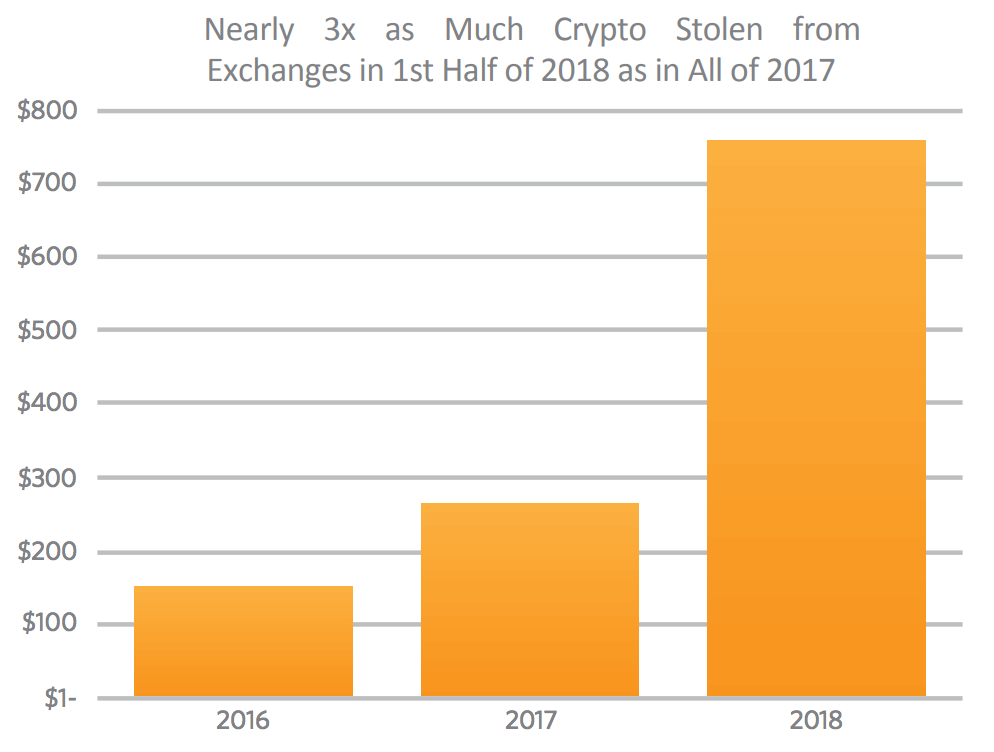

The first half of 2018 has seen more than US$750 million worth of cryptocurrency stolen from exchanges, nearly three times as much as in all of 2017. The losses could rise to US$1.5 billion this year, according to a new report by CipherTrace, a US-based cybersecurity firm that develops blockchain security, anti-money laundering (AML) compliance and enforcement solutions for cryptocurrency exchanges and banks.

In the last two years, criminals have made off with US$1.2 billion in cryptocurrency from exchanges, the report claims. Recent heists include Coincheck’s US$530 million hack, CypheriumChain’s US$10 million hack, and cryptocurrency trading app Taylor’s US$1.5 million hack.

In the last two years, criminals have made off with US$1.2 billion in cryptocurrency from exchanges, the report claims. Recent heists include Coincheck’s US$530 million hack, CypheriumChain’s US$10 million hack, and cryptocurrency trading app Taylor’s US$1.5 million hack.

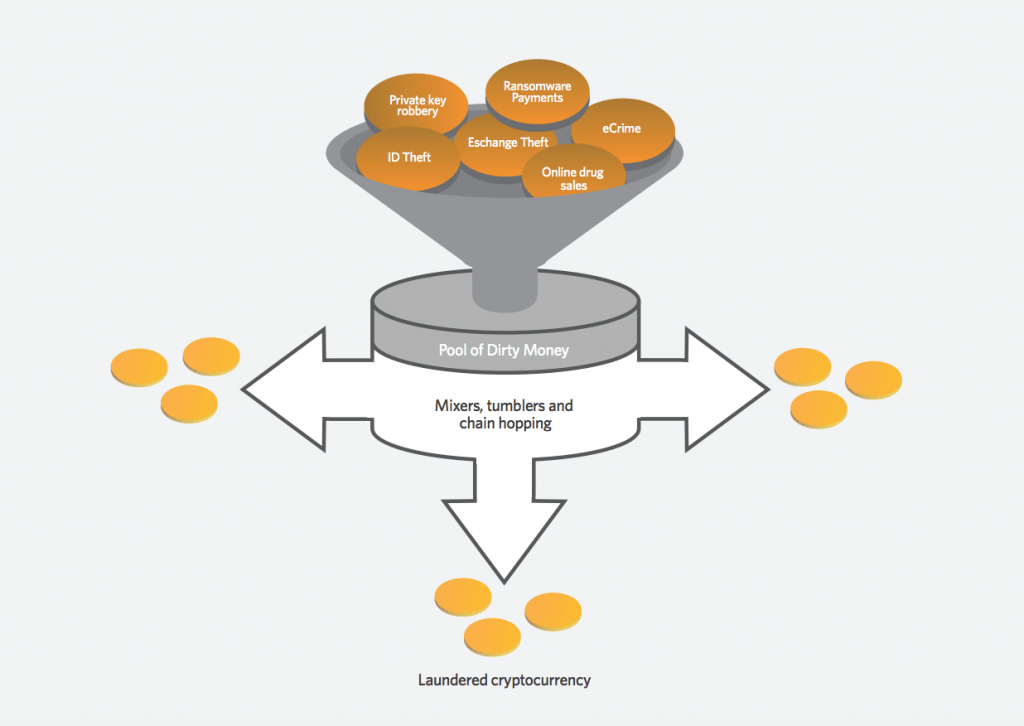

The stolen cryptocurrencies end up being laundered to help criminals hide their true identities and avoid arrest.

There are a number of money laundering services available for cryptocurrencies. These services, which are variously called mixers, tumblers, foggers and laundries, take in funds from multiple customers, mix those funds together, and then output the mixed funds. The purpose of these money laundering services is to obfuscate the origin and receipt of cryptocurrencies. They typically charge between 1% and 3% per transaction for their services.

Well-known cryptocurrency money laundering services include BestMixer.io, Bitblender, Bitcloak, and Coinmixer, to name a few.

Besides these specialized services, cryptocurrency gambling sites are also frequently used as money laundering facilities because these have little to no Know Your Customer (KYC) regulation, the report says. There are between 100 and 200 gabling sites on the Internet that focus on cryptocurrencies. Criminals can open accounts on these sites and then transfer funds to launder them. They will make simple bets, or even in some cases simply withdraw funds to a new address without any bets at all.

Besides these specialized services, cryptocurrency gambling sites are also frequently used as money laundering facilities because these have little to no Know Your Customer (KYC) regulation, the report says. There are between 100 and 200 gabling sites on the Internet that focus on cryptocurrencies. Criminals can open accounts on these sites and then transfer funds to launder them. They will make simple bets, or even in some cases simply withdraw funds to a new address without any bets at all.

In 2017, US$266 million was laundered via cryptocurrencies. So far, in 2018, that figure stands at US$761 million. This multi-billion-dollar and growing cryptocurrency money laundering problem has attracted the attention of regulators globally.

The report also provides insights into the global cooperation and crackdown by the international financial crime-fighting Financial Action Task Force (FATF). The current rules call for exchanges to be registered or licensed, verify customers’ identities, prevent money laundering, and report suspicious trading and transactions.

According to Reuters, the FATF is currently discussing making crypto exchange rules binding. Additional global enforcement action is also expected from US Financial Crimes Enforcement Network (FinCEN), and it will likely target money laundering services, crypto-to-crypto exchanges and privacy coins.

“Until now, the lack of regulatory guidance has hindered the broader adoption of cryptocurrencies. Now we are seeing the big guys coming together asking for cryptocurrency AML regulation—it is inevitable, it will be unified, and it will be global,” said Dave Jevans, CEO of CipherTrace and co-chair of the Cryptocurrency Working Group at the APWG.org.

“There will be little room for privacy coins without AML or mixers in these KYC and AML regulated regimes. This will also be a wake-up call for virtual currency exchanges and financial institutions, exposing them to the risk of facing stiff penalties.”