To learn more about the future of the cryptocurrency industry heading into 2021, we spoke with Konstantin Anissimov, Executive Director at the CEX.IO exchange

Who is Konstantin Anissmov?

Konstantin Anissimov is the Executive Director at the international CEX.IO exchange. He first gained experience in the world of blockchain in 2017-2018 as part of a startup that built a physical gold provenance platform using the Ethereum blockchain, and continued to involve himself in projects in the crypto field.Konstantin has extensive experience working with various markets across the world, including the UK, EU countries, China, South East Asia, South Africa. As well as a strong technical background in web development and working with the Ethereum blockchain.

Konstantin Anissimov is the Executive Director at the international CEX.IO exchange. He first gained experience in the world of blockchain in 2017-2018 as part of a startup that built a physical gold provenance platform using the Ethereum blockchain, and continued to involve himself in projects in the crypto field.Konstantin has extensive experience working with various markets across the world, including the UK, EU countries, China, South East Asia, South Africa. As well as a strong technical background in web development and working with the Ethereum blockchain.

What is CEX.IO?

CEX.IO was recently ranked in the top three exchanges for security by CryptoCompare: how do you balance providing a platform that is both secure and easily accessible for traders?

Konstantin Anissimov: We have been in the space of cryptocurrencies since 2013, and we are one of the longest-running cryptocurrency exchanges in the world. A couple of the things that we’ve been doing since 2013 is building our portfolio of intellectual property and gaining know-how in the business.

In 2013 you couldn’t just go to external suppliers and pick and choose components to build your exchange. A lot of the technology we needed for development was made in-house through strong innovation, research and expertise. This is one of the reasons why being in the industry for a long time allows us to have a very strong competitive advantage over newcomers.

We have learnt to not rely on external services — instead we use a strong core team who develop our trading platform, manage our cybersecurity, and facilitate API connections for professional traders. Collectively, all of these assets and values within the company allow us to keep providing a platform that is outstanding.

What’s at stake?

Why did CEX.IO choose to launch a staking service?

The most attractive factor about staking is the ability to earn money by simply holding coins. It is only logical that crypto exchanges, like CEX.IO, began to provide staking services to customers. We do act as custodians of coins for our users, after all.

Staking is an important element of the current development stage in the blockchain market. It involves participating in blockchain governance with a Proof of Stake (PoS) consensus.

The staked coins are delegated to a node, which takes part by confirming transactions and helping to run the decentralised network. In exchange for this, the owners of staked assets are rewarded with statoshis that are then issued by the blockchain.

For a CEX.IO user, the staking process is as simple as can be – we take care of all technical aspects so that the users do not need to figure out the details of how the process works. All they have to do is simply keep the coins in their accounts.

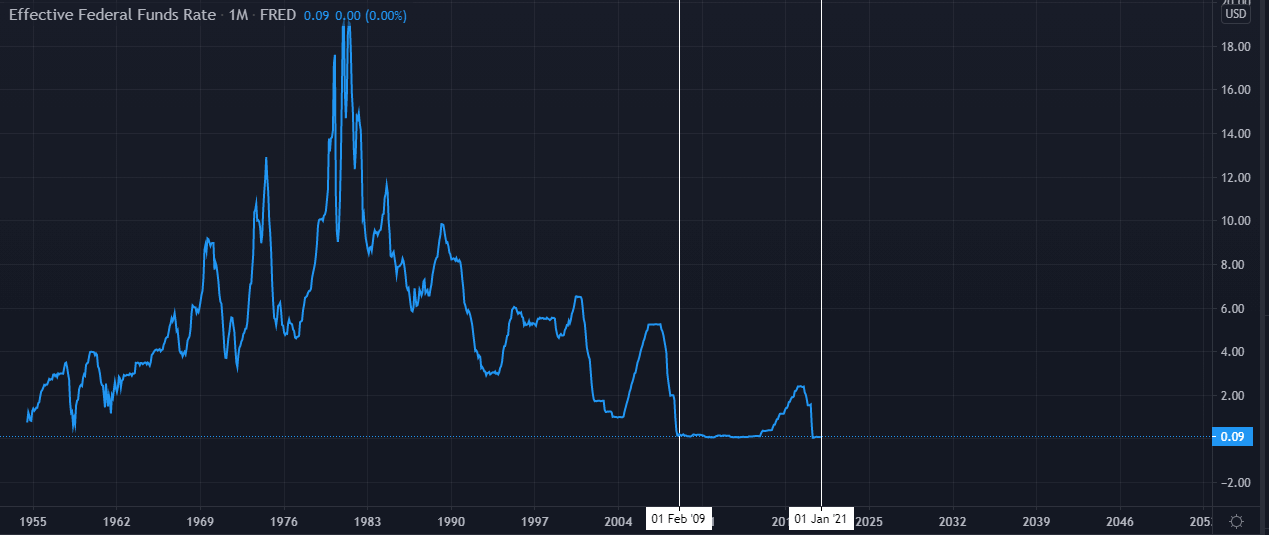

Monthly-chart for Effective Federal Funds Rate Source: TradingView

Monthly-chart for Effective Federal Funds Rate Source: TradingView

For the last 11 years, the Effective Federal Funds Rate (the rate at which banks charge each other interest for credit) has been set at zero almost consistently. This has impacted how consumers (and banks) have managed their capital since the banking crisis of 2008.

I think it is very important to understand that if you put your money into government-backed savings accounts, in a reputable bank, most EU countries offer a form of protection for your losses. In the UK, I believe it is £50,000. This guarantee from the government provides a bailout scheme in case the bank collapses into bankruptcy.

Everybody needs to understand that putting their money into alternative schemes – though it generates a greater rate of returns – also has greater potential risks compared to official government schemes.

In addition, more and more countries around the world apply taxation to capital gains from cryptocurrency trading, savings and other crypto activities. And I actually think that one of the things that will happen in 2021 is that more and more companies will start offering equivalents of ISA plans on cryptocurrencies, where your cryptocurrency investment will become part of the tax free investment plan.

Until then, I think, it would still be the realm of cryptocurrency enthusiasts and people who are willing to take additional risks. Though at CEX.IO we really made the process simple and achieved this in a regulated way by providing the staking service from our Gibraltar entity with a DLT license.

2020: The beginning of Crypto’s next stage?

In 2020 we observed a major spike in the interest towards cryptocurrencies. What factors contributed to this?

“My theory is that there is a lot of unrest around the world and a fair amount of volatility is still just around the corner”

“My theory is that there is a lot of unrest around the world and a fair amount of volatility is still just around the corner”

I think that the fast-paced growth of the crypto-field in 2020 can be attributed to several factors, but ultimately, most of them can be traced to the COVID-19 pandemic and the economic crisis that it brought upon the world.

That is when Bitcoin came into their line of sight. The funds of high-net-worth investors and major companies like MicroStrategy became the fuel for Bitcoin’s rapid growth. As the asset climbed higher, more people wanted to get a slice of the pie.

I believe that it is safe to say that what we are witnessing now is a permanent shift in the market. Cryptocurrencies are no longer a niche – they are becoming a full-scale investment class and we can expect this trend to continue in 2021.

Do you think more people will continue to invest in cryptocurrencies after the huge spike of interest this year?

I don’t see why not. I think that, with what has happened to the markets in March, both the traditional financial markets as well as the cryptocurrency markets dropped tremendously. But cryptos managed to recover quicker and stronger, sending a very reassuring signal. My theory is that there is a lot of unrest around the world and a fair amount of volatility is still just around the corner. I think that people will naturally be looking, where else they could store their value.

For example, if gold is volatile, and the US dollar is volatile, then you start looking for alternative assets to store your wealth in. Cryptocurrencies may become one of those interesting niche products that allows people to lock their value.

What plans does CEX.IO have for 2021?

For CEX.IO, 2020 has been a very important year, because this is the year when we applied for multiple cryptocurrency licenses around the world. We will see how this pans out, but in general we have a plan of becoming one of the very few cryptocurrency exchanges to have reputable regulations in the whole of the US, including New York, London, EU and Singapore, connecting the three continents together in one ecosystem. We believe that this regulatory basis coupled with the growth of the retail space will create a very unique ecosystem for the institutional and retail investors and allow us to grow exponentially.

In 2020, we began an expansion into Asia by applying for a licence to operate in Singapore, and this is just the beginning of our plans in the continent. We understand that Asia is probably the largest crypto market in the world, surpassing the US and Europe. We are not yet strongly present in that region and we understand the strategic importance of CEX.IO having a solid there. The Singapore office will not just be a placeholder office – we believe that it will become a centre for the expansion into the South-East Asian countries.

Our strategy is to keep on developing a regulated footprint of our ecosystem across the world.

2020’s DeFi boom: What next?

How is CEX.IO getting involved in the recent DeFi boom?

“By listing those tokens very quickly, we gave our users an opportunity to participate in the hype without having to get involved with the technicalities of the DeFi ecosystem.”

“By listing those tokens very quickly, we gave our users an opportunity to participate in the hype without having to get involved with the technicalities of the DeFi ecosystem.”

We have been following this topic very closely, even before it became a well-spread phenomena. One of the things we’ve been doing is actively investing small amounts of our own funds into various Dei tink Fi projects to test out the trustworthiness and stability of those products. There are a plethora of new projects and concepts that came out of that boom. It was very important for us to stay in touch with the new developments. As a centralised exchange, we need to understand what opportunities may exist in this new marketplace.

With DeFi, we’ve realized rather quickly that we needed to list DeFi tokens on our exchange for several reasons. The top one is that, as DeFi became more hyped, more people wanted to hold DeFi tokens (like UNI, for example). However, unless you were a cryptocurrency enthusiast, it was very hard to actually obtain these tokens without getting into the DeFi community and understanding all the instruments, places to purchase, etc. By listing those tokens very quickly, we gave our users an opportunity to participate in the hype without having to get involved with the technicalities of the DeFi ecosystem.

In addition to this we have some exciting further projects along the line, full information on which I cannot disclose, but what I will say is that we plan to integrate with DeFi even stronger and offer new services and features to our users.

Do you have plans to add more coins to the platform in the near future? If so, which are the likely candidates?

Our team is continuously working on expanding the number of coins available for our clients. Just at the beginning of November we have added 12 new DeFi tokens – since we noticed a growing interest towards them among our customers.

We carefully consider the ones that can be profitable and interesting to our users, both in terms of straightforward trading, as well as for staking. We are also very careful that anything we list aligns with our listing policies and has been carefully vetted to protect our users.

Regulation, regulation, regulation

In your experience, have financial regulators become more hospitable to the cryptocurrency sector in the last couple of years, as suggested by the news?

I think the main factor is that regulations are now better defined, which has allowed regulators to become more hospitable to crypto companies. In many jurisdictions, regulators now have a clearer understanding of where cryptocurrencies and crypto assets sit, and how businesses that process cryptocurrencies are dealt with. This has made it possible to acquire licences in the cryptocurrency space to show their adherence to the law.

I think, in addition to this, initiatives like MiCA regulation in the EU will only further standardise this field. I wouldn’t say that it will make it easier for companies to get regulation to operate in the space – in many ways it will probably be tougher due to a regulatory overshoot for new and innovative firms.

On the flip side — once a licence is obtained, the regulatory clarity will allow for better relationship building and partnerships with banks and other financial ecosystem players. This will further reduce friction and help make cryptocurrencies a much wider-spread investment class.

Do you think there needs to be more or less regulation in the crypto space?

Personally, I think that among the priority issues that need to be resolved are matters of passporting and the travel rules in the eurozone. It appears that many regulators expect cryptocurrency exchanges to adhere to the latter without providing common requirements. The requirements for applying for relevant licences and registrations in every separate country of the EU has a way of complicating and slowing down work for many crypto-related companies.

Another notable problem is how cryptocurrencies are categorised. This factor influences how crypto transactions are taxed. Since different countries consider cryptocurrencies differently — as property, goods, commodities, etc. — there is a need to work through a lot of inconsistencies on this front.