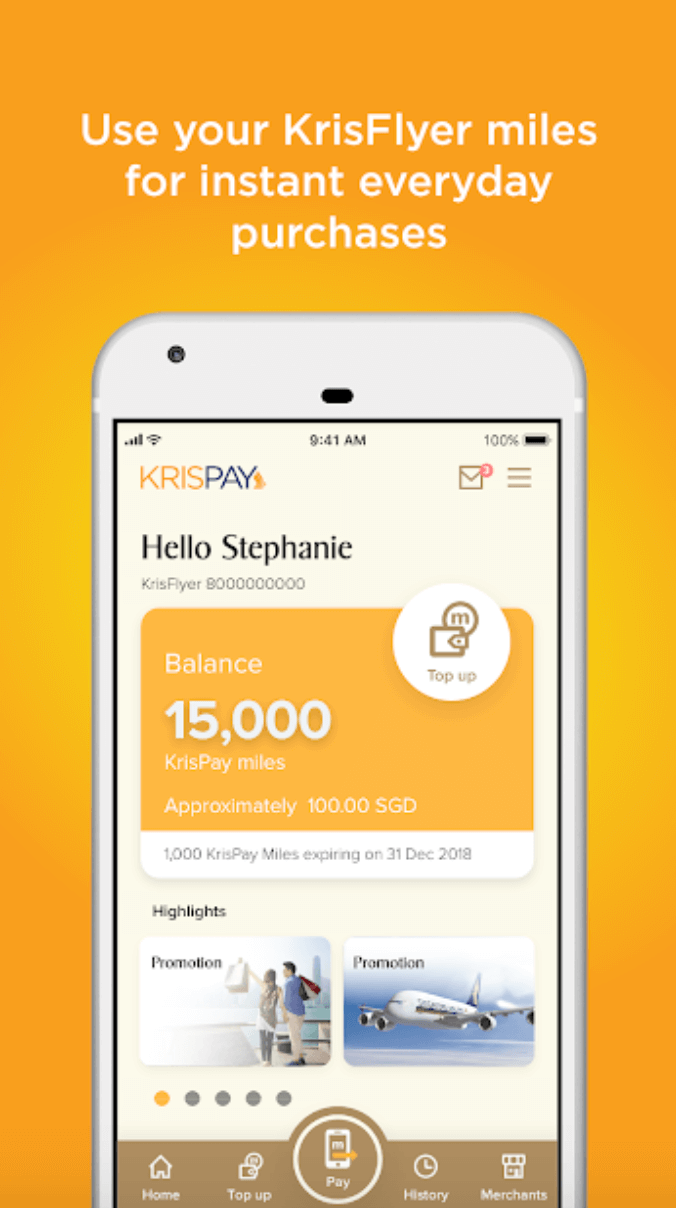

The KrisPay blockchain-based digital wallet was officially launched by Singapore Airlines on Tuesday. The firm claims KrisPay is the world’s first blockchain-based airline loyalty digital wallet.

KrisPay is now available for download on the Apple and Google Play Store. Once downloaded and installed, the app allows members to convert their KrisFlyer miles into KrisPay miles for instant purchases at partner merchants in Singapore right from their smartphone.

Commenting on the launch, Singapore Airlines’ CEO Goh Choon Phong, said:

“We are excited to be introducing KrisPay, a novel way for our KrisFlyer members to digitally access their miles at their fingertips, at any time. By creating a miles-based digital wallet which integrates the use of miles into their daily lives, KrisFlyer members have yet another way to use miles instantly on everyday transactions.”

KrisPay miles will initially be accepted at 18 merchants spanning different categories of beauty services, food and beverage, petrol and retail. Selected partners will offer discounts during the launch period. More merchants will be progressively added to the platform, and members can expect frequent in-app promotions and more app features to be delivered in the coming months.

KrisPay was developed in collaboration with KPMG Digital and Microsoft and runs on a private blockchain. The launch follows a successful proof-of-concept, which, according to KPMG, involved testing the blockchain platform and doing trial runs with merchants.

Singapore is a leading fintech hub in Asia, home to more than 400 fintech startups, and blockchain technology is one particular area in which the nation strives to become a pioneer.

The Monetary Authority of Singapore (MAS), the city-state’s central bank and financial regulator, has been experimenting with blockchain technology in numerous projects such as Project Ubin, an initiative aimed at using blockchain for cross-border payments, and the Global Trade Connectivity Network (GTCN), a cross-border infrastructure for trade finance developed in collaboration with the Hong Kong Monetary Authority.

During the Money20/20 conference in March, Ravi Menon, managing director of MAS, told the audience:

“One of the potentially strongest use cases of crypto tokens is to facilitate cross-border payments in traditional currencies.

“This is the challenge that Singapore’s Project Ubin has set itself to solve: to use blockchain technology to enable entities across jurisdictions to make payments to one another without intermediaries, with greater speed and efficiency, and at lower risk and cost.

“Following two successful proofs-of-concept domestically, MAS has entered a collaboration with the Bank of Canada to test and develop a cross-border solution using crypto tokens issued by the two central banks.”

Earlier this month, Singapore government-owned deep technology development firm SGInnovate made a strategic investment into MediLOT Technologies, a blockchain and healthcare analytics startup. MediLOT Technologies has developed a decentralized health data protocol connecting patients with health organizations including pharmaceuticals, insurers and government.