South Korean company BxB Inc. has announced the launch of KRWb, the world’s first 1:1 Korean won-backed stablecoin aimed at providing greater liquidity to cryptocurrency exchanges and global accessibility of value transfers into and out of South Korea.

KRWb is a token issued against a safe deposit denominated in Korean won. KRWb tokens can be stored and exchanged using Ethereum’s ERC20 protocol, with all transaction information and details recorded on the blockchain.

BxB deployed the smart contract and soft-launched the ERC20 token on Airswap earlier this month. The full launch on Tuesday came with the announcement of an initial capital deposit of KRW 400 million as collateral to the equivalent volume of newly minted KRWb tokens.

“We’re excited to announce and bring to the global community the world’s first provably collateralized Korean Won backed stablecoin,” said Hwan Kim, CEO and co-founder of BxB Inc.

“We hope that over time we can grow beyond just a cryptocurrency into a new fiat-to-crypto solution that improves the way we do business in and out of Korea.”

South Korea is one of the world’s largest market for cryptocurrency trading with KRW-based trading accounting for 30% of global volume.

But moving fiat KRW into and out of Korea is difficult and expensive due to strict regulations governing capital flow. Until now investors and businesses faced large foreign exchange risk dealing with Korea. KRWb was created as a fully compliant, technology-driven solution to mitigate this risk.

Furthermore, KRWb is one of the first non-USD backed stablecoins, offering investors and businesses more options and opportunities.

According to JJ Peterson, co-founder of BxB Inc., a KRW-backed stablecoin serves two primary use cases: give Korean traders the ability to denominate in KRW while still participating in the global crypto markets, and provide global investors with access to the Korean crypto-economy without the need for an onshore entity or bank account.

“For local Koreans, it gives them an opportunity to denominate in a KRW derivative in the crypto-economy. This reduces their foreign exchange exposure and simplifies prices,” said Peterson.

“For example, a Korean trader using USDT as their base trading currency might have made more USDT on their investment, but could effectively lose money on the exchange between the USD and KRW, based on fluctuations in price between those two national currencies.

“For the global market, KRWb is a KRW derivative that can be held offshore. This is a huge benefit for entities with South Korean interests, because it is extremely difficult and/or costly to do so with fiat KRW, given the current regulatory landscape.”

QCP Capital, a crypto-asset trading firm based in Singapore, has been selected as the first “issuance partner,” ensuring market liquidity of KRWb tokens. KRWb tokens are not publicly offered but instead issued exclusively based on direct contracts between BxB and selected partners. Issuance partners play a significant role in distributing KRWb tokens into the market via cryptocurrency exchanges, OTC trading and other means, acting as market makers by supplying and redeeming KRWb to and from the market.

“Korea has always been a strategic but challenging market for us,” said Darius Sit, managing partner at QCP Capital.

“KRWb is a great solution to many of the problems faced by market participants both onshore and offshore. Beyond crypto liquidity, we are excited to be part of a project that is pioneering new ‘fiat-to-crypto’ solutions in Asia.”

Additional issuance partners will be announced in the near future, BxB said.

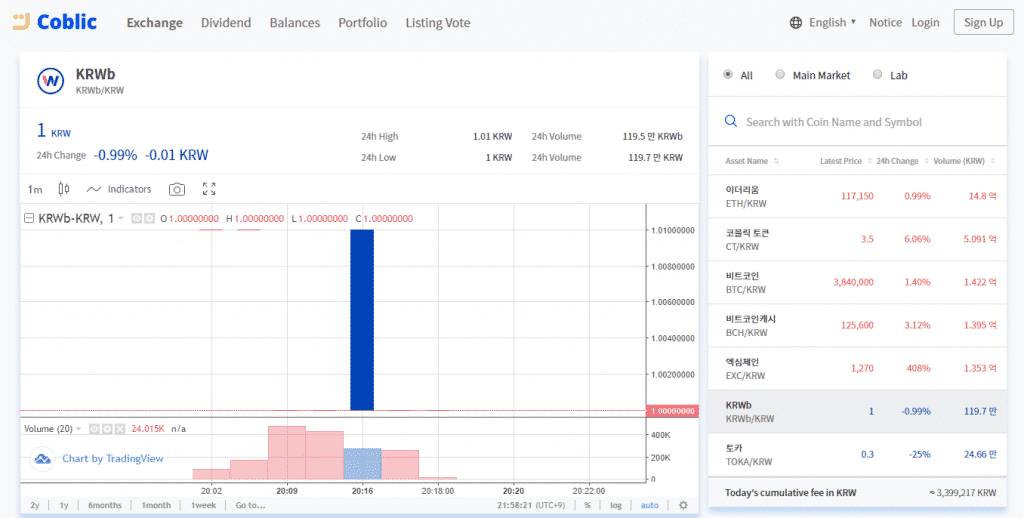

Cryptocurrency trading platforms Coblic, from South Korea, and BeQuant, from the UK, began offering KRWb on Wednesday with additional exchange listings expected over the course of Q1 2019.

In the long-term, Peterson said the company wants to create and introduce multiple business lines and tools for people to leverage KRWb as a Korean Won derivative for things like payments, lending, margin trading, foreign exchange hedging, options, and more.