-

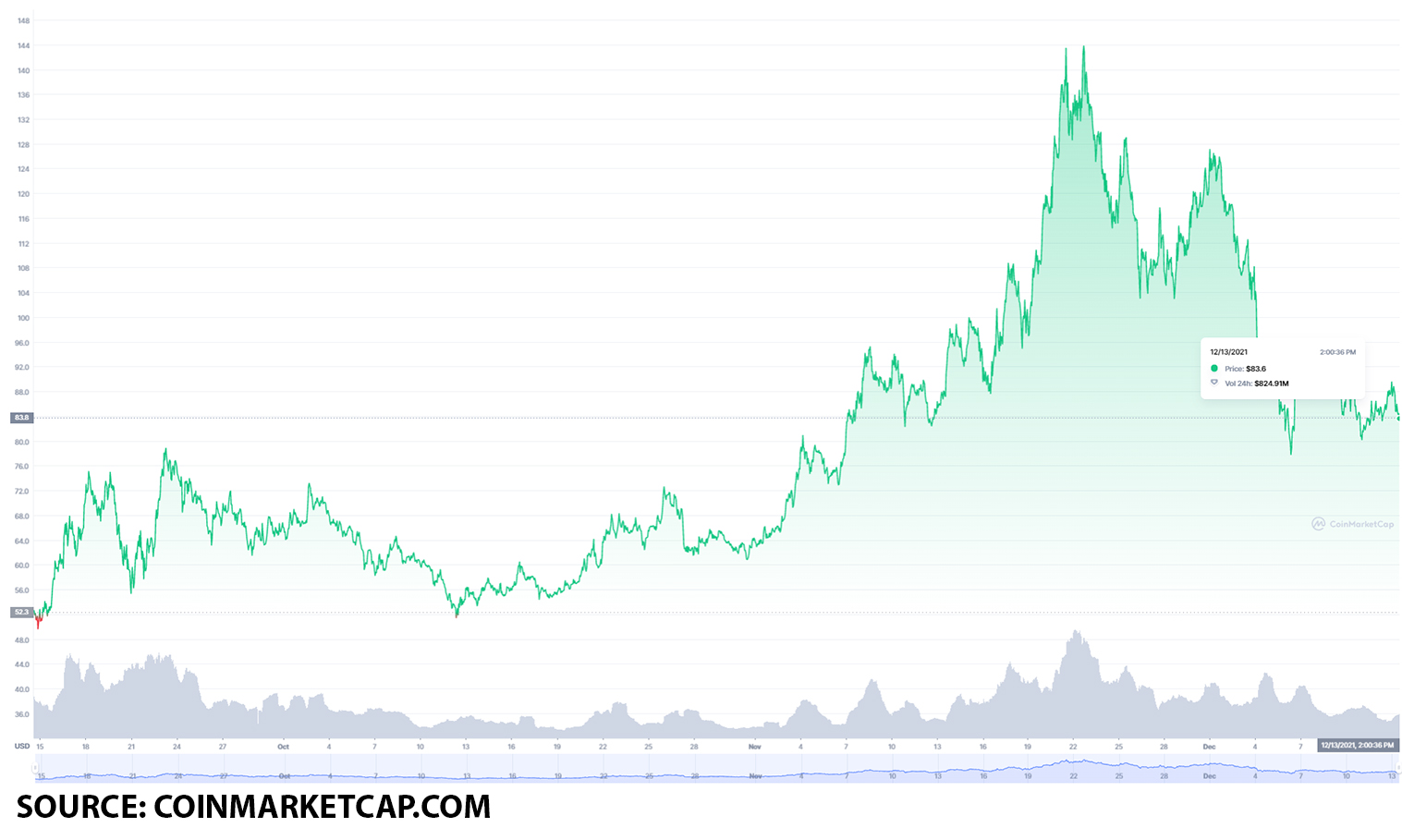

AVAX saw an increase in trading volume by 32% in the last 24 hours.

-

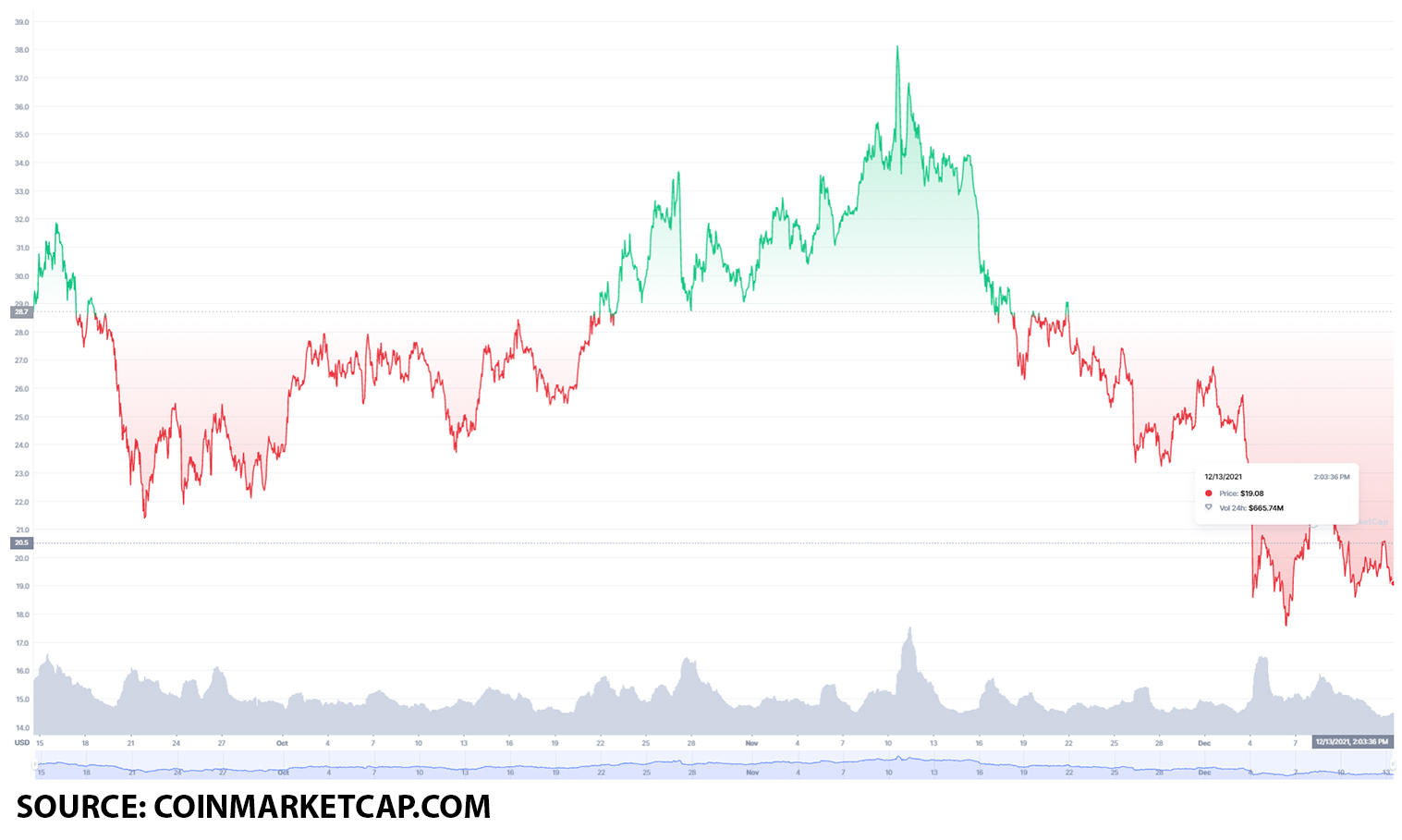

LINK saw an increase in trading volume by 8% in the last 24 hours.

-

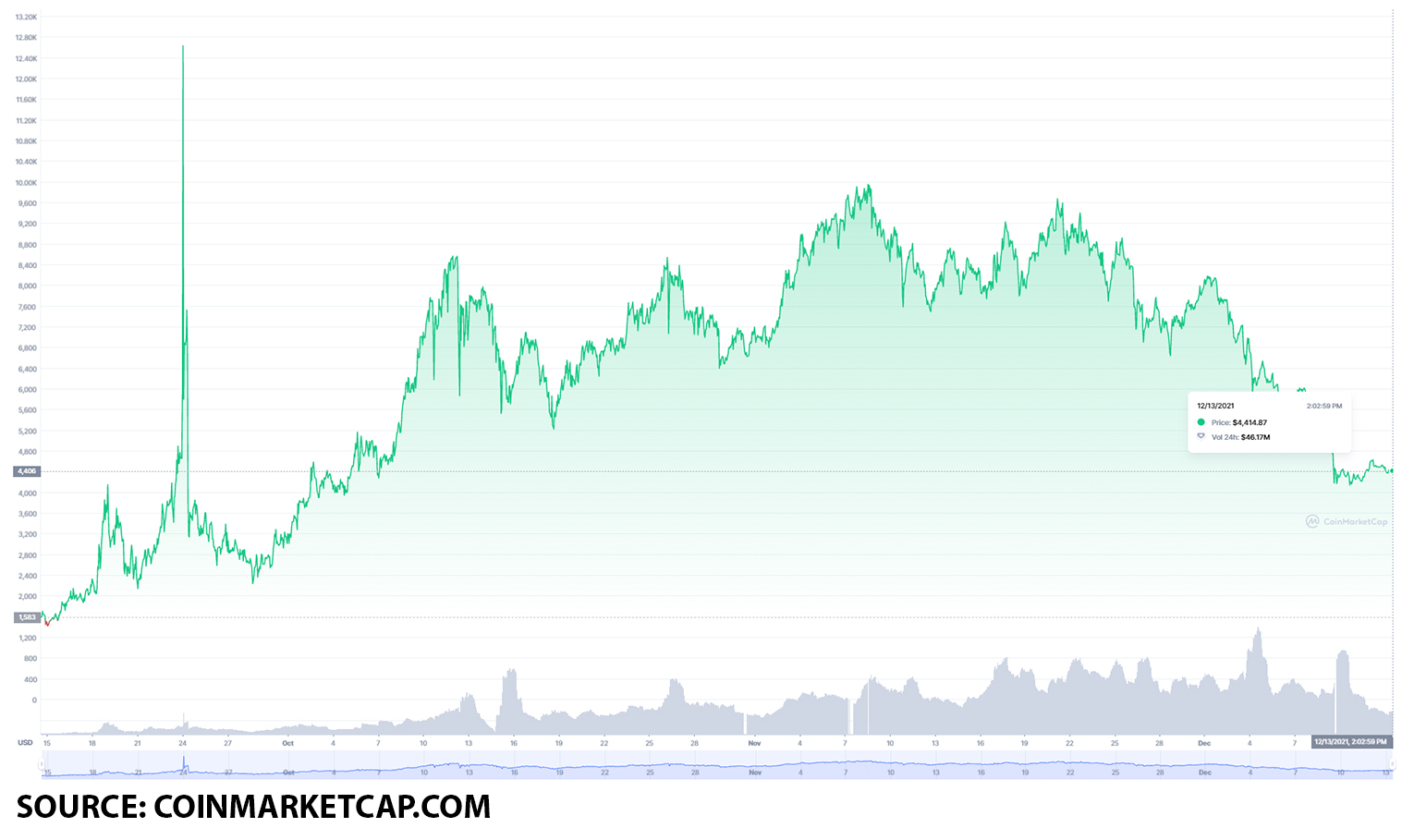

TIME has the potential for solid growth.

Avalanche is a layer-one blockchain designed to be a platform for decentralized applications and custom blockchain networks, where AVAX is its native token.

Chainlink integrated with Avalanche to supercharge decentralized finance (DeFi) development, where LINK is its native token.

Wonderland is the first decentralized reserve currency protocol available on the Avalanche Network, where TIME is its native token.

Should you buy Avalanche (AVAX)?

On December 13, Avalanche (AVAX) had a value of $83.6.

To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high value as well as its performance last month.

Its lowest point of value in November was on November 1, when the token fell to a value of $62.9.

AVAX had its all-time high value point on November 21, when the token reached $144.96 in value.

Here we can see that in November, the token increased in value by $82.06 or by 130%.

However, from November 21 to December 13, the token decreased in value by $61.36 or by 42%.

This marks a solid opportunity towards buying the AVAX token, as it has the potential to climb back up to $90 by the end of January 2022.

Should you buy Chainlink (LINK)?

On December 13, Chainlink (LINK) had a value of $19.08.

In order for us to get an indication as to what kind of value point this is for the token, we will go over its ATH value point as well as its performance in November.

The LINK token had its all-time high-value point on May 10, when it reached $52.70 in value. Here, we can see that at its ATH value point, the LINK token was $33.62 higher in value, or by 176%.

When we look at November’s performance of the LINK token, its highest point was on November 10, when the token reached a value point of $38.12.

Its lowest value point was on November 28, when the token fell to a value of $23.23. This gives us an indication that the token decreased in value by $14.89 or by 39%.

However, at its price point of $19.08, the token is at a solid buying opportunity.

If LINK breaks the $24 barrier, it has the potential to climb to $30 by the end of January 2022. However, if it falls under the $18 price point, then it might be worth reconsidering.

Should you buy Wonderland (TIME)?

On December 13, Wonderland (TIME) had a value of $4,414.87.

To see what this value point means for the TIME token, we will go over the performance of the token in November, as well as its all-time high-value point.

The TIME token had its all-time high value on November 7, when the token reached a value of $10,063.72. Here, we can see that at its ATH value point, when compared to the value on December 13, the token was $5,648.85 higher in value, or by 127%.

When we go over the performance in November, the token’s lowest point was on November 2, when it had a value of $6,796.32.

Its highest value point was on November 8, when the TIME token reached a value of $9,948.15. Here, we can see that throughout November, the token increased in value by $3,151.83 or by 46%.

However, from November 8 to December 13, the token has decreased in value by 55% or by $5,533.28, making it a solid time to jump in and buy the TIME token.

This is due to the fact that the token has the potential to increase in value to $6,500 by the end of January 2022, making it a solid buy.