While Bitcoin (BTC) has remained as one of the largest cryptocurrency tokens in terms of market capitalization, it is not the only coin within the crypto industry, and for investors that want to diversify their portfolio, knowing which altcoins provide them with solid opportunities plays an essential role in their overall decision-making process.

This is due to the fact that many altcoins historically have showcased the huge potential for growth, and as such, play a major role in shaping the overall cryptocurrency market.

However, with a vast number of altcoins available, in fact, over 17,000 at the time of writing, it can be a challenge to decide which one to pick. As such, today, we will be going over the top 3 altcoins that are worth taking a look at throughout February of 2022.

What is an Altcoin?

The term altcoin is essentially a reference to any cryptocurrency token that is not Bitcoin, otherwise known as an alternative to Bitcoin. As of February 2022, there are over 17,000 altcoins currently available, and some of the main types of altcoins include mining-based cryptocurrencies, stablecoins, security tokens, and even utility tokens.

The word altcoin is a combination of two words, specifically, alternative and coin, and includes every single alternative to Bitcoin. This means even its toughest competitor, Ethereum, is also an altcoin.

The main reason why many of these altcoins were developed is to improve upon Bitcoin’s limitations as a means of establishing a competitive advantage and give investors a reason to invest in the coin rather than invest in Bitcoin or alongside Bitcoin.

There are newer altcoins out there that use Proof-of-Stake (PoS) as a means of minimizing the energy consumption as well as the time required to create blocks as well as validate new transactions.

Each altcoin attempts to solve an issue or take advantage of the blockchain to bring a higher level of utility and functionality to even the most basic tasks. There are altcoins created for just about anything, even as jokes or memes.

The three best Altcoins worth taking a look at in February of 2022

- Cardano (ADA)

- Curve DAO Token (CRV)

- Algorand (ALGO)

Cardano (ADA)

Cardano is a proof-of-stake (PoS) blockchain platform that has a reputation for being founded on peer-reviewed research and developed through evidence-based methods.

The primary use case for Cardano is to allow transactions in its native cryptocurrency ADA and to enable developers to essentially build secure as well as scalable applications that are powered through the utilization of its blockchain network.

The Cardano blockchain is split across two layers, known as the Cardano Settlement Layer (CLS), which is used to transfer ADA and record the transactions, and the Cardano Computation Layer (CCL), which contains the smart contract logic that developers use.

Any computer that decides to run the Cardano software can join as a part of three nodes, including mCore nodes, which stake ADA tokens and participate within the governance, Relay nodes which send data between mCore nodes and the internet, as well as Edge nodes which create cryptocurrency transactions.

Overall, Cardano (ADA) is a solid altcoin as well as a project which has showcased a high level of promise with its development as well as growth, making it a solid token to keep an eye on.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

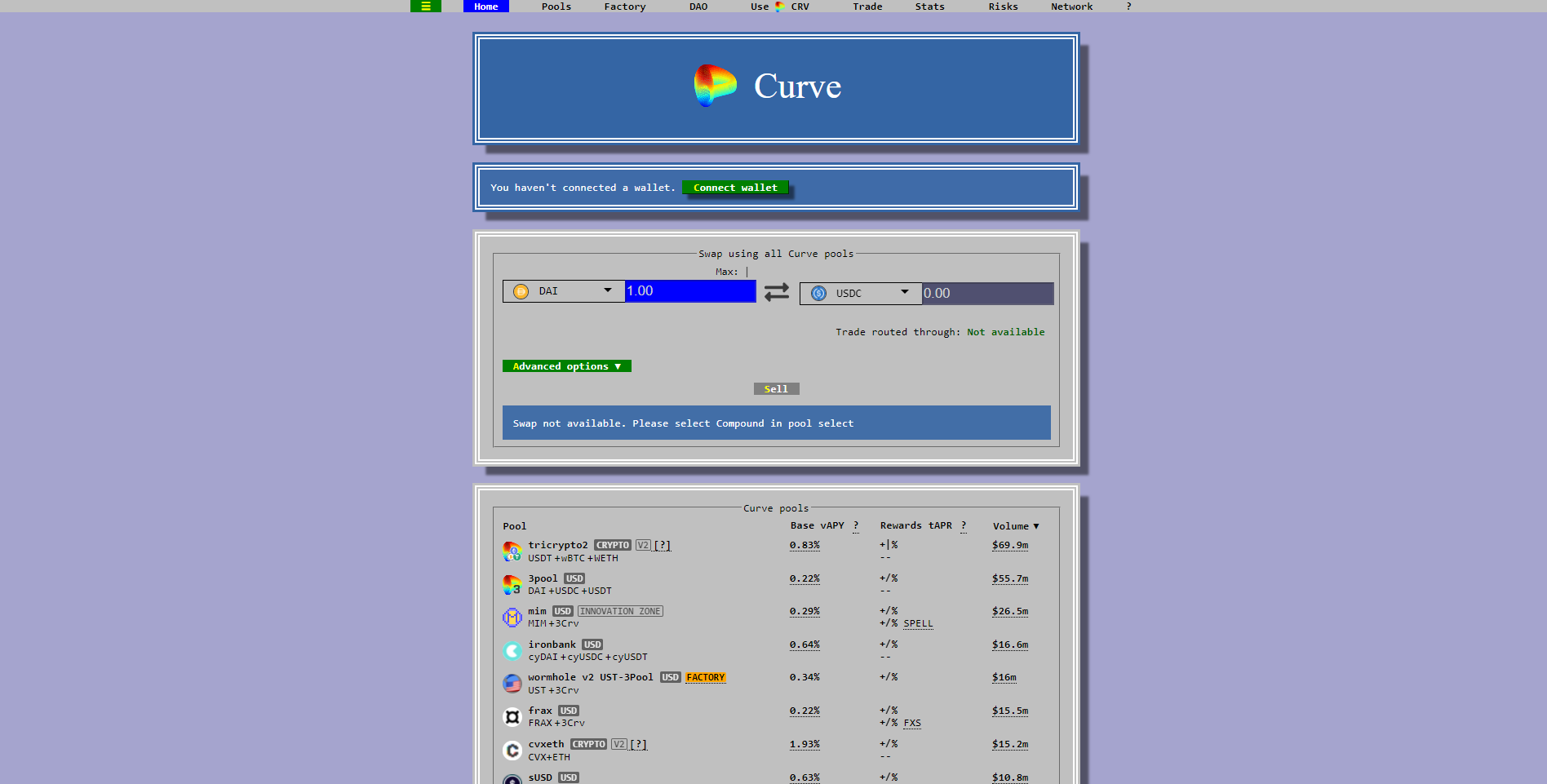

Curve DAO Token (CRV)

Curve (CRV) utilizes multiple cryptocurrencies as a means of operating an automated market-making service, specifically focused on stablecoins.

The Curve platform is governed by a mathematical feature specifically designed to let stablecoins trade at the best possible price; a feature called the bonding curve. These bonding curves are deployed by other DeFi cryptocurrencies, but Curve’s specifically focuses on stablecoins.

Curve requires a group of users to lock up cryptocurrencies so they can end up getting traded by others, and Curve keeps the coins in ratios to one another so that they become cheaper or more expensive as the amounts fluctuate.

As a means of incentivizing users to lock their coins, Curve offers them a return on their coins, alongside a proportion of the fees from trades.

CRV token holders can vote on proposals in regards to the development of the platform, and since stablecoins are heavily utilized within the crypto space, CRV is another altcoin worth taking a close look at.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Algorand (ALGO)

Algorand is a smart contract platform that aims to solve what is known as the blockchain trilemma, which includes scalability, decentralization, and security, and aims to help democratize finance.

It is a project that launched in June of 2019 and is a permissionless as well as open-source blockchain network where anyone can build.

It is designed to be a payments-focused network that offers rapid transactions and puts an emphasis on achieving near-instantaneous finality, which means that it can process over 1,000 transactions per second (TPS).

Algorand utilizes what is known as a Proof-of-Stake (PoS) consensus mechanism where it distributes validator rewards to all holders of its native ALGO cryptocurrency.

Overall, it is another solid project and its token, ALGO, is a worthwhile altcoin to take a look at in February.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Summary

At this point in time, hopefully, you have a heightened perspective of exactly what altcoins are and which ones are worth your attention in February of 2022.

Remember that not every single altcoin project out there is a worthwhile investment and that you need to do a bit of research of what the project behind the altcoin is trying to achieve so you can have a heightened perspective of its potential growth.

Each of the tokens listed here tries to solve real issues which cryptocurrency users have had to face historically, and this solution to an issue is what gives their tokens value long-term.