This year has not been a particularly good one for any of the markets. From commodities to stocks, even cryptocurrencies and forex, external geo-political concerns have laid a blanket of fear and uncertainty over the markets.

Covid-19 and the global pandemic surrounding it has been the main driver for poor performing markets. However, the major drop in most markets in the middle of March that was felt around the world has at least offered some opportunity for markets to rebound.

Many markets plummeted to record lows in March, but there was a steady recovery as the world got a better handle on the Covid-19 pandemic and its impact on different major economies. However, one market that, while recovering from a position where it was trading at zero US Dollars, does not look like it will end the year on a high — Oil.

The price of US oil turned negative for the first time in history in April this year as demand dried up following lockdowns across the world, tensions rose between oil producing nations, and strategies were put in place to drive the price down.

Prices of course did rise above zero, but then plateaued somewhat in the past three months with a clear downward trend developing which does not point to a successful end to the year for the oil price.

The path for the rest of the year has been outlined by PrimeXBT’s lead analyst Kim Chua, and she doesn’t see much hope for the popular commodity in the coming months

Flat and falling

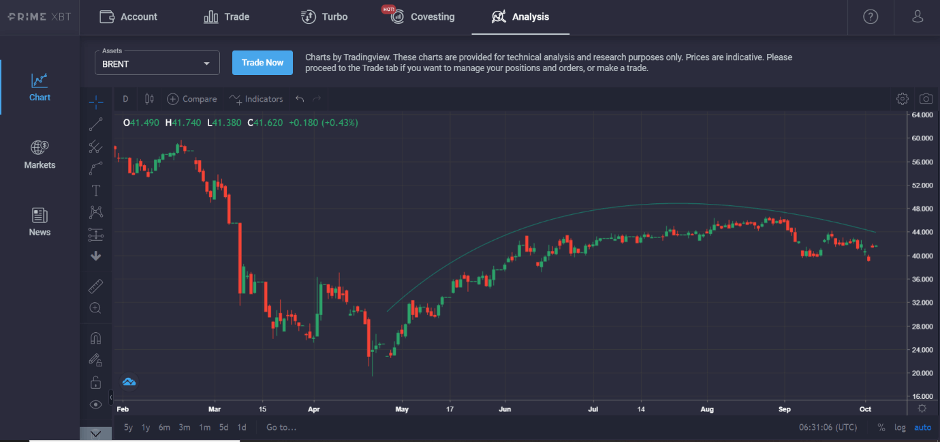

After staying relatively flat for three months since its recovery from the March COVID19-led selloff, Oil started October on a lousy footing with it becoming one of the worst performing assets of the quarter, ending September with a fall of around 10%.

At the close of trading last Friday, Brent Crude even broke below its psychological support of $40 to close at $39 per barrel on the back of negative sentiment led by US President Donald Trump’s COVID19 diagnosis. It is currently retracing its down move to around $41 after Trump’s condition is said to have improved greatly.

On the more actively followed US WTI Crude Oil Daily Chart, the 200-day MA at around $36 seems to be providing some short-term respite from the falling price of oil at the moment, with price action seemingly undecided about where to go in the near-term.

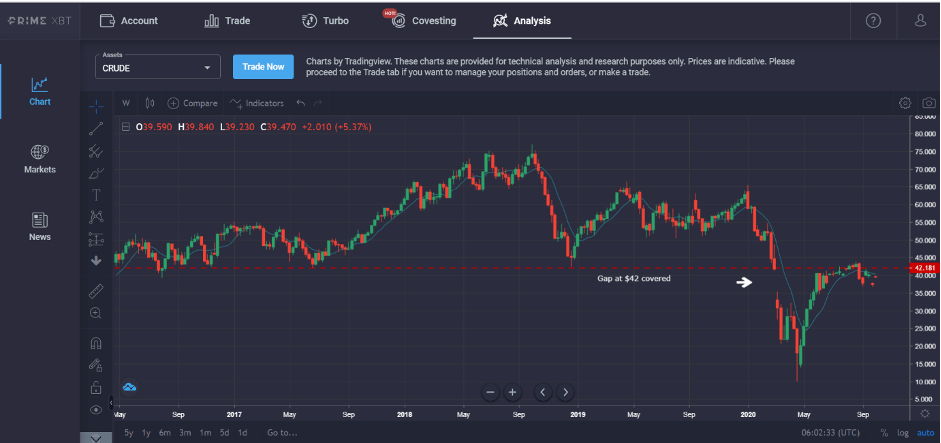

The weekly chart, however, throws up more clarity. We can see quite clearly that the previous month’s oil price recovery to around $42 level appears to be merely an attempt to cover the gap created in March where it opened gapped down $10 to around $32 on March 9th after closing at $42 the week prior.

With the gap covered, the downtrend looks set to resume unless we get a sustainable close above $42, predicts Chua. “Some traders could be lining up their shorts around there as it appears to be a trade that offers a decent Risk:Reward ratio”, she said.

Other than a weak chart, the fundamental side of the oil story is also deteriorating.

Managing prices

Since the fall of oil prices to negative, driven by tensions between OPEC and Russia, as well as others, and Covid-19, there has been work put in to correcting things, According to the PrimeXBT’s analyst.

In May, OPEC and its rival members like Russia and Oman have agreed to a production cut by a record 9.7 million barrels per day to allow demand to normalize, but other exempted members like Venezuela have been ramping up output as they struggle to keep their economies afloat due to their over reliance on oil export.

As reported by Reuters, countries like Libya, and even Iran, which had been banned from exporting oil to other nations due to US sanctions, had been stealthily increasing output and selling their oil through backdoor methods. Libya, for instance, has seen output triple in a span of only two weeks as at the end of September.

Even Russia has mentioned on October 2nd that they have produced above their September quota. Iraq, OPEC’s second largest producer, has also increased its oil production slightly in September despite its pledge to cut production. It almost seems as though that no country is keeping to its promise of a supply reduction after just three months.

While supply is creeping back up slowly but surely, the demand side of the story remains weak, and could possibly get worse. COVID19 cases are rising again in Europe, raising the chances of yet another lockdown with the colder autumn and winter months approaching.

With major airlines laying off staff, planes grounded, and the borders of most countries still shut, the demand for oil in the coming months appears bleak. The new ‘work from home’ phenomenon created by the COVID19 social distancing measures adds salt to the wound, as gasoline demand for work commuting is also greatly reduced.

Major countries like the US, and even important global players in Europe, are also reporting signs that are not promising for the ongoing oil price

“News of US President Trump contracting COVID19 further draws attention to the pandemic”, Chua explained. “Traders were once again reminded of the impact it had on oil prices on April 20th, when WTI Crude price collapsed and the May contract settled for -$37.63 a barrel. With COVID19 infections picking up speed again, the outlook for oil looks dire indeed”.

Countries in Europe and cities in the USA are already planning on imposing new lockdowns. “At the rate this is going, oil price may be revisiting the $20s again before the end of this year”, predicted the PrimeXBT analyst.

The opposite of the spectrum will be that a vaccine is found for COVID19 that can be deployed across the world within a short timeframe, or that COVID19 miraculously disappears on its own.

Chance of stabilization?

Other than that, oil producing nations agreeing to cut back production again may help stabilise oil prices a little, but after observing them all secretly ramping up production despite having agreed to cut back in May, it is a wonder how effective such pacts can be in achieving their desired effect of a supply reduction.

One factor in favour of an increase to the oil price is if there is a sooner than expected passing of the widely anticipated new US stimulus bill. This may send the USD lower, and consequently, raise the price of oil in response due to its inverse relationship with USD. However, unless the fundamental outlook improves for oil, any positive price change in response to a weak USD may be short-lived.

However, unless something unforeseen happens on the demand side, for instance, an onset of war, the outlook for oil remains a cloudy and gloomy one.

All analyses provided by lead PrimeXBT market analyst Kim Chua. Traders can long or short Brent and WTI Crude Oil CFDs with the award-winning PrimeXBT, alongside cryptocurrency margin trading, forex, gold, silver, stock indices, and more.