SBI Savings Bank, by South Korea’s SBI Group, has deployed a new blockchain-based personal authentication service. Called SBI Simple Authentication, the service is now open to the public and was developed in cooperation with domestic blockchain startup Iconloop.

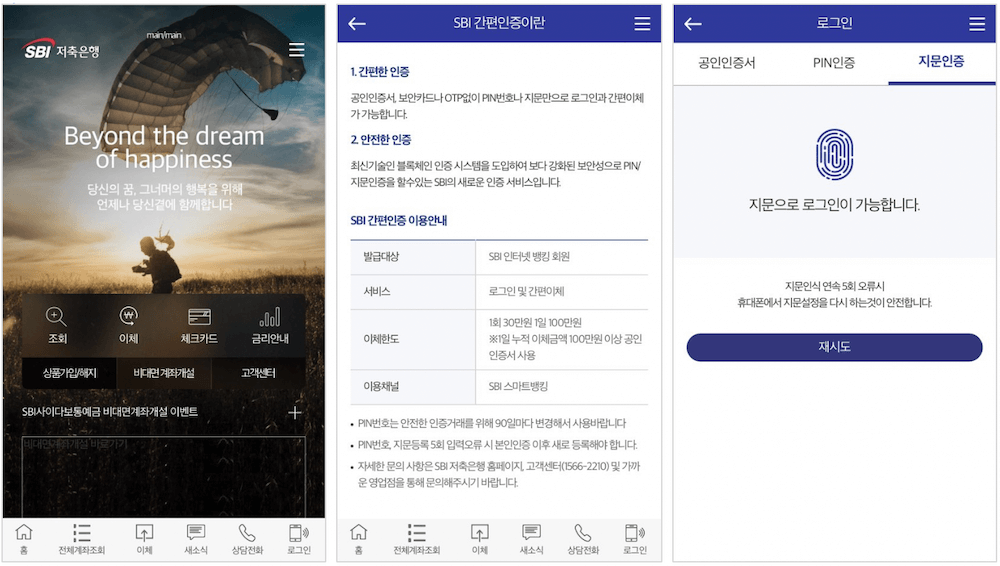

Integrated into SBI Savings Bank’s mobile smart banking

application, the service allows users to easily and more securely log in and

initiate transfers by using a PIN or fingerprint without a public certificate,

security card or one-time password (OTP).

SBI Simple Authentication stores PIN and fingerprint

authentication information with consensus among the nodes of the SBI blockchain

server (instead of getting proof from certification authorities) and verifies

the data integrity through SCORE, a smart contract environment developed by

Iconloop, at the time of issuing a certificate.

The solution applies private and public key structure and is

compatible with the existing certificate standards by adopting their specifications.

It also follows the FIDO standards to support biometric authentication.

According to SBI Savings Bank and Iconloop, blockchain

enables enhanced security and makes it impossible to falsify information and

misuse certificates, all the while improving user experience.

“The new service based on Iconloop’s blockchain technology

is a great opportunity to bolster our competitiveness in financial services,”

said Eunhwa Lee, director of SBI Savings Bank’s fintech task force.

“By providing safer and more convenient services, SBI

Savings Bank expects to offer new benefits to customers and create new market

opportunities. We will introduce various technologies to lead the financial

industry and maximize customer satisfaction.”

Iconloop has been working with SBI Savings Bank to apply

blockchain technology to personal authentication, electronic document

certification and time stamping since November 2018.

Jonghyup Kim, CEO of Iconloop, said the startup will

continue to work with the bank on varied applications of blockchain with the

goal of providing “differentiating solutions.”

Alongside the newly launched authentication service, SBI

Savings Bank is also working a blockchain-based document certification system.

Employees are presently uploading file attachments from SBI Groupware boxes,

such as draft documents and official notices, to the new system, which confirms

that the files are not damaged or tampered with when browsed or downloaded.

Founded in 2016, Iconloop is a blockchain startup based in

Seoul and the company behind the ICON blockchain platform. It develops

blockchain solutions for financial institutions and has conducted projects

together with the Seoul Metropolitan Government, the National Election

Commission, and Kyobo Life Insurance, among others.

Iconloop was incubated by Dayli Financial Group and is led

by computer scientists from Postech, a private research university focusing on

science and technology in South Korea.