After a very strange year for the markets, cryptocurrencies endured a pandemic after just leaving a long bear market and have gone from strength to strength

As we see every year, there are always huge winners in the crypto space with eye-watering four-figure percentage increases.

We’re going to start by looking at Bitcoin before moving onto some unknown projects that set off for the moon this year.

Bitcoin

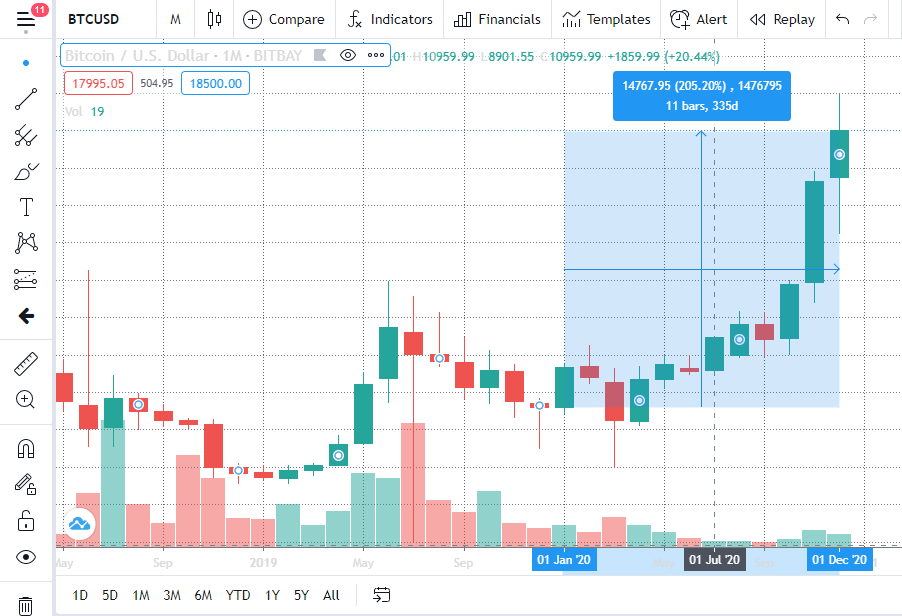

In January 2020, Bitcoin was priced at around $7,000. The halving was coming up in May and things were generally optimistic in the market.

Then March came and lockdowns started taking place across the world because of a deadly new disease. In hindsight, most would agree that the sell offs seen across financial markets were an overreaction, but at the time, there was a great deal of uncertainty on how Covid-19 would spread and what impact it would have.

There was some speculation that Bitcoin’s selloff had actually been caused by miners who were trying to cash in before their rewards were halved in May. The evidence? Most of the Bitcoin sold off was newly minted Bitcoin.

At the time of writing, Bitcoin is priced at $23,200 — a 205% increase in price since the beginning of the year and a new all time high, looking to discover new highs in 2021.

BTC USD Month Timeframe: TradingView

Altcoins

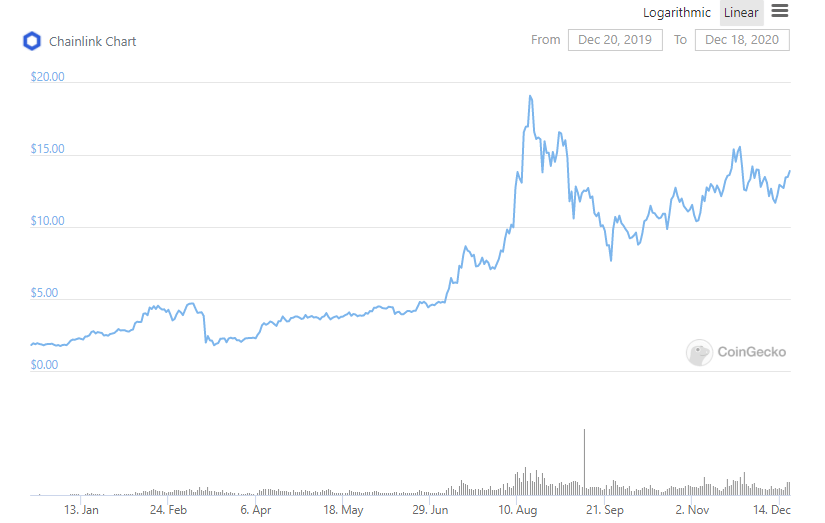

Chainlink (LINK) has also had a great year, going from $1.76 at the start of the year to now reach $13.89, representing a 629% increase in price. Chainlink is a fascinating complement to the Ethereum blockchain as it is able to take real world data and apply it to smart contracts. If smart contracts are to become more widely used in the future (a distinct possibility in the increasingly remote world) then this project could still be severely undervalued and make more serious gains in 2021.

Chainlink performance from December 2019 to December 2020: Coingecko

A few outliers also managed to make huge gains this year, with Gamestars (GST) gaining a mammoth 68,999%. To put this in perspective, a $100 dollar investment in January in GST would now be worth $69,000. Other token yearly increases included zap (ZAP 6,374%), auctus (AUC 5,489%), aave (AAVE 5,121%), and starchain (STC 3,674%).

Having the strength to hodl

Compared to the last couple of years, the crypto market is now looking like it will enter a bull phase. Having shaken out a lot of people, the bear market over 2018 was a consolidation phase for large scale investors who used the period of fear and uncertainty to accumulate as much crypto as possible before the next bull phase.

Buying up crypto at cheap prices is not a unique strategy to the crypto markets. The stock and forex markets also have long market cycles in which the steadiest hands make the best returns.

Of course choosing the right asset to invest in and hold is also important, as well as knowing when to quit and when to take profits in the green.

Maybe you’re thinking about how the crypto market will look in December 2021 — one thing is for certain; there will be gainers and there will be losers, so how do you make sure you hold onto one of the winners? Spread your bets. As can be seen in some of the above examples of gainers from this year, a small investment in a project that has a four-figure percentage increase can give returns of tens of thousands of dollars.

Let’s say you have $500 to invest in January 2021 that you don’t mind losing. You could just buy Bitcoin with this and see where you are in a years’ time, however spreading this money to say, 10 different projects for $50 each could potentially earn an investor a much greater return if one of those projects ends up making a list like the above this time next year.