Singapore-headquartered startup Uppsala Foundation has raised US$8 million in its initial coin offering (ICO) for the development of its fraud prevention blockchain, Sentinel Protocol. The public token sale reached its sales target under four minutes, the company said.

Sentinel Protocol is a blockchain-based threat intelligence platform that aims to defend users against hacks, scams, and fraud using crowdsourced threat data collected by security experts and artificial intelligence.

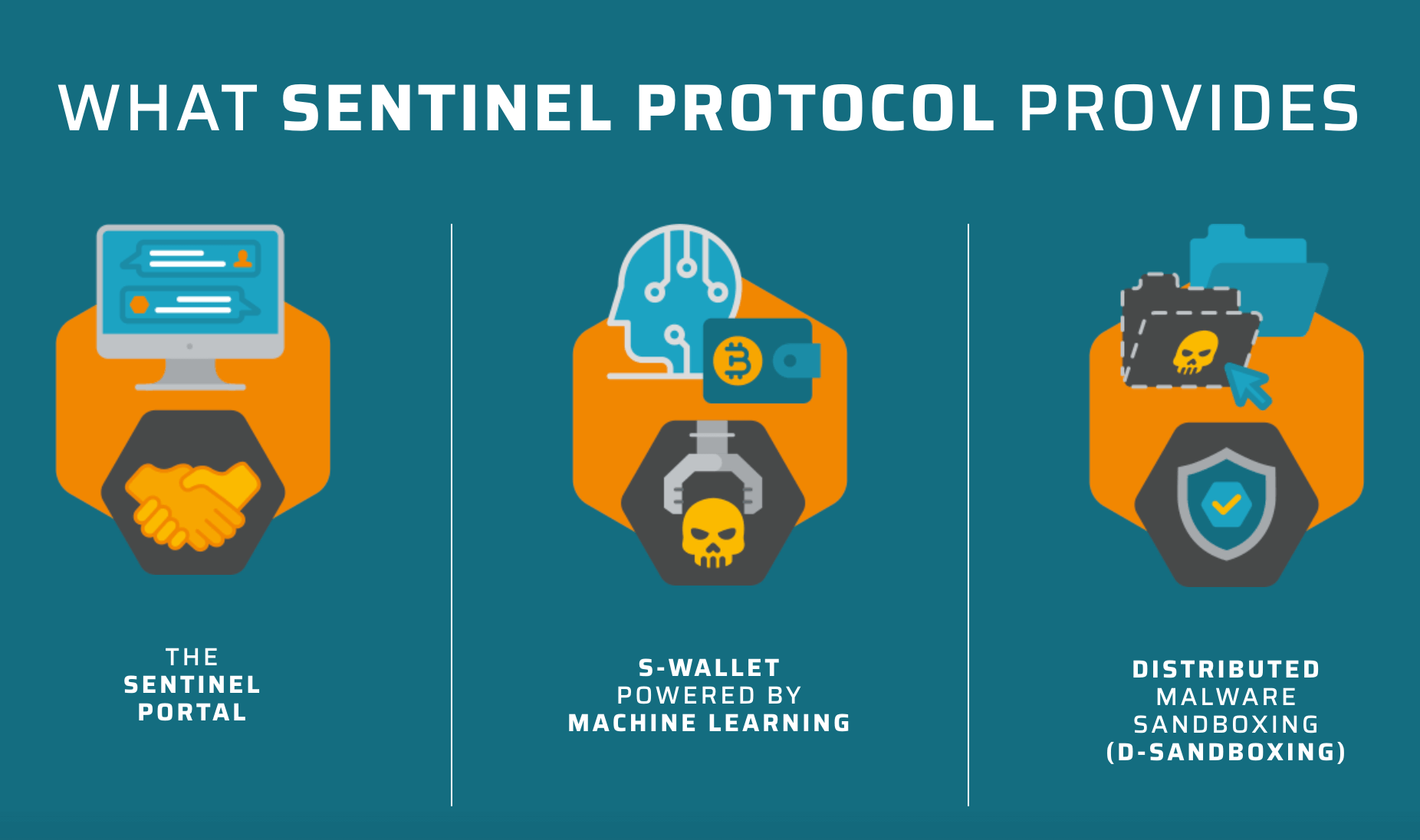

The platform collects and analyzes real-time hacks, scams, and fraud information, which it then makes available to crypto exchanges, wallets and payment services through the decentralized Threat Reputation Database (TRDB) as a free API.

Uppsala Foundation aims to create an ecosystem that discourages malicious behavior by preventing the use of stolen cryptocurrencies while incentivizing security professionals who are rewarded for their contributions. Individuals or organizations will also be able to report hacking incidents on the Sentinel Portal.

Sentinel Protocol is targeting the ever-growing number of hacks and frauds in the cryptocurrency industry. In the first three months of 2018 alone, investors had lost no less than US$670 million of cryptocurrencies in hacks and scams, according to Crypto Aware.

Notable heists since the start of the year include the US$530 million hack of Japanese cryptocurrency exchange Coincheck in January, the US$170 million hack of cryptocurrency exchange BitGrail in February, and Vietnam’s US$660 million exit scam in April.

“Cryptocurrency is receiving more and more validation as a means of value transfer, with top coins reaching historically high prices toward the end of last year — this attracted a lot of new, unseasoned investors who are not well-versed in terms of online security and who are identified as easy targets by scammers,” Anna Wu, the founder of Crypto Aware, told Business Insider.

“Cryptocurrency frauds, scams, and hacks tend to rise every time there is considerable upward momentum in pricing for cryptocurrency market, so be extra cautious when the market is bullish,” she warned.

“Phishing scams are by far the most popular type of scams, and you can easily avoid them by checking the website address against the officially published URLs character by character.

“If it seems too good to be true, it is. Investment scams often try to entice gullible investors with unrealistic returns. Don’t be greedy.”