-

LUNA saw an increase in value in the last 24 hours by 8%.

-

UNI and AAVE have the potential to increase in value.

-

Each of these tokens plays a key component within the world of decentralized finance.

Terra is a blockchain protocol that uses fiat-pegged stablecoins to power a price-stable global payments system, where LUNA is used for staking and absorbing the volatility of the Terra stablecoins.

Uniswap is an Ethereum-powered decentralized exchange, where UNI is the native token.

Aave is a decentralized, non-custodial money market protocol where users can both distribute and borrow, which is powered by the AAVE token.

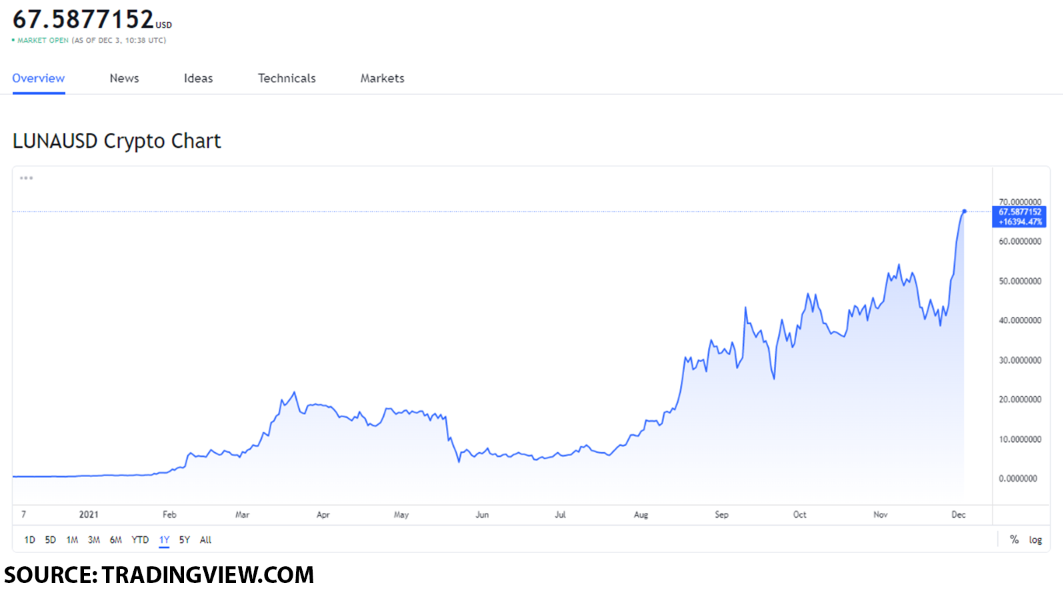

Should you buy Terra (LUNA)?

On December 3, Terra (LUNA) had a value of $67.58.

To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high value as well as its performance last month.

The ATH value of LUNA was on December 3, four hours prior to the creation of this analysis, where the token reached a value of $69.56. Here, we can see that the token only fell in value by $1.98 throughout that time span.

In terms of the performance in November, on November 24, the token had its lowest value point at $37.99.

Its highest point of value was achieved on November 30, when the token reached a value of $58.81.

This gives us an indication that LUNA grew in value by $20.82 or by 54%.

With this in mind, we can expect LUNA to reach a new ATH value point of $72 by the end of December, making it a solid buy.

Should you buy Uniswap (UNI)?

On December 3, Uniswap (UNI) had a value of $21.81.

With the goal of establishing what kind of value point this is for the token, we will go over its all-time high value as well as its performance in November.

UNI’s all-time high value was on May 3, when the token reached $44.92 in value. At its ATH value point, when compared to the value on December 3, the UNI token was $23.11 higher in value or by 105%.

In terms of November’s performance, on November 10, the token had its highest point of value at $28.4.

Its lowest point was on November 28, when the token fell to a value of $18.82.

Here, we can see that the token fell in value by $9.58 or by 33%.

However, from November 28 to December 3, we can also see that the token increased in value by $2.99 or by 15%.

With this in mind, UNI can reach $25 by the end of December, making it a solid purchase.

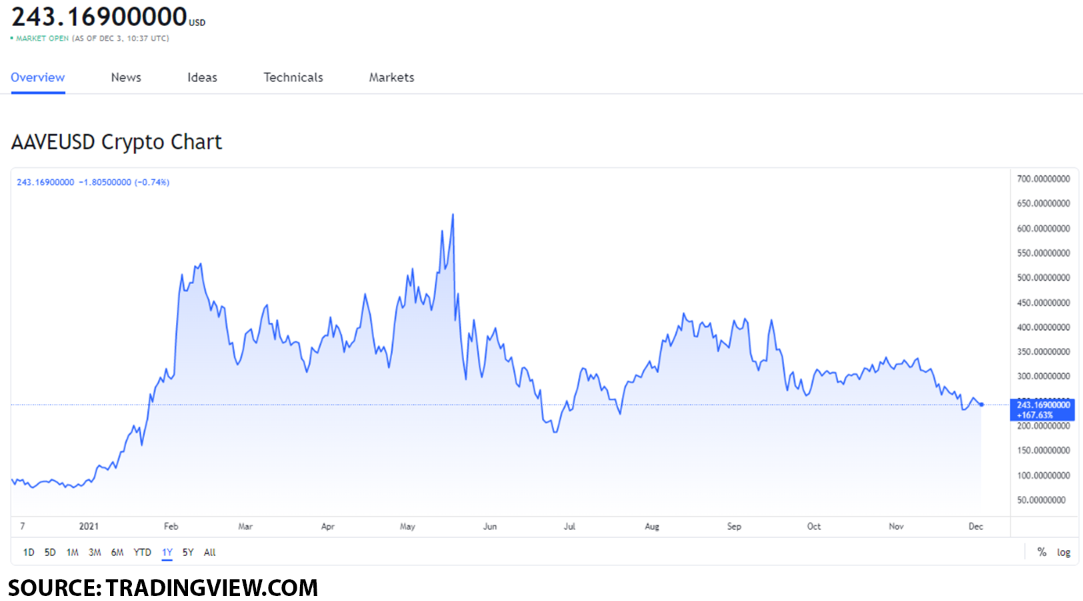

Should you buy Aave (AAVE)?

On December 3, Aave (AAVE) had a value of $243.

To see what this value point means for the token, we will go over its all-time high value as well as its performance in November.

AAVE’s all-time high value was on May 18, when the token reached a value of $661.69. This gives us an indication that the token was $427.69 higher in value at its ATH point when compared to December 3.

When we look at the performance in November, on November 9, the token had its highest point of value of the month at $346.

Its lowest point was on November 28, when the token decreased to $224. This indicates that the token fell in value by 35% or by $122 throughout that span of time.

However, from November 28 to December 3, the token increased in value by $10 or by 4%.

With that in mind, we can expect AAVE to reach $240 by the end of December, making it a solid token to buy on December 3.