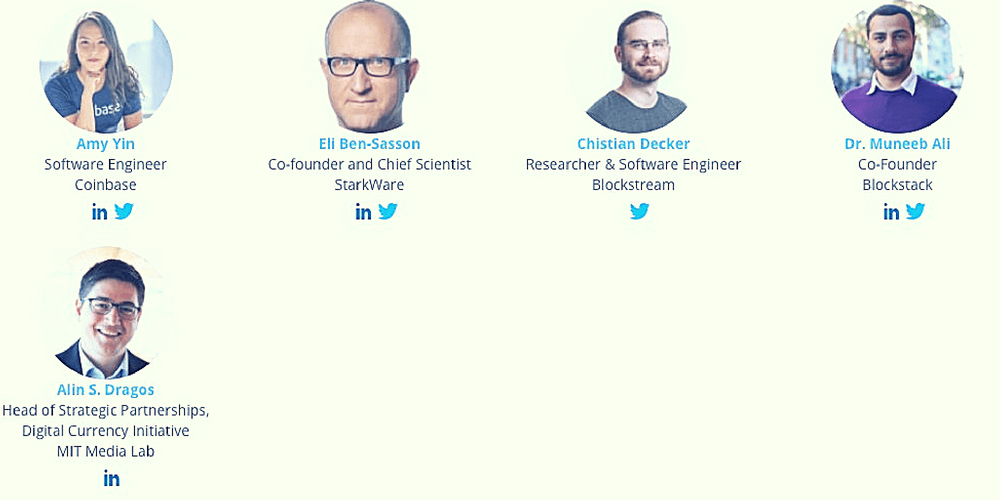

At Consensus 2018 today, as it has been for the past three years, scaling was at the forefront of everyone’s minds. “SCALING, LAYER 2 AND CRYPTOGRAPHIC INNOVATIONS” was created to address just that issue. Panel participants included Alin S. Dragos of the MIT Media Lab, Amy Yin of Coinbase, Christian Decker of Blockstream, Muneeb Ali of Blockstack and Eli Ben-Sasson of StarkWave.

Amy Yin started with a talk about Coinbases’ innovations and move towards giving customers control of their funds.

This has been a sore spot for Coinbase for a long time. Often called a Bitcoin bank, that is a term they used instead to describe what Yin called Coinbase’s favorite competitor, BitPay.

Coinbase is arguably Bitcoin’s most visible company and that has required them to balance a fine line between appealing to Bitcoin’s privacy minded, cypherpunk roots, while also playing nice with the regulators that are drawn to them like gnats to a florescent light on a warm summer evening.

There have been controversies abound, most notably when Wikileaks claimed that Coinbase had blocked their account and a few years prior when customers started complaining that their accounts were blocked after using their bitcoin for online gambling.

Yin’s speech didn’t mention either controversy nor the broader complaints from the cryptocurrency community. Regardless, it was difficult not to think about these issues while Yin talked about using Heritartical Deterministic (HD) wallets to give users more autonomy over their funds.

According to Yin, there are now three different Coinbase products that allow for permissionless sending and receiving of funds. This includes Coinbase Merchants. One caveat to the permissionless aspect of it: Coinbase has to allow you to sign up. During the Q&A session, Yin revealed that banned countries (like Cuba and Iran) will not be allowed. This is likely a move to placate the regulators. No one who must play nice with the regulators wants to be associated with countries that the US has embargoed, so the move isn’t a surprise.

This all may have you wondering what it has to do with scaling. It’s not really a solution. But it is something that could help lessen the need for on-chain transactions. If Coinbase can handle all the overpayments, underpayments and determine that a transaction has been sent before it is confirmed by the miners, then it makes things a lot easier for merchants. If they can do that while still giving merchants and users control of their private keys, it gets us closer to moving away from banks (and bitcoin banks) while not overloading the network with every coffee purchased with Bitcoin.

They probably didn’t go far enough for the people who wish bitcoin will forever be regulated to the dark corners of cypherpunk culture, but it certainly seems like a step in the right direction.

Moving onto actual scaling solutions, Christian Decker of Blockstream took the stage to talk Lightning Network.

While he didn’t get too deep into the technical details, Decker did provide a quick overview of how Lightning works and its current state.

In layman terms, Lightning works by opening off chain channels between different participants. A bunch of transactions are grouped together and then added to the blockchain in one large group. The money is held in the meantime and can’t be spent elsewhere.

According to Decker, each channel can process about 500 transactions per second. With thousands of channels being utilized at once, Bitcoin could theoretically scale beyond not only any other cryptocurrency but any other payment method, including VISA.

Decker also explained that the Lightning Network will provide more privacy than on-chain transactions. With the transactions being grouped together it would be impossible for blockchain analysts to track who sent what to who. And while the Lightning nodes theoretically could have that information, they are set up not to. Instead, they only know to as Decker explained: “take from the left and give to the right” they don’t know if their move is the last in a chain of transactions, the first, or somewhere in the middle. So long as a participant has more than one channel open, it should be impossible to determine how Lightning Network users are spending their bitcoins.

To that end, he presented some statistics on how Lightning is being used on the Mainnet (even though they haven’t officially moved from the TestNet). He claimed that 1,706 nodes are currently being used, opening up 6564 channels and currently has about 20BTC within the network. The number of Fees and total transactions can’t be calculated, Decker said, because the network is unable to record that. He did claim that each transaction fee was as low as a millionth of a penny.

Alin S. Dragos from the MIT Media Lab talked about smart contracts using Bitcoin. This was as opposed to Ethereum, which is more associated with smart contracts, especially in recent days.

Dragos talked about Oracles and how they can be used to facilitate smart contracts and off-chain transactions. He stressed the importance of reliable Oracles and said that risk can be mitigated by using an Oracle that isn’t aware that it is an Oracle (an example would be a stock ticker) or by using multiple Oracles at once.

Muneeb Ali of Blockstack then took the stage. His talk was a little, strange. He went on about how there are no experts in our industry. He seemed to have an issue with the hackathon run yesterday and stressed the importance of sticking to our ideals.

According to Ali, the participants of the previous day’s hackathon created products that would work in a private database, not a blockchain. He then went on to talk about distributed database solutions that have been developed outside of the crypto community and how we should consider those innovations for our scaling solutions.

It was a rather jarring speech, but one that did bring a unique perspective.

Finally, it was Eli Ben-Sasson of StarkWave’s turn. He talked about STARK, SNARK (currently used by ZCash) and Bulletproof protocols. He mentioned that all three have zero-knowledge protection, meaning that any of them can obscure a single or group of transactions.

The primary innovation in terms of scaling is that in normal blockchain verification, every transaction needs to be verified by every participant. This obviously slows down transaction times and makes the blockchain unwieldy. But by trusting the Protocol, the time to make a transaction using SNARK or STARK is lessened greatly and the verification time goes up. But because the protocol is trusted, merchants don’t have to wait all that time.

STARK is an improvement over SNARK because it lessens both the time it takes to make a transaction and the time to verify it. Eventually, they hope to get the verification time lower than traditional blockchain verification. He also claimed that STARK will be resistant to quantum computing, something the other methods can’t claim.

He then finished the speech by stressing that the company is not running an ICO.

Missing from all these speeches, was the idea of increasing the block size to infinity, much to Roger Ver’s chagrin.