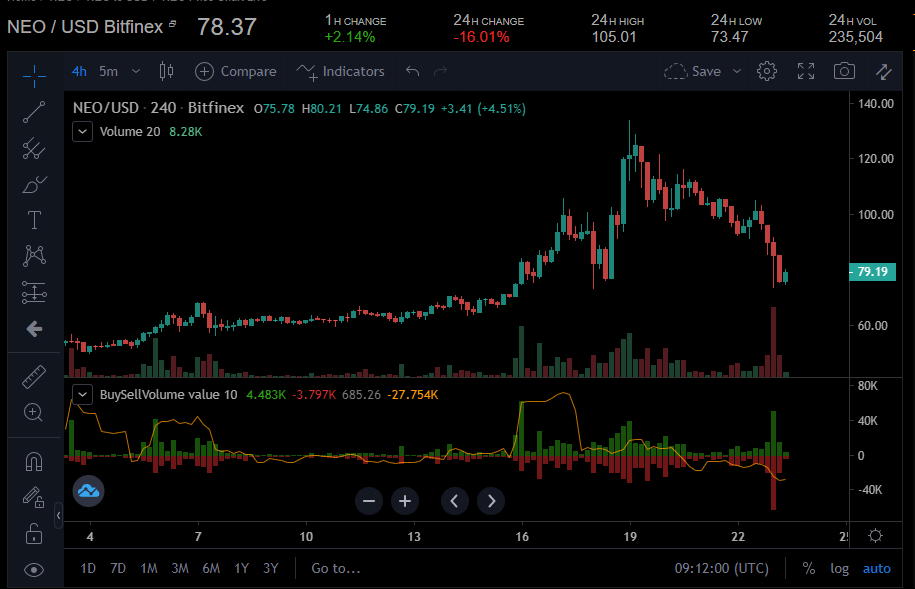

NEO is in a similar situation to BNB. The NEO/USD pair is up by 2% in the past hour and down by 16% over the last 24 hours, with the 4-hour chart currently still looking bearish. The cryptocurrency has defended the $72 support and is slowly marching towards the $84 resistance point.

NEO/USD 4-hour chart. Source: Coinalyze

If the bulls mount a recovery, NEO could attempt a run at $90 and move towards $100 this weekend. However, the technical indicators are bearish at the moment, pointing to further losses this weekend. Failure to defend the $72 support could see the NEO/USD pair spiraling towards the 200-day SMA ($63.02).

UNI price outlook

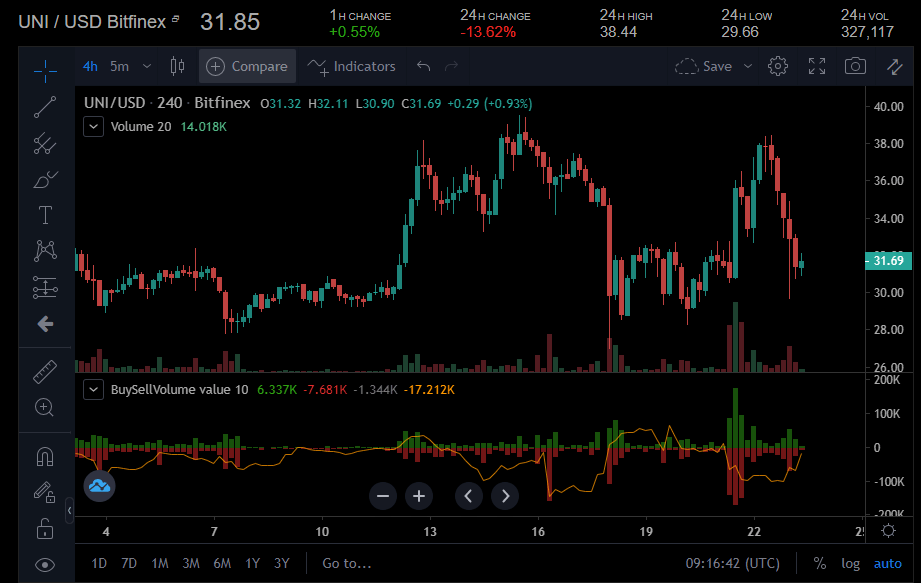

Uniswap (UNI) is echoing the broader market’s performance after losing 13% of its value in the past day. The UNI/USD pair is looking incredibly bearish at the moment. If the current trend continues, UNI will be forced to defend the $28 support point. Further losses could see UNI drop below $25, a price that hasn’t been seen in weeks.

UNI/USD 4-hour chart. Source: Coinalyze

The bearish cycle could continue as its MACD level is in the red zone. The RSI is below 50, which indicates a negative cycle.

However, UNI could recover if it gets help from the broader market. A rally will see UNI surpass $32 and attempt to break the $35 resistance. An extended market rally might help the cryptocurrency reach its weekly high of $39.44 again.