Spencer Bogart, a prominent venture capitalist and a partner at Blockchain Capital, stated that the integration of bitcoin from Robinhood and TT is a big deal.

This week, Trading Technologies International Inc, better known as TT, has added Coinbase into its network that allows various assets and products to be traded on major exchanges. TT CEO Rick Lane said in an interview that adding Coinbase onto the company’s system would increase the liquidity and accessibility of cryptocurrencies for institutional investors and large-scale retail traders.

“Institutions are trading with increasing frequency and regularity in these markets, although they’re doing so without institutional-grade, professional-grade technology. They’re largely underserved and there’s a lot of trading volume and trading opportunity left on the table,” Lane stated.

According to Lane, TT is currently connected to 19 of the 20 largest firms in the global futures market. Given that Cboe and CME process $150 million worth of bitcoin contracts on a daily basis, Lane noted that the strategic partnership between TT and Coinbase will likely result in the processing of more bitcoin futures contracts than the two companies combined.

The TT and Coinbase partnership “will absolutely move the needle in terms of the futures volume,” Lane added.

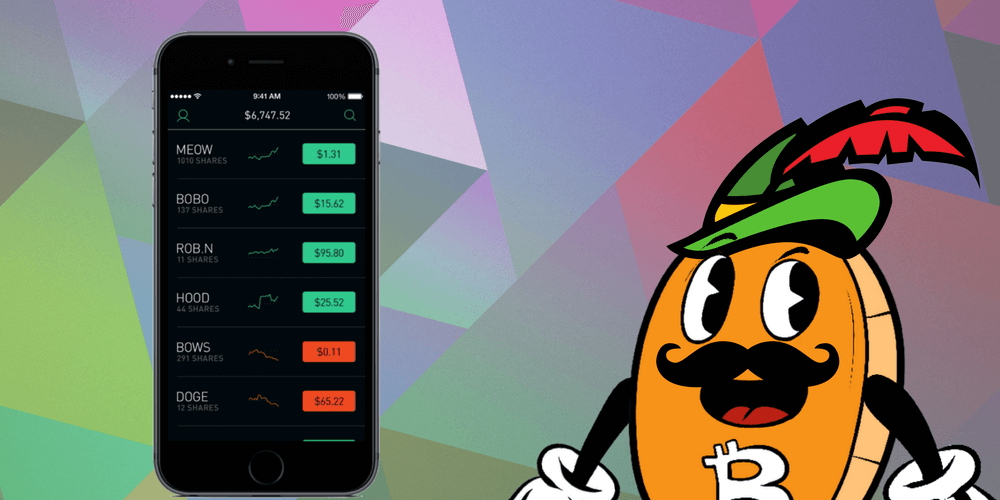

Robinhood, a major U.S. based financial services company operates a mobile app allowing individuals to invest in publicly traded companies and exchange-traded funds listed on U.S. stock exchanges, they’ve also integrated cryptocurrencies to its existing infrastructure.

Starting February, Robinhood announced that in February it will allow its users to trade, buy, and sell bitcoin and Ethereum through its mobile app. Robinhood’s development team already integrated a cryptocurrency feature into the app that enables users to keep track of the price of 14 top cryptocurrencies.

“We’re planning to operate this business on a break-even basis and we don’t plan to profit from it for the foreseeable future. The value of Robinhood Crypto is in growing our customer base and better serving our existing customers,” said Robinhood co-founder Vlad Tenev.

The majority of analysts in the cryptocurrency sector have stated that 2017 was the year cryptocurrencies including bitcoin and Ethereum went mainstream. In regions like South Korea, US, and Russia, reports suggest that an overwhelming majority of the population are already aware of bitcoin and the cryptocurrency market.

The integration of major cryptocurrencies by TT and Robinhood, two of the largest financial service providers in the US market, will only further drive the adoption of bitcoin, Ethereum, and other cryptocurrencies.

The entrance of more institutional and retail traders with billions in capital would also prevent several whales or large-scale investors from manipulating the bitcoin market through the futures market. While the rumors that institutional investors in the US market are intentionally bringing down the price of cryptocurrencies to cash out short contracts are yet to be confirmed, investors in the global market are still concerned with the possibility of a small group of investors gaining control over the market.