The Liquidity Card claimed that it was a Mastercard that could be used to transact with stablecoins

Two South African firms have been issued emergency cease and desist orders by the Texas State Securities Board (TSSB) and the Alabama Securities Commission (ASC) over a cryptocurrency credit card scheme that sought to defraud investors in the two states.

The orders have been directed to the CEO of Liquid Gold Trust, Lance Angus Jerrard, and the following companies: Liquid Gold Trust, Liquidity Card Solution and Liquidity Global Card Solution.

The order explains that the defendants promoted the Liquidity Card, claiming that it could be used to transact with stablecoins such as the USD Coin (USDC), The Trueusd Coin (TUSD) and the PAX Coin (PAX).

The accused also claimed that the Liquidity Card was a Mastercard, that functioned in a similar way to traditional debit cards.

“Cardholders can use the Liquidity Card to receive and spend profits as stablecoins, avoiding taxes that would otherwise be recognized when converting cryptocurrencies to dollars or other fiat currency,” the companies added.

However, the Texas Securities Board explained that the system can only work if the Liquidity companies are able to recruit new cardholders, since they need the funding to continue with their recruitment.

The order elaborates that the Liquidity Card was due to launch in October of this year and the company planned on drawing in eight million cardholders over the next three years.

In addition, part of the company’s plans to fund the marketing campaign involves Liquidity selling out 8,400 “portions” in their global project partnership.

“Each portion costs $1,150 and entitles purchasers to residual income derived from fees paid by cardholders,” they claimed.

The defendants also perpetuated the claim that their investors will be receiving $1,516.72 for every portion on a monthly basis, with the payout increasing to $5,008.62 after 24 months.

The profits are also, allegedly, ‘guaranteed’.

The order points out that the companies have not provided any information that can demonstrate their capacity to repay investors such large sums all at once.

“The Liquidity companies are accused of concealing important information about their relationships, their contracts and their compensation.” the announcement from the Texas Securities Board reads.

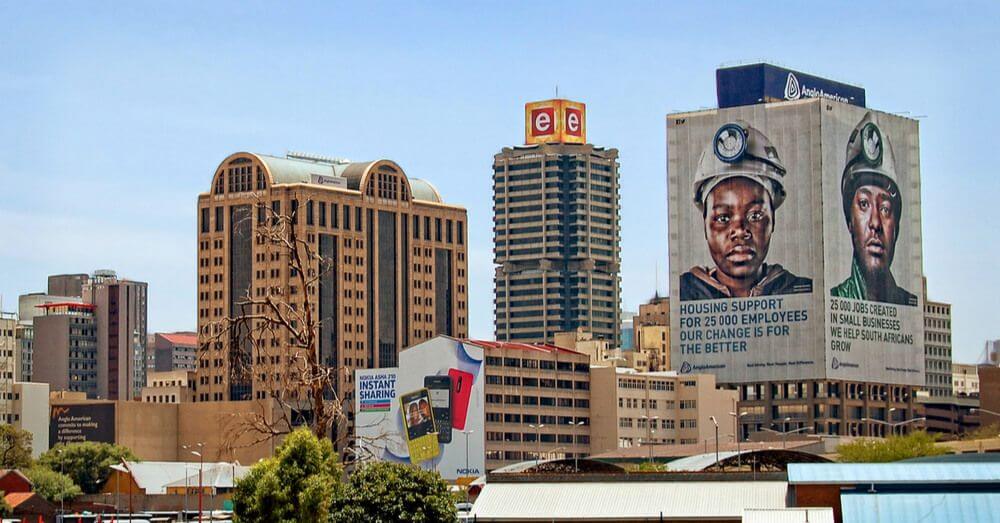

The Board has also pointed out that the companies have been using stock photos in lieu of actual pictures of their offices.

The accused have also not registered with either Texas or Alabama to sell their securities and investments.

The defendants have been given 30 days to challenge the entry of the order.